A divided Federal Reserve cuts 25bps as an announcement of a new Fed chair looms

Wednesday’s 25bp Fed rate cut was no surprise, but Scope Ratings (Scope) may consider it as the wrong decision nevertheless partially forced through political and market pressure. It was certainly a highly divisive decision with the most dissents since 2019 and, for the second consecutive meeting, dissents for holding rates unchanged as well as for a bigger cut. Divisions on the Federal Open Market Committee (FOMC) are only set to widen after next May as the unifying figure of Jerome Powell steps aside and a potentially polarising new Chair takes the helm. The politicisation of the Fed and weakening of central bank independence is a meaningful concern for economic and financial stability.

Data lapses after the government shutdown remain real, and inflation remains elevated. Nevertheless, Fed doves appear to have had primacy over the hawks recently. After 175bps of easing during the past year and several months, official rates are within a Fed range of the neutral value. It is prudent that the Fed has suggested a momentary pause of rate reductions. But this communication may prove less convincing ultimately after the composition and leadership of the Fed shifts further: the next Fed Chairman is seen pushing through further easing later next year. In a similar vein, the dot plot intended to communicate Fed thinking – suggesting one further 25bp reduction next year – may be less reliable presently.

Fed officials upgraded median 2026 growth expectations to 2.3% from 1.8%, which better aligns with Scope’s 2.4% projection for 2026. Officials assumed slightly lower inflation, but given the resilient US economy, mixed labour-market data and above-target inflation, there was no need for the cut on Wednesday.

Beyond the formal dissents, six FOMC participants pencilled no rate change for this week. On the other side, Stephen Miran – appointed recently by the President – signalled no less than 150bps of cuts for next year with the US President saying the 25bp cut Wednesday ought to have been “at least doubled”.

Fed officials authorised fresh purchases of USD 40bn a month of short-term Treasury securities for maintaining an ample supply of bank reserves. After the quantitative tightening since 2022, this month has seen the brisk return to slight quantitative easing.

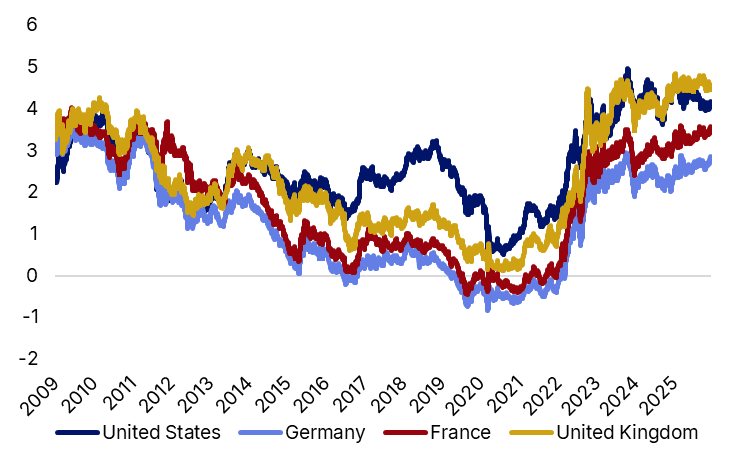

Global government yields have risen to post-2009 highs

Global average long-dated government bond yields rose earlier this week to their highs last seen in 2009 – as markets priced a pause in US rate reductions alongside concerns around increasing global debt, inflation and tighter monetary policy.

10-year treasury yields, %

As of 12 December 2025. Source: Macrobond, Federal Reserve Board, Investing.com.

Author

Dennis Shen

Scope Ratings

Dennis Shen is Chair of the Macroeconomic Council and Lead Global Economist of Scope Ratings, the European rating agency, based in Berlin, Germany.