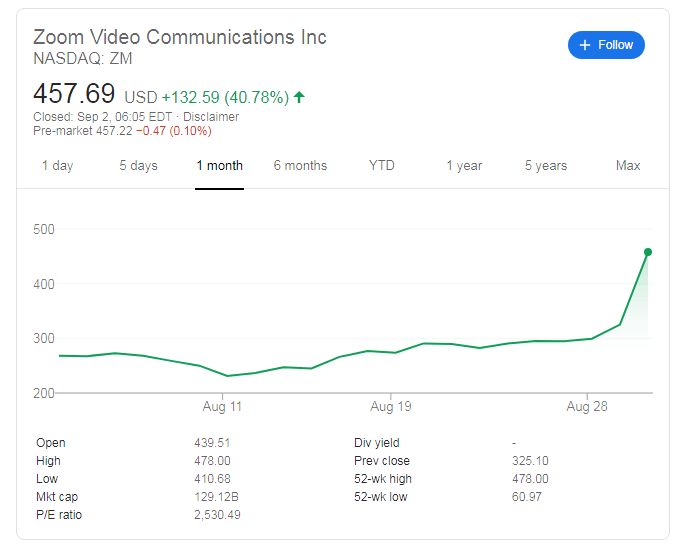

ZM Stock Price Today: Zoom Video Communications In's robust guidance implies 40% is only the beginning

- NASDAQ: ZM has jumped by over 40% to $457 after smashing earnings' estimates.

- Zoom Video Communications Inc's coronavirus-era growth is set to extend.

- The company has nearly doubled its guidance for fiscal 2021, opening the door to more gains.

"It just works" – that is the notion of many using Zoom's video conferencing services. The San Jose, California-based tech firm has become the go-to application for communicating with locked down family and friends, and for work.

Rivals such as Microsoft's Skype and Google's Meet have adopted some of Zoom's features – and also made their offers more attractive to businesses – yet Zoom's growth has been tremendous. Revenue grew by 355% annualized in the firm's fiscal second quarter that concluded at the end of July.

That tops a growth rate of 169% in the three months ending on April 30 – showing that the firm's expansion exploded beyond the harshest lockdown period and into the gradual reopening of economies.

The firm run by CEO Erik Yuan overcame concerns about security by addressing them promptly and also won over investors – earnings per share stood at 92 cents, more than double 45 estimated by analysts surveyed by Refinitiv.

Another doubling is in ZM's guidance – a range of $2.40 to $2.47 for the full fiscal 2021 against $121 to $129 beforehand.

Does that imply more room to rise for the share?

ZM Stock Forecast

Zoom has hit a valuation of around $129 billion, topping chipmaker AMD and Silicon Valley veteran IBM. Is it overpriced? Probably not in the current febrile stock market, nor given its strong fundamentals.

A correction is likely after the leap, but the figures – including an exponential surge of 4,700% in monthly active users to 148.4 million – will probably keep investors attracted to NASDAQ: ZM.

Broader markets remain upbeat after the Federal Reserve announced a dovish shift in policy, signaling to hold lower rates for longer.

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Yohay Elam

FXStreet

Yohay is in Forex since 2008 when he founded Forex Crunch, a blog crafted in his free time that turned into a fully-fledged currency website later sold to Finixio.