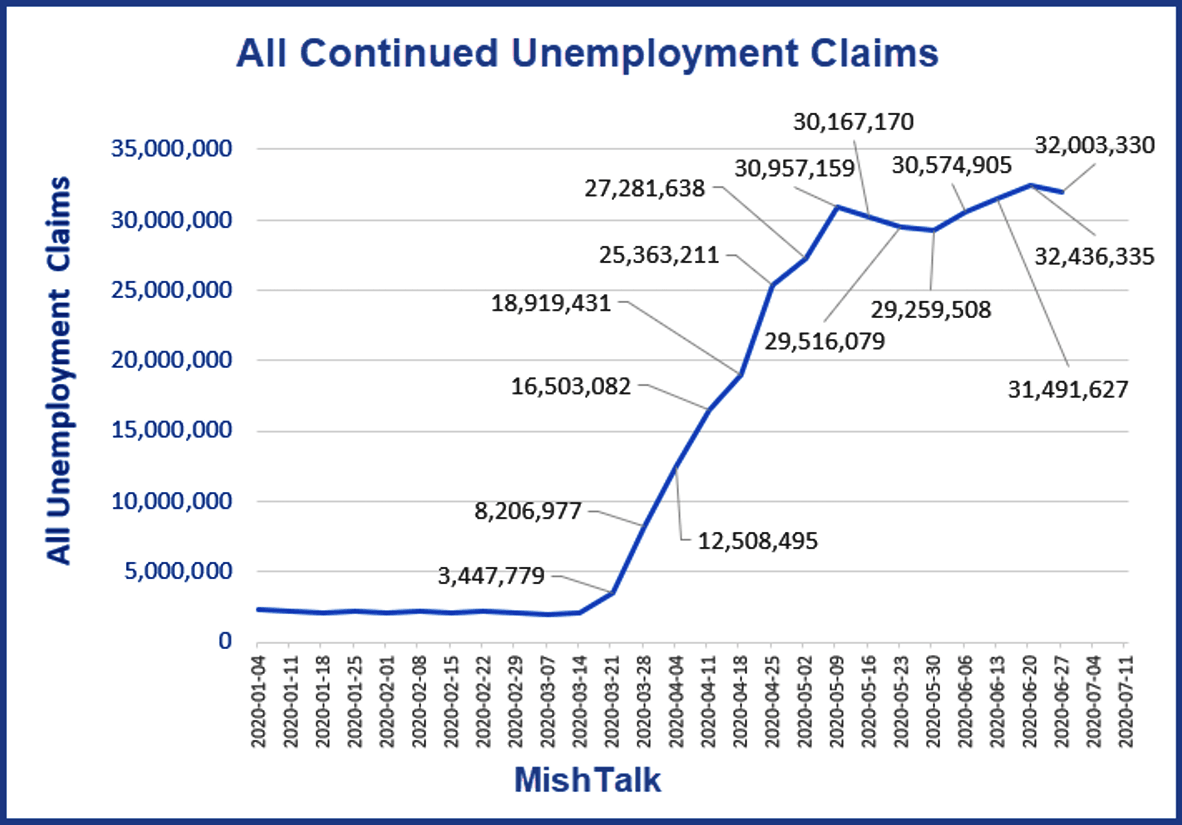

All continued Unemployment Claims top 32 million again

All continued claims dipped slightly but still top 32 million.

Based on Pandemic Unemployment Assistance, admittedly lagging, there is little or no improvement in the number of unemployed.

My "All Continued Claims" chart is the sum of state claims, federal claims, and various pandemic unemployment assistance (PUA) claims.

All claims lags state continued claims by two weeks.

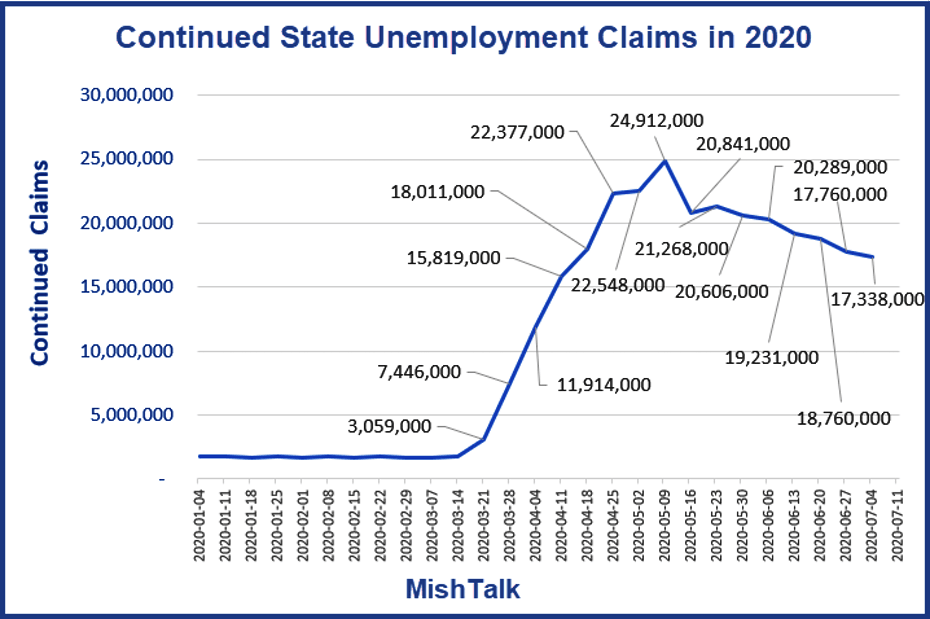

State continued claims

State continued claims dipped slightly to 17.338 million but have remained above 15 million for 13 weeks.

