A brief update on the state of play

S2N observations

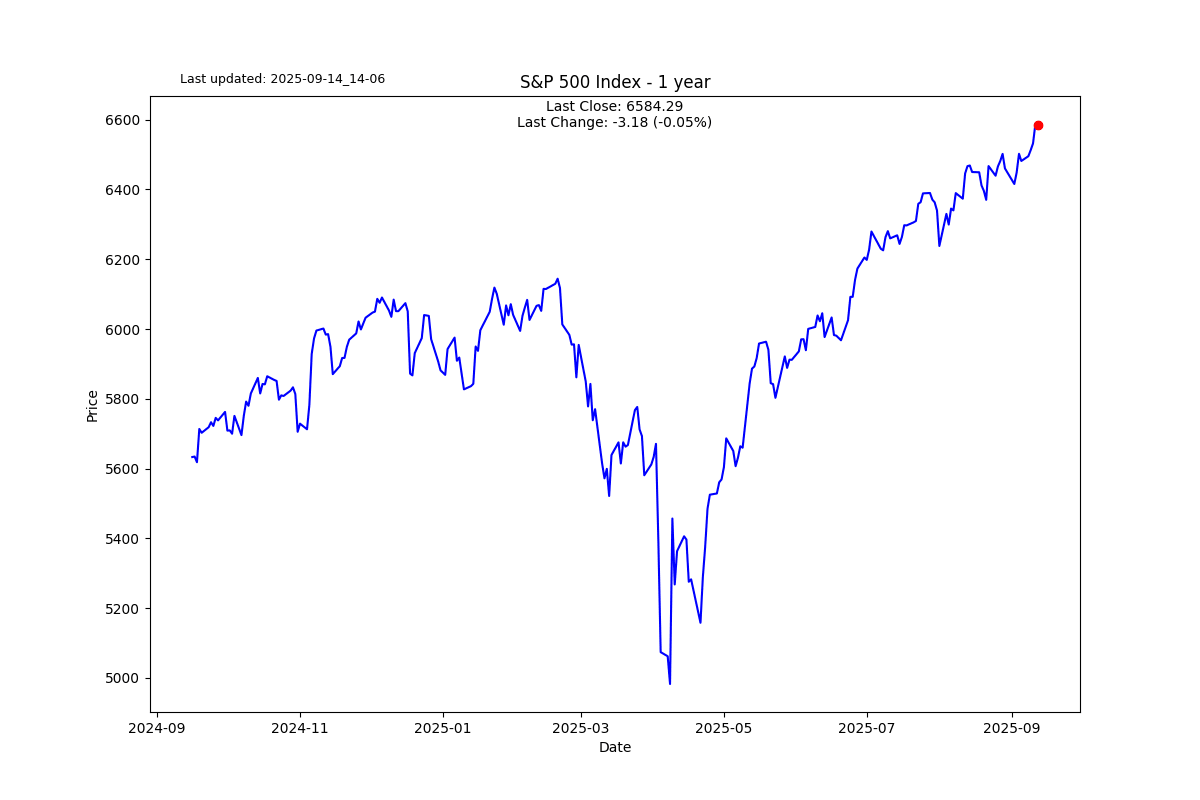

The S&P 500 is at all-time highs with valuations based on the Shiller PE (i.e., 10-year trailing earnings) only higher during the dot.com boom.

