A strong recovery is underway in the US Service sector

Key highlights

IMF has raised India's GDP growth forecast for FY22 to 12.5% from 11.5% estimated in January.

US Initial Jobless claims in regular state programs increased to 744,000 in the week ended on 3rdApril, higher than the survey estimation of 680,000 claims.

India’sforexreserves declined by USD 2.41billion to stand at USD 576.86billion in the week ended on 2nd April.

FX market update

USDINR Weekly performance & Outlook

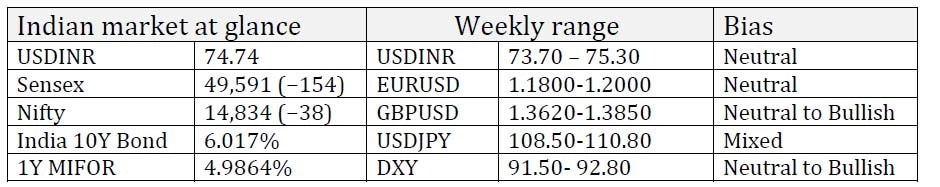

The Indian rupee initially opened gap up at 73.42. The USDINR pair was volatile throughout an eventful week. Rupee remained weaker against the greenback on the back of strong US economic recovery data. India’s manufacturing PMI dropped to a seven‐month low of 55.4 in March from February's 57.5.US ISM non-manufacturing PMI for March hit a new record, indicating that a strong recovery is underway in the US Service sector. Rupee depreciated the most in two years this week, recordinga fall of 2.2%.RBI in its monetary policy unanimously left key rates unchanged but introduced a G-SAPunder which it would buy Rs 1 lakh crs of G-Sec. The RBI also extended the amount and tenor of it's VRRR facility through which it would give suck out some of the excess liquidity from the banking system. While VRRRcould cause the money market rates to move higher, G-SAP would cap long-term yields. While the bonds and equities rejoiced RBI's move of capping long-term yields, the Rupee had to bear the brunt as the move would reduce the carry. FPIs who had been receiving carry in offshore unwound their positions causing the Rupee to weaken. RBI may have chosen not to intervene as recent Rupee out performance had caused it to become overvalued and RBI would have seenthis bout of Rupee weakness as correction of that overvaluation. The FOMC minutes confirmed Fed's commitment to keeping policy accommodative until it sees sustainable, significant progress towards its inflation and employment objectives.Globaloutage inReuters interbank dealing system led to an exaggerated move as banks scampered to take stops in exchange-traded futures. In the first auction of the fiscal year, RBI raised Rs 37,853 crsusing greenshoe options instead of the planned Rs 32,000 crs. The yield dropped to 5.97%, butit climbed up to close at 6.02% once it was found that the RBIhad refused to sell a new 5-year benchmark paper at the rate demanded by the market.

Outlook

the coming week, the Indian rupee is likely to trade with a neutral to positive bias after closing in the futures market around 74.81 levels.

Since March 23rd, the rupee has been depreciating amid concerns over COVID and the RBI policy announcement. Many currency traders and analysts argue that the abrupt fall in the rupee cannot be a “false signal”; they expect the rupee to head back to levels of77-78 over the nextfew months. The newly announced program, called G-SAP, is being read as a sort of quantitative easing policy in which the RBI tries to support the Government’s elevated borrowing program through the infusion of liquidity.

Fitch Solutions, an American credit rating agency sees RBI keeping benchmark interest rates unchanged during the fiscal to March 2022 following its decision to buy ₹1 lakh crore of government bonds. It also revised its inflation rate forecast to an average of 5% in FY22, up from 4.6% previously, due to elevated inflationary pressures.

Large-scale bond-buying and money-printing may result in a glut of rupees, causing the rupee to depreciate against the dollar. This, along with a rising dollar, is creating grounds for therupee to depreciate further. The general feeling among experts is that the RBI may not intervene if the depreciation is gradual, but may do so if there is a big volatility.

