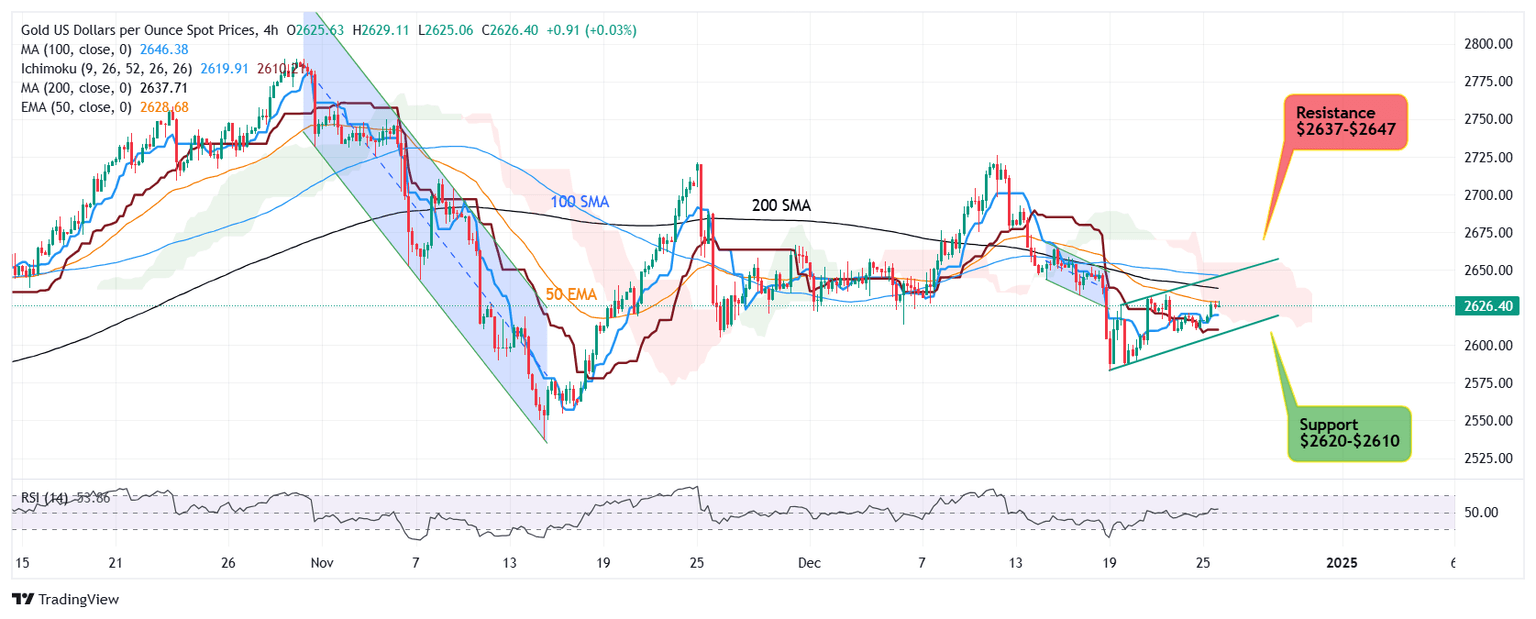

Amidst thin trading volume, Gold looks for $2,650-$2,660

-

Markets lack strong volume as institutional traders are absent.

-

Despite thin trading, Gold trades above $2624 local support.

-

Next support $2620 & $2610, Next Resistance $2637 & $2647.

-

Major Resistance may come at $2655-$2665.

As institutional traders are not participating due to holiday season that stretches from Christmas to New Year, markets witness low trading volume.

Meanwhile, Gold has been trading above local demand zone $2624 and awaits a break above $2631-$2633 initial hurdle to advance its prevailing rally towards next resistance band $2637 followed by $2647.

If this resistance band is cleared with stability above the zone, recovery rally is likely to extend legs for $2655-$2665.

Sellers may be seen repositioning their short positions on heights in anticipation of another bearish push lower which will be signalled by strong break below $2624 and downside targets may be considered initially to revisit $2610-$2600 followed by major downside target $2550-$2530.

Author

Sunil Kumar Dixit

SK Charting

Sunil Kumar Dixit is Chief Technical Strategist and founder of SK Charting, a research firm based in India. He tracks Precious Metals, Energy, Indices and Currency Pairs. He also participates as an expert panellist on Channel Television, Nigeria.