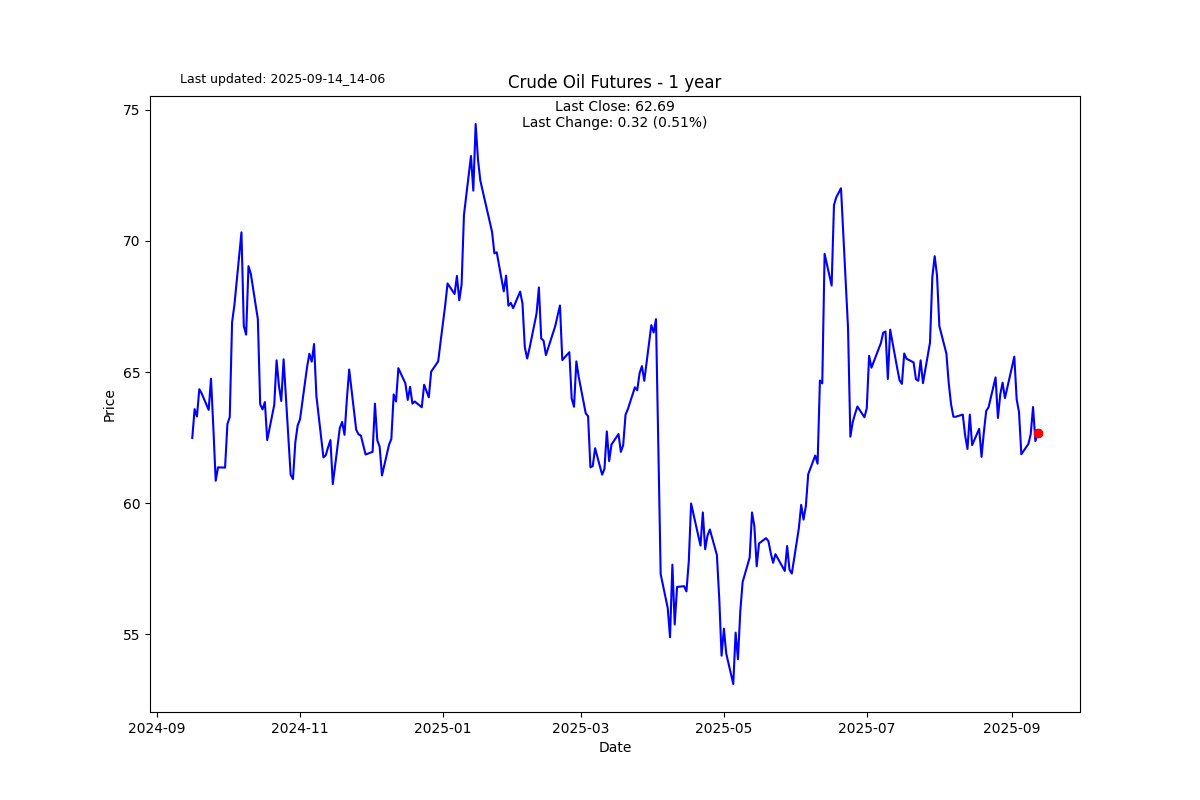

Inflation numbers came out for August last week, and they are still hovering around 3% per annum. The Fed is still likely to cut rates as rising unemployment is starting to pick up.

I have been speaking to a lot of people in the business community, and there is not a person I have met who doesn’t think that AI is going to replace many, many jobs, a lot of them permanently. I foresee the non-farm payrolls' year-on-year growth soon dipping into negative territory.

