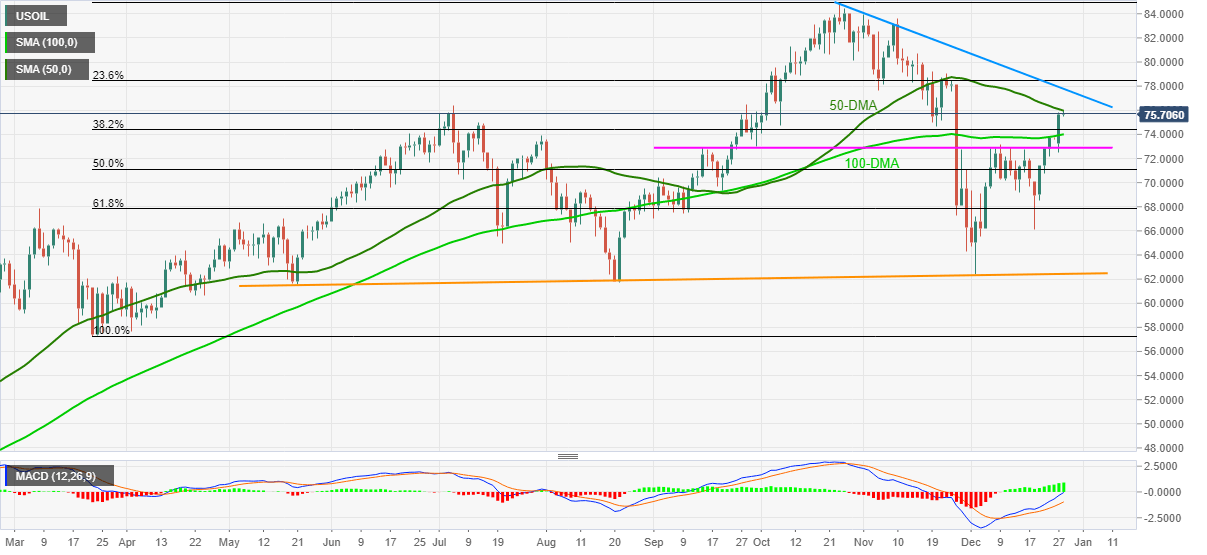

WTI Price Analysis: Bulls step back from 50-DMA around monthly top

- WTI consolidates the biggest daily gains in three week to ease from one-month high.

- Bullish MACD signals, sustained trading beyond 100-DMA favor buyers.

- Two-month-old resistance line challenge further upside, bears need validation from $72.80.

WTI crude oil, also known as US oil, seesaws around monthly high, down 0.15% intraday near $75.55 during Tuesday’s Asian.

In doing so, the black gold eases from the 50-DMA after rising the most since December 06 the previous day.

Even so, firmer MACD signals and a clear upside break of the 100-DMA keep WTI bulls hopeful to overcome the $76.00 immediate hurdle.

Following that, a descending trend line from October 25, around $77.80, will be in focus as it holds the gate for the commodity’s further rally targeting the yearly top marked in November around $85.00.

Meanwhile, pullback moves may aim for the 100-DMA level of $74.00 and horizontal support from mid-September near $72.80.

In a case where oil bears break the $72.80 support, the odds of witnessing further downside towards the $70.00 threshold can’t be ruled out.

WTI: Daily chart

Trend: Further upside expected

Author

Anil Panchal

FXStreet

Anil Panchal has nearly 15 years of experience in tracking financial markets. With a keen interest in macroeconomics, Anil aptly tracks global news/updates and stays well-informed about the global financial moves and their implications.