A third quarter of negative GDP is now highly likely

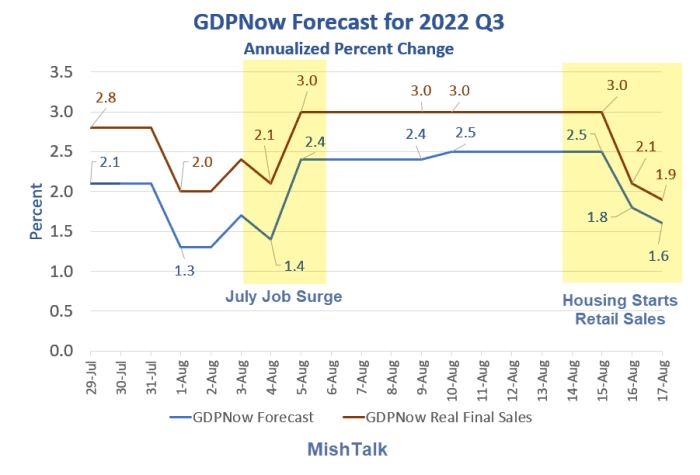

The GDPNow estimate for third quarter of 2022 dipped again today. Looking ahead expect much more weakness, led by housing and durable goods.

GDPNow data from Atlanta Fed, chart by Mish.

Please consider the latest GDPNow Estimate for third-quarter 2022 GDP.

The GDPNow model estimate for real GDP growth (seasonally adjusted annual rate) in the third quarter of 2022 is 1.6 percent on August 17, down from 1.8 percent on August 16. After this morning's retail sales report from the US Census Bureau, the nowcast of third-quarter real personal consumption expenditures growth decreased from 2.7 percent to 2.4 percent.

Base forecast vs real final sales

The real final sales (RFS) number is the one to watch, not baseline GDP.

RFS ignores changes in inventories which net to zero over time. This is a good reason to ignore the talk of two quarters of declining GDP being a recession.

RFS in the second quarter was positive but retail sales plunged in May after a strong April. That's when housing started to crumble as well.

GDPNow jumps on jobs data

On August 10, I commented GDPNow Third-Quarter Forecast Jumps to 2.5 Percent, Recession Off?

Models Don't Think

Models don't think. Humans can, perhaps incorrectly.

The baseline job numbers do not match 200,000 layoffs at Amazon, consumer sentiment, rising jobless claims (albeit from record low levels), warnings from retailers including Walmart and Target, layoffs at Walmart, and two warnings from Micron on demand for computer chips.

I smell huge revisions to the job numbers. If so, this forecast jump will be short lived.

There are three retail sales reports coming and a myriad of housing reports. Those will hold the key to the third quarter, not the July jobs report.

Recession territory

At +1.9 percent on RFS, we are not in recession territory.

But it's not where estimates are now. It's where the final data ends up at the end of September.

The economic reports, other than the July jobs surprise, have all been where I expected, not where the market or GDPNow expected.

Housing starts drop 9.6 percent, now below pre-pandemic level, led by single family

Yesterday, I commented Housing Starts Drop 9.6 Percent, Now Below Pre-Pandemic Level, Led By Single Family

No growth in retail spending, missing expectations, negative revisions

Today, I noted No Growth in Retail Spending, Missing Expectations, Negative Revisions

Looking ahead

Looking ahead, housing rates to be miserable and durable goods (appliances, furniture, cabinets, etc.) miserable along with housing.

We are one revision away in jobs for a huge plunge in these estimates.

Regardless, I expect the rest of the quarter to be very weak even if the July Jobs report is accurate.

The economic trend is down, and GDPNow has a big history of high early estimates that sink as the quarter progresses.

1.6 percent is not a big cushion, with over two-thirds of the data for the quarter still to be seen.

Housing bust and cyclicals the recession key

In case you missed it, please see Cyclical Components of GDP, the Most Important Chart in Macro.

Also see A Big Housing Bust is the Key to Understanding This Recession.

If the data follows the path I expect, we will have a third quarter of negative GDP with real final sales falling since May.

Author

Mike “Mish” Shedlock's

Sitka Pacific Capital Management,Llc