A lesson from Gold and trading fresh sentiment shifts as we saw for the GBP yesterday on Nigel Farage’ election announcement

Learning point: Gold and it’s response to ‘risk on’ and ‘risk off markets’

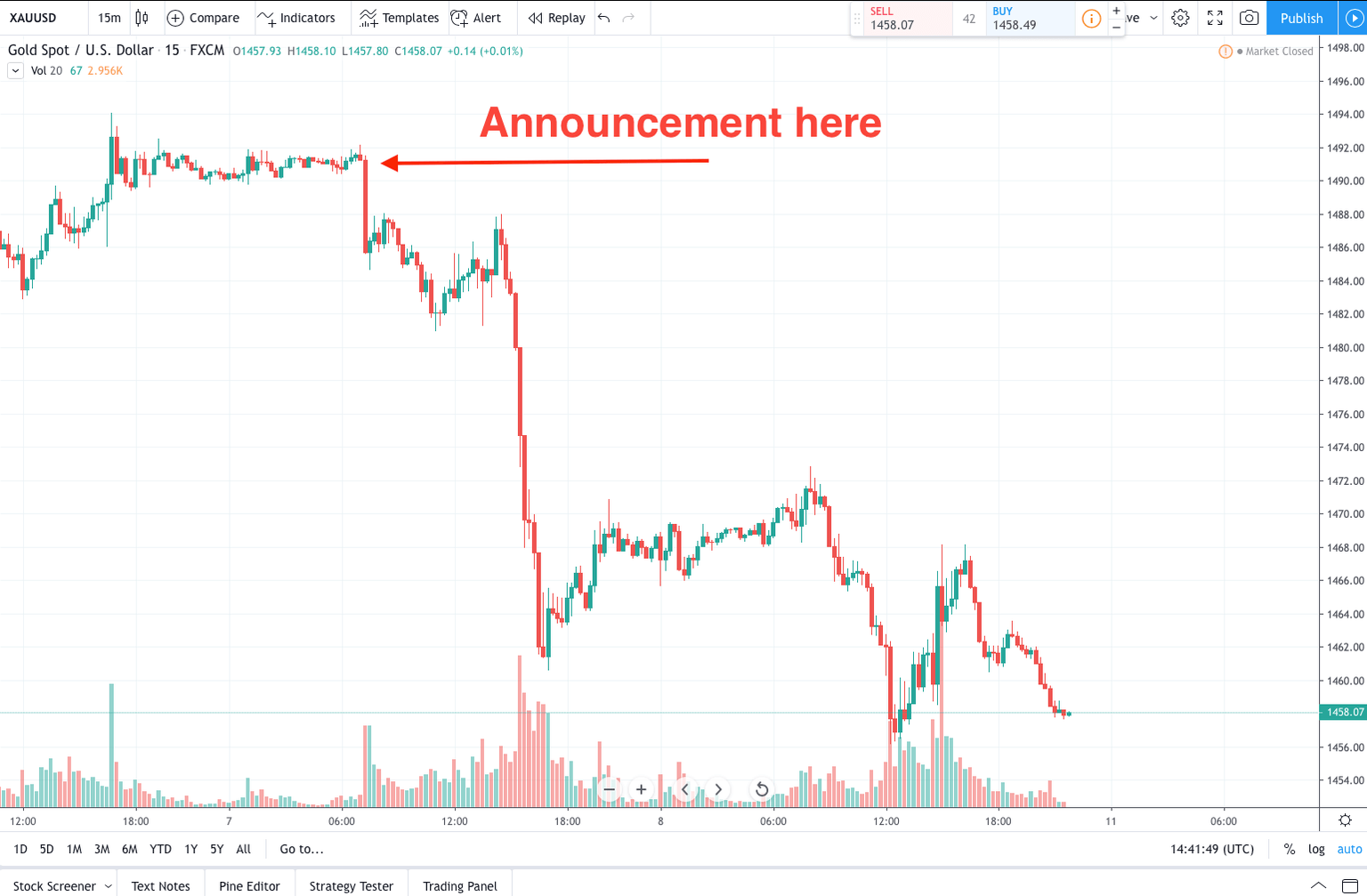

Gold, which is measured in dollar terms (XAUUSD), loses value when the market is pursuing risk on assets. When the market is pro risk we tend to see Gold losing value. An example of this was on November 07, 2019 (last week!) when China’s Commerce Ministry expressed a willingness to start rolling back tariffs on the signing of the US-China ‘phase 1’ trade deal. By contrast, when the market is worried and moves into a ‘risk off’ mood, then Gold increases in value. The general bid in gold over the last months has been due to concerns about a low growth, low interest rate and low inflation environment. Investors have sought the safety of gold to try and lock in alpha.

Latest UK election polls show conservative party still has the lead

The Panel base poll estimates yesterday showed support for the Conservatives at 40% (unchanged), Labour 30% (+1), Liberal Democrats at (+1), and the Brexit Party (-1). The Opinium poll (6-8 Nov) shows support for the Conservatives at 41% (-1%), Labour 29% (+3), Liberal Democrats 15% (-1)m and the Brexit Party 6% (-13).