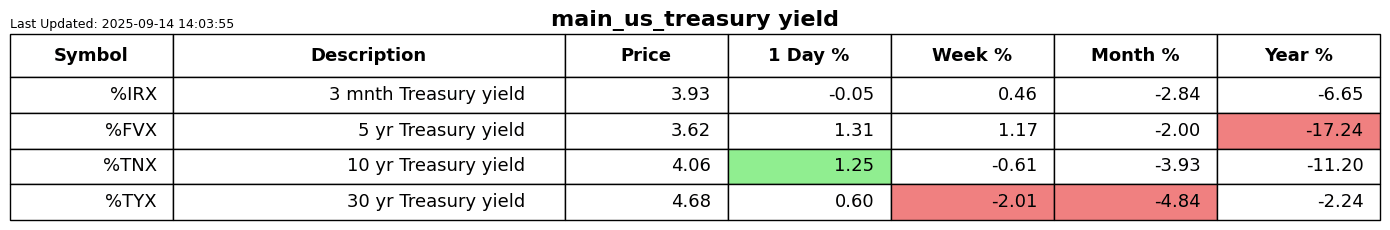

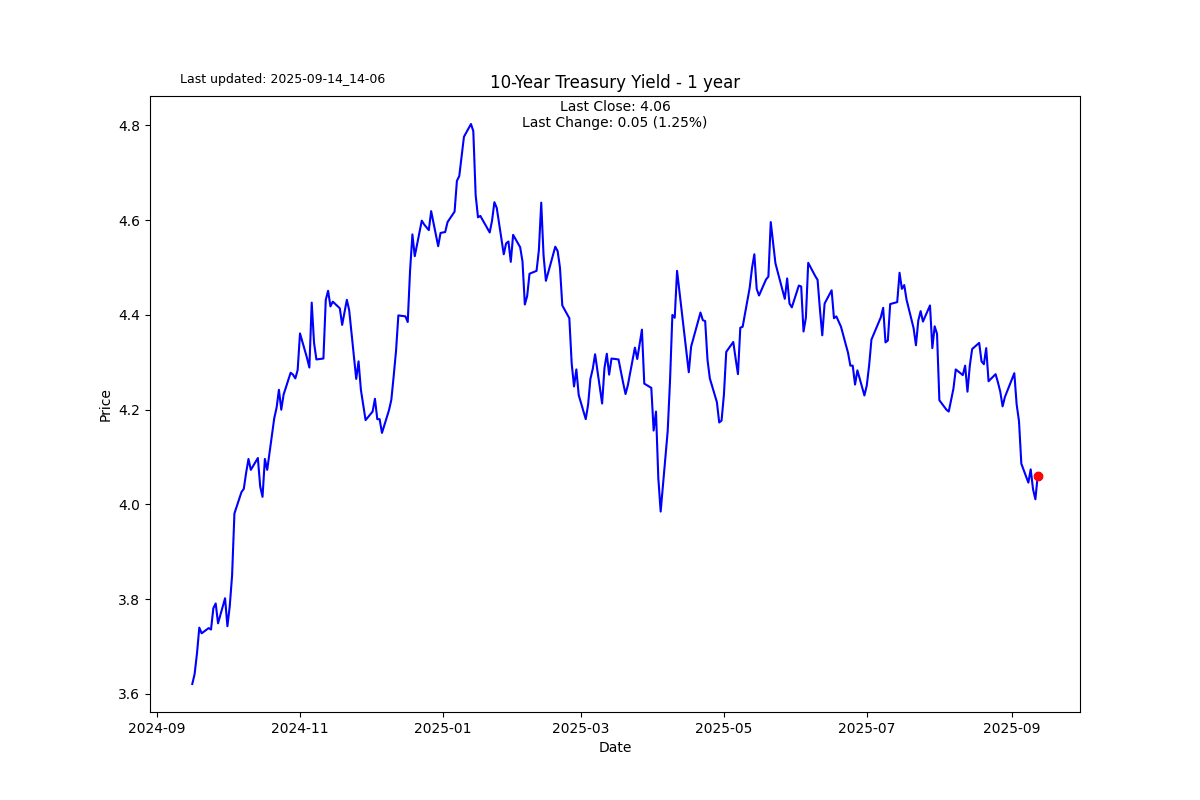

It would seem that initial jobless claims will soon be heading upwards, which is why the bond market is suggesting a rate cut.

