USD/JPY Price Analysis: Steady poised for potential uptrend as the week closes

- USD/JPY shows minimal change, indicating a stable weekly close.

- The weekly chart suggests an upward trend with resistance at Tenkan-Sen (149.53); a break above could target 150.00.

- USD/JPY daily chart key levels to watch include 150.77 and YTD high at 151.91 for upside, 148.01, and 147.15 for downside.

The USD/JPY is almost flat late in the North American session, though set to end the week near today’s opening price and exchange hands at 149.47, printing minuscule losses of 0.02%.

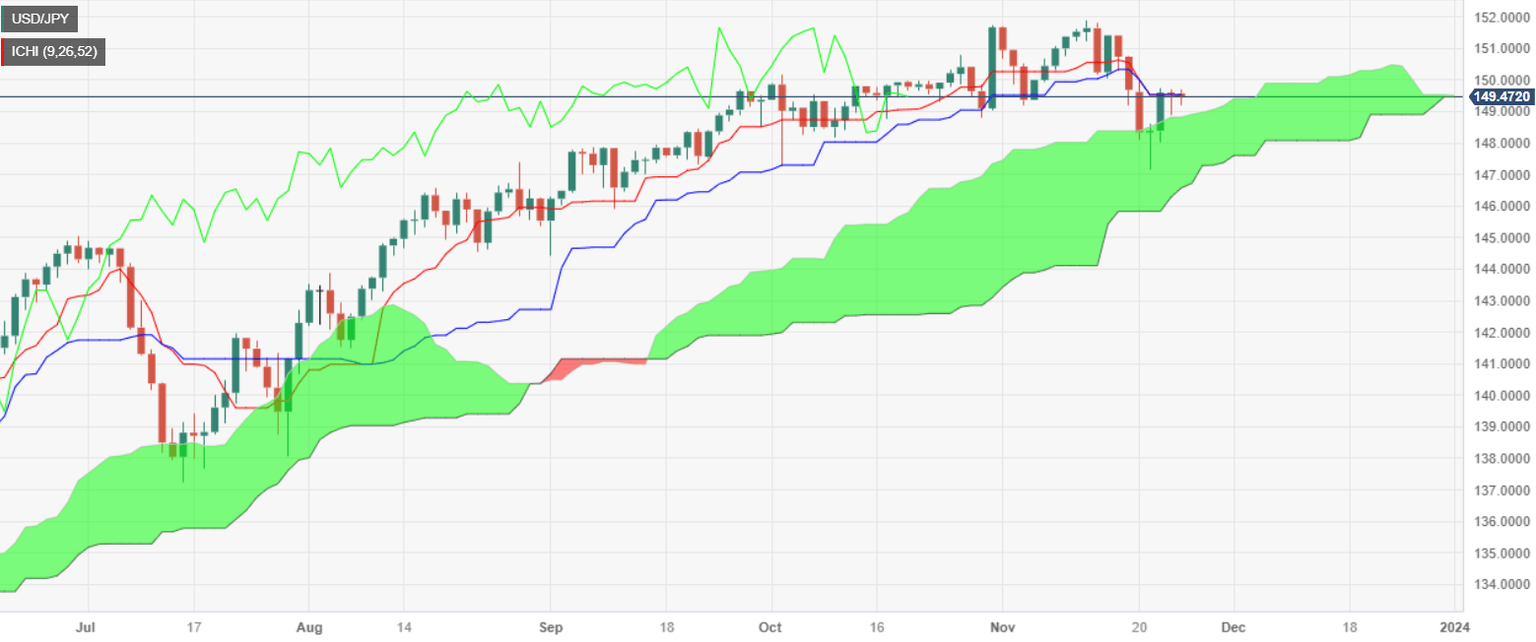

From a weekly chart perspective, the USD/JPY is upward biased, and as the week comes to an end, a ‘dragonfly doji’ is forming, which implies the pair could resume its uptrend. Nevertheless, the major faces solid resistance at the Tenkan-Sen at 149.53. If buyers achieve a weekly close above the latter, the pair could re-test the 150.00 figure.

