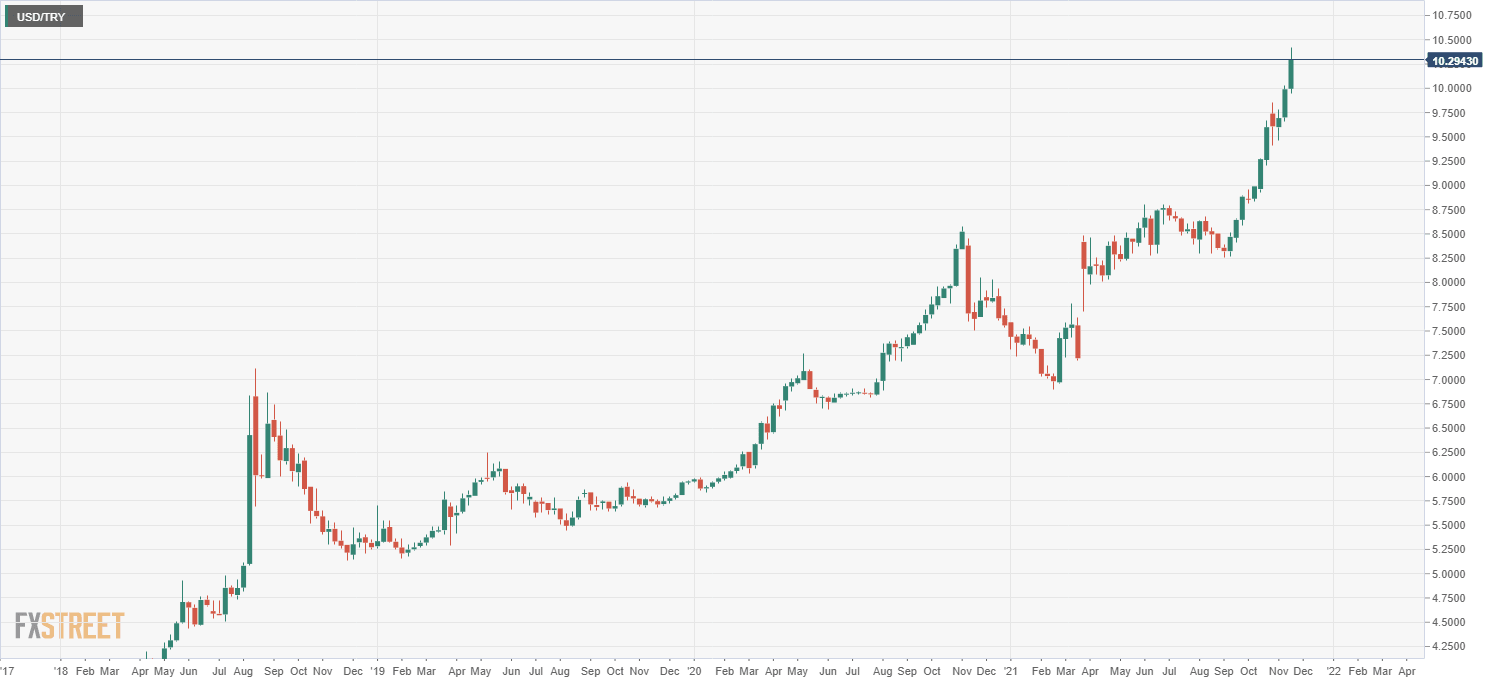

USD/TRY continues surge, nearly hits 10.40, as lira battered ahead expected CBRT rate cut

- USD/TRY continues to surge higher after it broke above 10.00 for the first time last week.

- The pair nearly hit 10.40 early in the US session but has since moderated back below 10.30.

- The CBRT is expected to cut interest rates by another 100bps on Wednesday despite surging inflation.

The Turkish Lira has been under intense selling pressure since the start of Tuesday European session. USD/TRY, which pushed above 10.00 for the first time since, picked up pace from 0600GMT upon the arrival of European market participants, and has since surged north of 10.20. At one point, about an hour after the US market open, the lira appeared to undergo a small flash crash, with USD/TRY surging from 10.28 to just under 10.40 in a matter of minutes. It has since reversed back below 10.30, where it trades higher by about 2.2% on the day and is the worst-performing major currency in the world.

There haven’t been any fresh fundamental catalysts to drive the upside in the lira on Tuesday. Rather, traders have cited concerns about another rate cut from the Turkish central bank (CBRT), who set policy on Wednesday, as the main reason for the lira’s ongoing woes.

Despite the fact that the YoY rate of CPI in Turkey surged to just shy of 20% in October, the is expected to lower interest rates by another 100bps to 15.0% on Wednesday. That would take Turkey’s real interest rate on bank deposits (when compared to current headline CPI) to around -5.0%, one of the lowest in the world - no wonder no one wants to hold liras.

The ongoing decline of the lira points to an ongoing lack of trust in the CBRT’s ability to get inflation back to its 5.0% target. That’s because the bank’s policymaking is tainted by the hand of Turkish President Recep Erdogan, who unconventionally believes that interest rates should be lowered to bring down inflation and has consistently fired governors who failed to cut rates. Only a few weeks ago, Erdogan fired three rate-setters who reportedly disapproved of the CBRT’s most recent 200bps rate cut back in September.

Erdogan, who served as the country’s PM from 2003-2014 and has since served as the country’s President, is not expected to lose the 2023 election. Therefore, the prospect that the CBRT manages to rebuild credibility and reverse the lira’s ongoing decline is very unlikely in the coming years. Fears continue to grow that Erdogan’s unconventional approach to economic policy, sometimes quipped as “Erdoganomics”, will ignite a financial crisis in the country. The lira has lost 40% of its value versus the dollar so far this year, with more than 20% of that decline coming in the past three months.

Author

Joel Frank

Independent Analyst

Joel Frank is an economics graduate from the University of Birmingham and has worked as a full-time financial market analyst since 2018, specialising in the coverage of how developments in the global economy impact financial asset