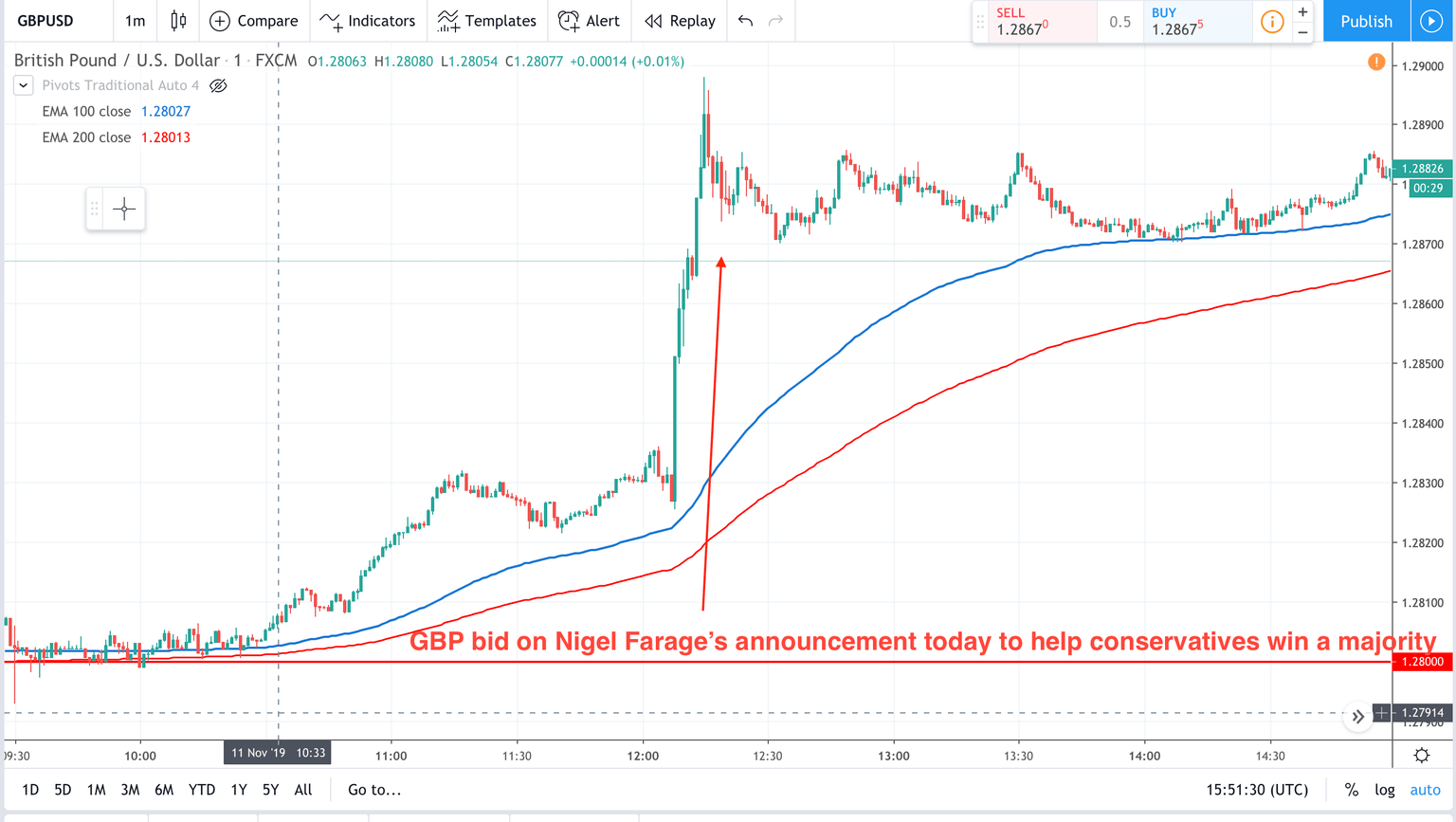

The main driver on the GBP will now be about which party is leading the polls. If the conservatives are leading the polls, expect GBP strength. However, in order for the polls to strongly impact the GBP there needs to be a shift in the polls from what was known previously. e.g. what has changed?

So, yesterday we saw such a shift when Nigel Farage announced his plans to stand down candidates at the General election in order to try and avoid a hung parliament. This means that the conservative party would have a greater majority and a hung parliament would be less likely. This led to the GBP being bid, as buyers immediately entered the market.

If, for example, there was another sudden 5% jump in the Conservative party share of the vote to say then GBP buyers would jump in to the GBP on that news again. So, traders will be watching these polls, for news that shows a shift from previous figures. Trading the fresh sentiment shifts is a strategy used by many professional traders. Watch out for it!

Author

Giles Coghlan LLB, Lth, MA

Financial Source

Giles is the chief market analyst for Financial Source. His goal is to help you find simple, high-conviction fundamental trade opportunities. He has regular media presentations being featured in National and International Press.