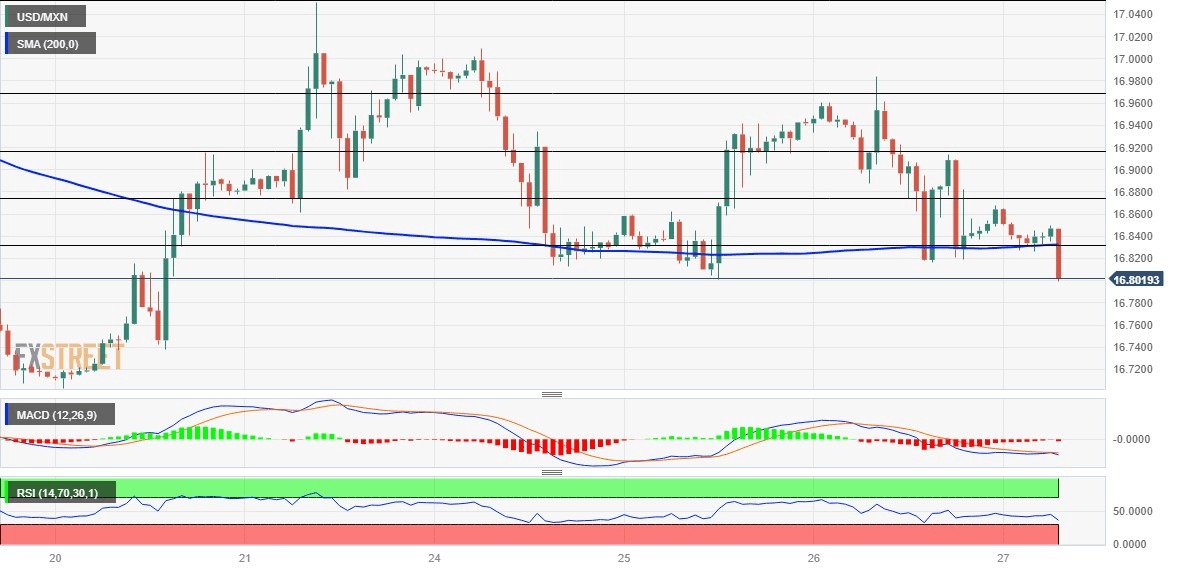

USD/MXN Price Analysis: Bears have the upper hand near 200-hour SMA/61.8% Fibo. confluence

- USD/MXN is seen consolidating in a narrow trading band through the early European session.

- The technical setup favours bearish traders and supports prospects for a retest of the YTD low.

- A move back above the 23.6% Fibo. level is needed to negate the near-term bearish outlook.

The USD/MXN pair lacks any firm intraday direction on Thursday and oscillates in a narrow trading band, below the 16.85 level through the early European session.

From a technical perspective, spot prices currently hover around the confluence comprising of the 200-hour Simple Moving Average (SMA) and the 61.8% Fibonacci retracement level of the recent modest recovery from the lowest level since December 2015. Some follow-through selling below the overnight swing low, around the 16.80 area, will be seen as a fresh trigger for bearish traders and pave the way for a further near-term depreciating move.

Meanwhile, oscillators on the daily chart - though have been recovering - are still holding in the bearish territory and have again started gaining negative traction on hourly charts. This, in turn, suggests that the path of least resistance for the USD/MXN pair is to the downside. Hence, a subsequent slide back towards challenging the multi-year low, around the 16.70 region touched last week, looks like a distinct possibility.

Sustained weakness below the latter will be seen as a fresh trigger for bearish traders and expose the next relevant support near the 16.60 region. The USD/MXN pair could extend the downward trajectory and eventually drop to October/November 2015 lows, around the 16.3555-16.3250 area.

On the flip side, the 50% Fibo. level, around the 16.8740-16.8745 region now seems to act as an immediate strong barrier. A sustained strength beyond might trigger a short-covering move towards the 16.9200 zone en route to the 16.9600-16.9700 supply zone. The latter coincides with the 23.6% Fibo. level, which if cleared decisively will negate the negative outlook and lift the USD/MXN back above the 17.00 mark.

USD/MXN 1-hour chart

Key levels to watch

Author

Haresh Menghani

FXStreet

Haresh Menghani is a detail-oriented professional with 10+ years of extensive experience in analysing the global financial markets.