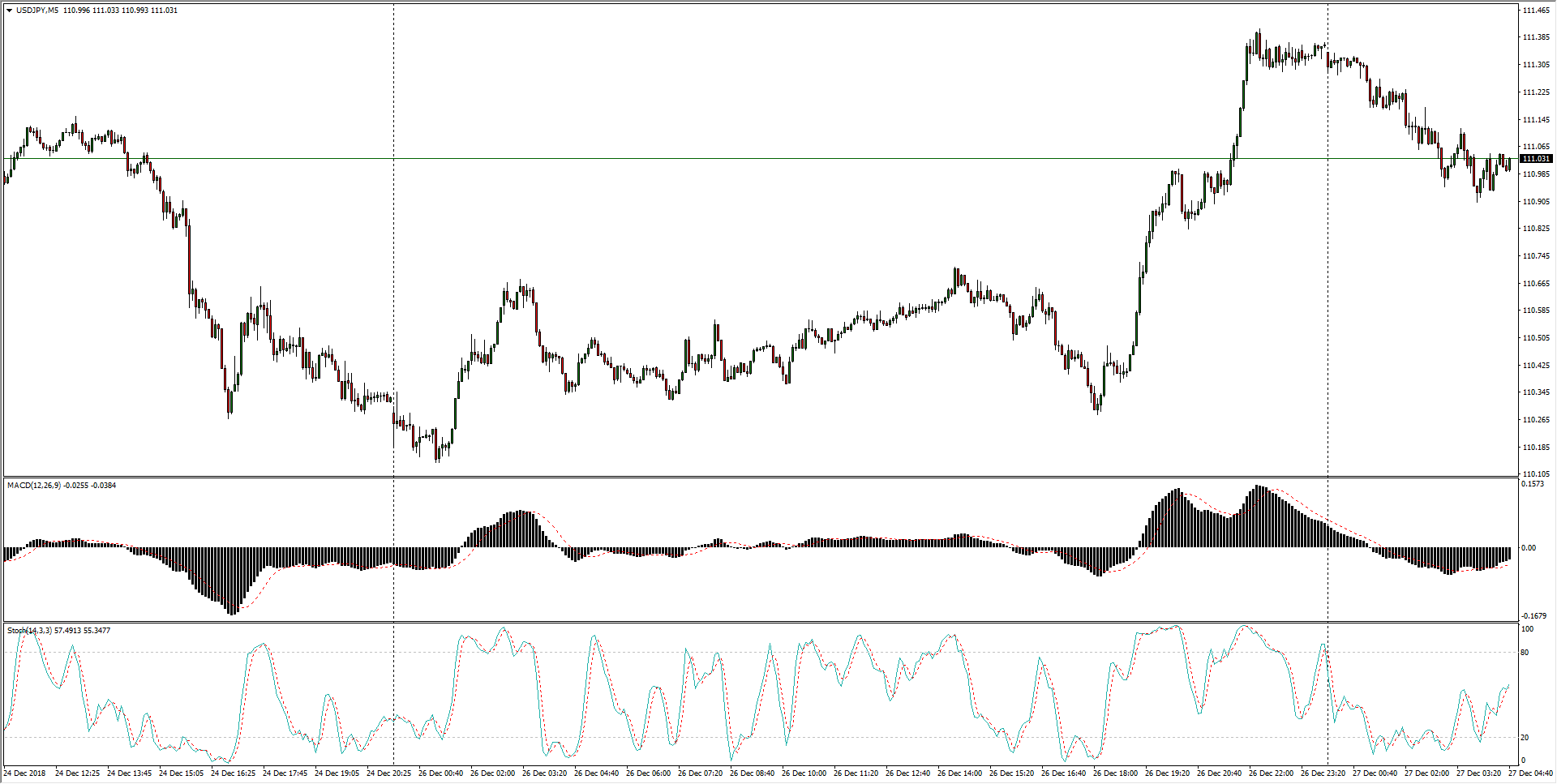

USD/JPY Technical Analysis: Slipping back into 111.00 as buyers disappear

- USD/JPY is seeing bearish drift in early Thursday action, dropping back into the 111.00 major handle after clipping into an intraday high of 111.40 on Wednesday.

USD/JPY, 5-Minute

- The Dollar-Yen pairing still remains firmly bearish in the near-term, lacking a workable higher low for bidders to launch from.

USD/JPY, 30-Minute

- This week's bull run for USD/JPY sees little chances of continuing, with buyers already threatening to run out of gas with the pair remaining firmly below the last relevant swing lows near 112.40.

USD/JPY, 4-Hour

USD/JPY

Overview:

Today Last Price: 111.04

Today Daily change: -30 pips

Today Daily change %: -0.269%

Today Daily Open: 111.34

Trends:

Previous Daily SMA20: 112.56

Previous Daily SMA50: 112.86

Previous Daily SMA100: 112.38

Previous Daily SMA200: 110.97

Levels:

Previous Daily High: 111.41

Previous Daily Low: 110.13

Previous Weekly High: 113.52

Previous Weekly Low: 110.81

Previous Monthly High: 114.25

Previous Monthly Low: 112.3

Previous Daily Fibonacci 38.2%: 110.92

Previous Daily Fibonacci 61.8%: 110.62

Previous Daily Pivot Point S1: 110.51

Previous Daily Pivot Point S2: 109.68

Previous Daily Pivot Point S3: 109.23

Previous Daily Pivot Point R1: 111.79

Previous Daily Pivot Point R2: 112.24

Previous Daily Pivot Point R3: 113.07

Author

Joshua Gibson

FXStreet

Joshua joins the FXStreet team as an Economics and Finance double major from Vancouver Island University with twelve years' experience as an independent trader focusing on technical analysis.