U.S. Treasury Secretary Janet Yellen warned of the risk of a permanence divergence in the global economy in the wake of the COVID-19 crisis and urged major economies to inject significant new fiscal support to secure a robust recovery. In a statement to the steering committees of the International Monetary Fund and the World Bank, Yellen underscored the need for major economies to continue supporting developing countries as they grapple with the pandemic, climate change and high debt burdens. She also stated that substantial fiscal and monetary support from major economies had improved the global economic outlook significantly, but more efforts were needed.

Markets would remain cautious ahead of key macroeconomic dataset such as CPI Inflation, Retail sales, Initial Jobless claims and Industrial Production data from the U.S. Few key datasets like CPI Inflation, Industrial Production, WPI Inflation and Trade Balance are expected to release from India which would keep the rupee under pressure. While India’s CPI inflation for March is expected to be at 5.40% which is within RBI target level, the WPI inflation is projected to surge by 5.90%. India’s Index of Industrial Production is expected to record a de-growth of 3.0% in March. USDINR is likely to trade in a range of 73.70 –75.30 in the coming week.

EUR/USD

The EURUSD pair openedat1.1761 levels.The ECB said it would conduct PEPP asset purchases at a significantly higher pace than during the first months of this year. Loose monetary conditions, which include a softer EUR, are contributing to both strong equity marketsand rising inflation expectations in the Euro area. This will encourage the ECB to carry on with its current plan, especially while the underlying economy remains fragile, prone to lockdown risk, and lacking a US-style fiscal impulse. The EURUSD pair approached the 1.1900 level after encouraging EU datasets. The March Services PMIs for the EU and most of them were upwardly revised. The German index was confirmed at 51.5, while for the whole Union, it printed at 49.6, better than the previously estimated 48.8. The Euro Area Services PMI increased from 45.7 in February to 49.6 in March compared to the analyst consensus of 48.8. A stronger-than-expected Services PMI report provided additional support to Euro. ECB President Lagarde stated that the pandemic willweigh on Eurozone growth over the coming months but longer-term risks are receding and growth will pick up once lockdown measures can be lifted. she also added that the overall risks surrounding the Euro area growth outlook have become more balanced, although downside risks associated with the pandemic remain in the near term.The TheEURUSD pair closed the weekat 1.1896levels.

GBP/USD

The Sterling opened at 1.3827 levels on the back of rising expectations for stronger growth as economy reopened.However, the USD's market valuation continues to drive GBPUSD's movements. The Services PMI for the UK arrived at 56.3 and missed the market expectation and the flash estimate of 56.8. Riots on the streets of Belfast exactly 100 days after Brexit serve as a stark reminder of the implications of Britain's exit from the EU and its complexities not only for trade but also for peace in Emerald Isle. Frustrations over the terms of theaccord in Northern Ireland are the latest factor to push the pound lower. Britain is also grapple with a dry monthof vaccine supplies, exacerbated by the recent debacle over AstraZeneca's jabs. Another downside drive for the pound is profit-taking, which followed several weeks of gains. The dollar hasalsoplayeda major factor in keeping the lid on the GBPUSD pairrecovery. Afterdovish messages from the Fed, the greenback madea comeback alongside the increase in bond yields.GBPUSD pair is expected totrade in a narrow rangeon the back of UK GDP data.

Dollar index

TheUS dollar index opened at 93.01. The DXY sank low versus a basket of its peers, moving in tandem with retreating treasury yields from recent peaks despite signs of a robust U.S. economic recovery. The monthly payroll data, followed by the recent reading for services industry activity on record indicates that much of the bullish outlook is priced in for now. The U.S. dollar slip further, after minutes of the Federal Reserve's March policy meeting offered no new catalysts to dictate market direction. Fed officials remained cautious about the risks of the pandemic even as the U.S. recovery gathered steam amid massivefiscal stimulus and committed to pouring on monetary policy support until a rebound was more secure. Looking at the broader picture, the dollar remains on the back footing so far this week as the US economic recovery narrative looks somewhat exhausted and priced in by investors, which now appear to have shifted their focus to Europe and the improvement in the vaccine rollout.The Dollar Index closed the week at 92.16 levels.

Author

Abhishek Goenka

IFA Global

Mr. Abhishek Goenka is the Founder and CEO of IFA Global. He pilots the IFA Global strategic direction with a focus on relentlessly improving the existing offerings while constantly searching for the next generation of business excellence.