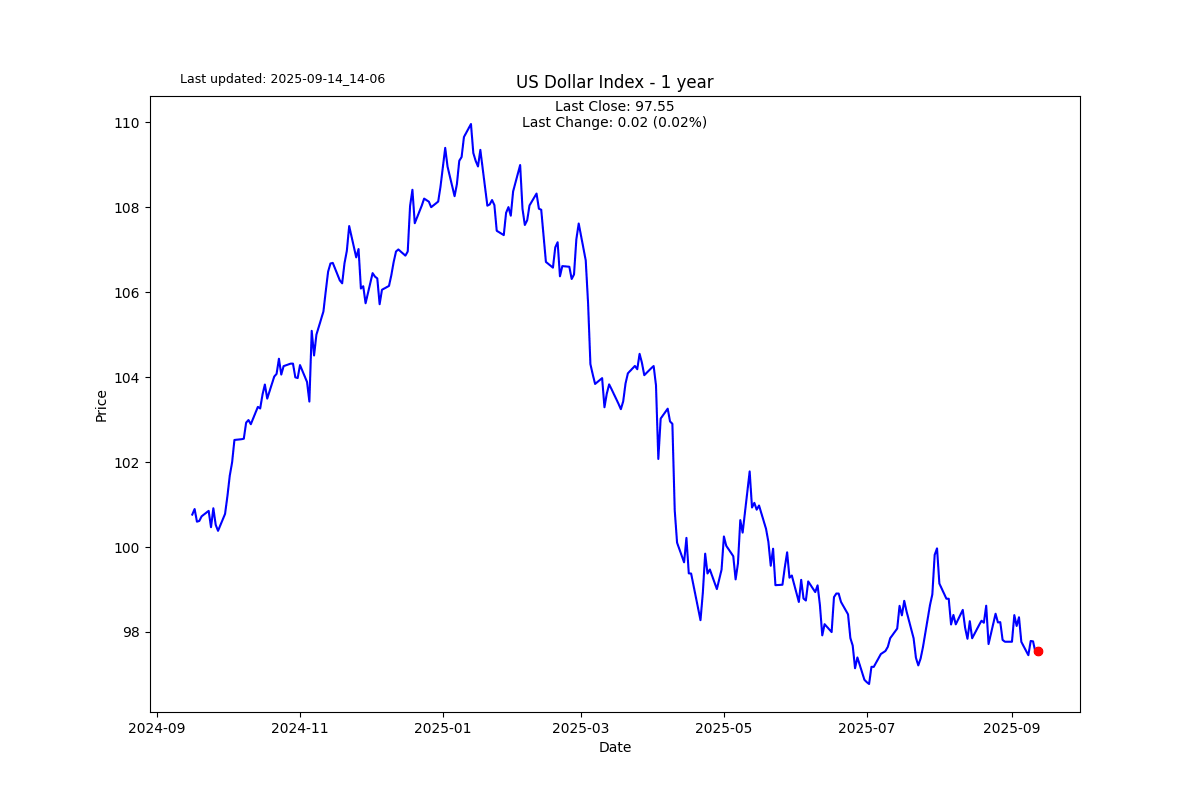

The 2-year is still suggesting we will get a rate cut, but it is looking like a small cut. Like when I shave my bald head from a 1 to a zero.

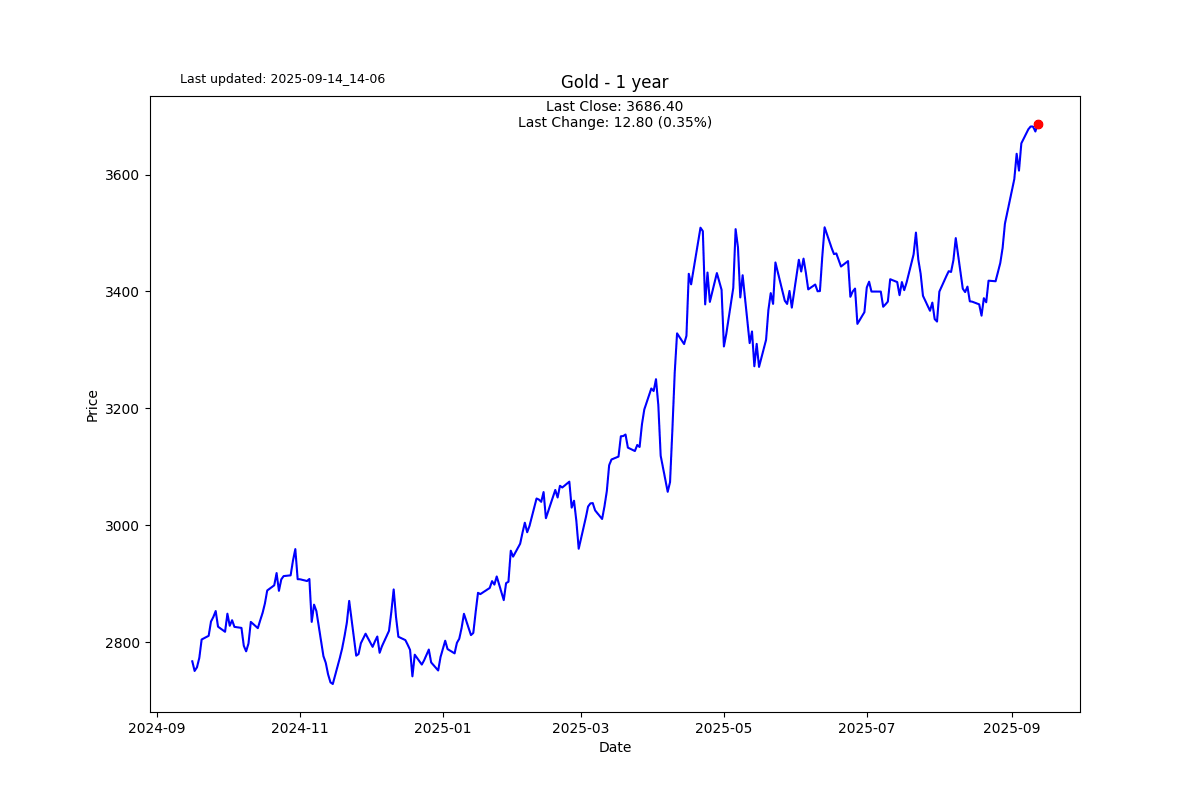

Gold has proven itself as sound money, outpacing inflation and maintaining purchasing power. It certainly has not been an easy thesis to believe in. There would have been many years and decades over the last 45 years where you would have felt stupid maintaining a view that gold is a store of value.

S2N screener alert

The Dow Jones Global Index made a new ATH.

Silver made a new ATH in almost every major currency but the US Dollar. Here is a new ATH with Silver and the British Pound.

S2N performance review

S2N chart gallery

Author

Michael Berman, PhD

Signal2Noise (S2N) News

Michael has decades of experience as a professional trader, hedge fund manager and incubator of emerging traders.