Based on trends in PUA claims, any improvement at the state level is likely a mirage.

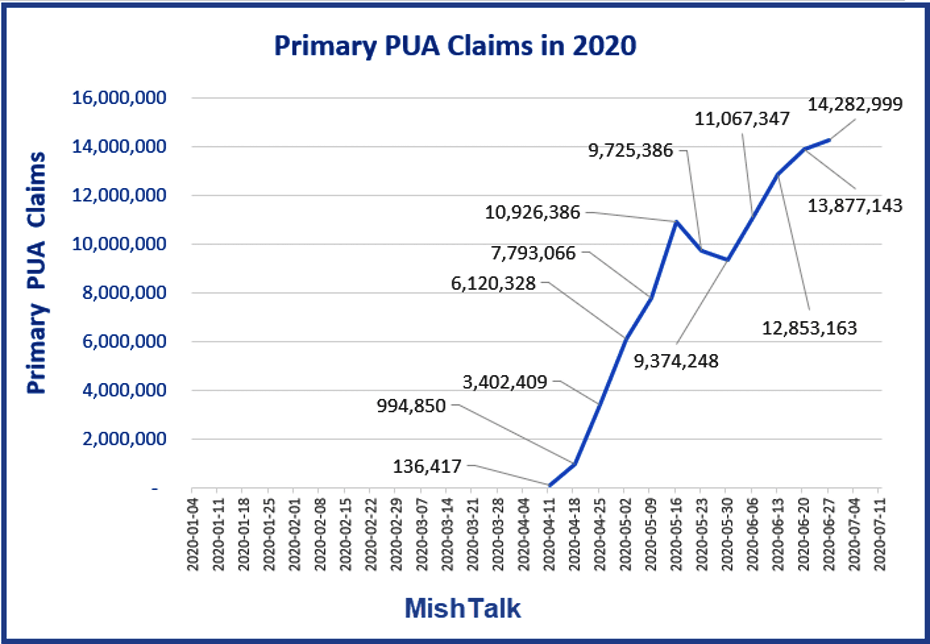

Primary PUA claims

Primary PUA claims rose for the 4th week to a record 14.283 million.

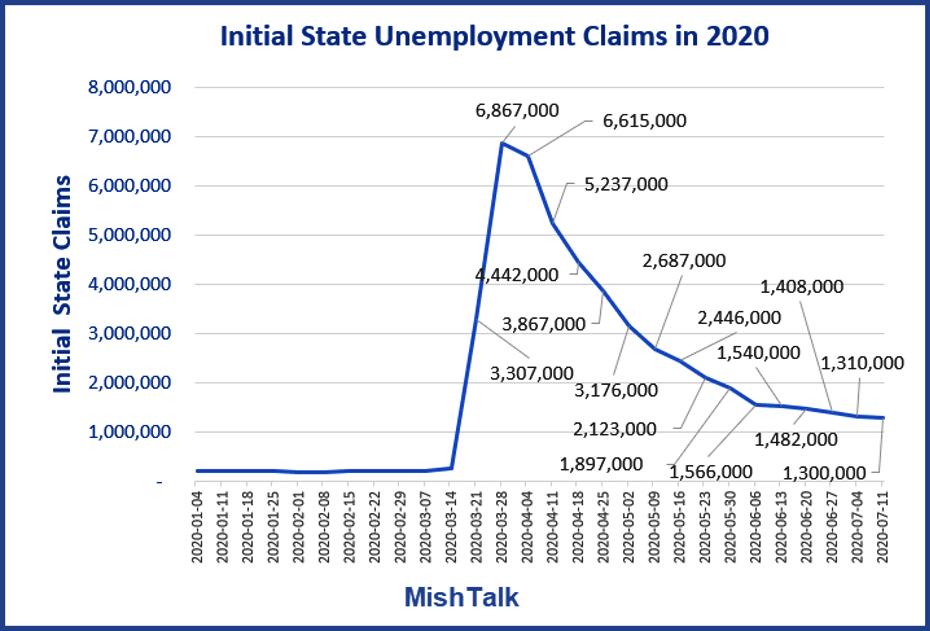

Initial State claims

Initial claims turn into continued claims in a week. But people drop off continued claims if they find a job or expire all their benefits.

The number of initial claims is down from the pandemic surge but is very elevated historically.

People must first file at the state level but some do not qualify. And some who did qualify exhausted state benefits and now need to apply for PUA.

Not a pretty picture

The trends suggest the unemployment picture is not improving much. Instead, people who qualified at the state level now need PUA assistance.

Add it up and there are 20 to 30 million people unemployed.

Things about to get worse

With reopenings in reverse, and airlines in severe trouble, things are about to get worse.

- American Airlines is in Deep Financial Stress and will shed 16,000 or more jobs.

- United Warns It May Cut 36,000 Employees

- A Surge in Small Business Bankruptcies is Underway

- That Fewer People Pay Their Rent on Time in July suggests more people are struggling.

- Phone Data Shows the Retail Recovery Has Stalled in Covid Hotspots

- Patients Stranded in Emergency Rooms as Hospitals Fill Up

- Trump Claims to Have Saved 51 Million Jobs

Author

Mike “Mish” Shedlock's

Sitka Pacific Capital Management,Llc