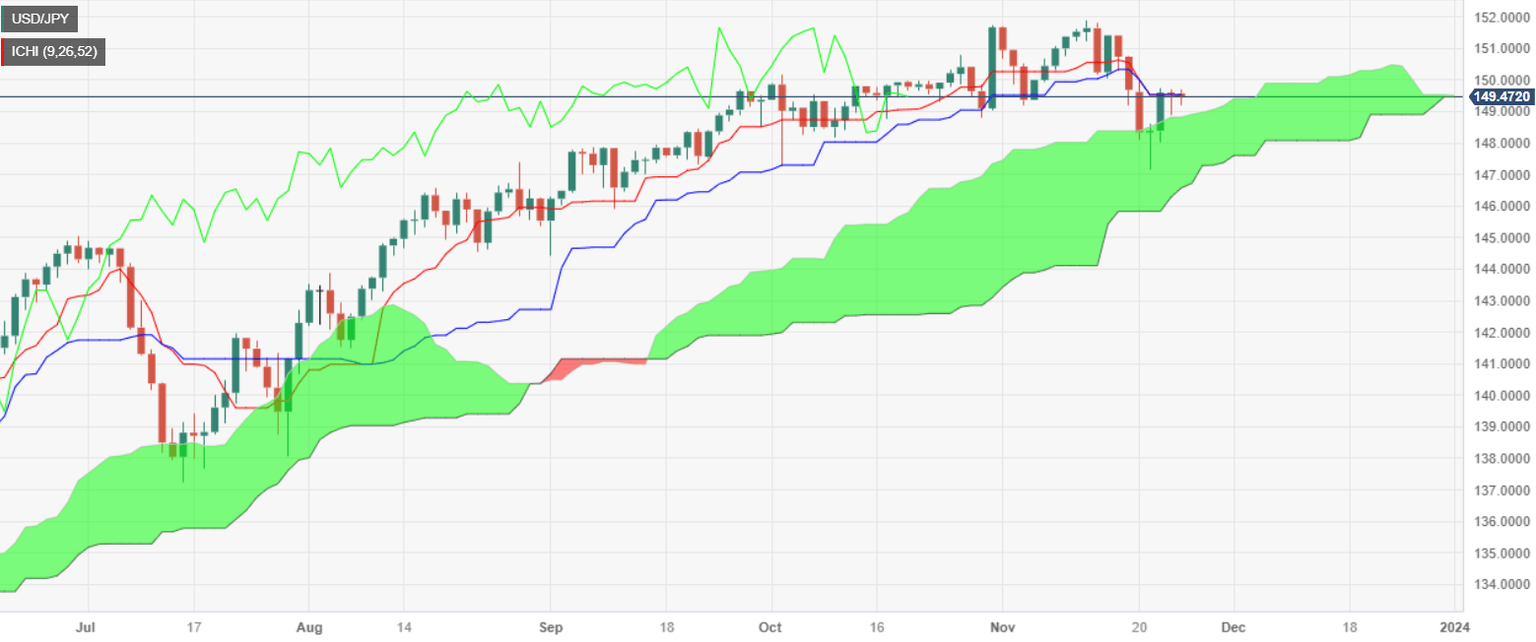

The USD/JPY daily chart shows back-to-back session posting doji’s, which implies traders are undecided. On the upside, traders will collide with the Tenkan-Sen at 149.47, followed by the 150.00 figure, and the November 17 swing high at 150.77. Once cleared, the next resistance would be the year-to-date (YTD) high of 151.91.

On the flip side, if sellers drag prices below 149.00, that would exacerbate a drop toward the November 21 daily low of 148.01, followed by the latest cycle low at 147.15.

USD/JPY Price Analysis – Daily Chart

USD/JPY Technical Levels

Author

Christian Borjon Valencia

FXStreet

Markets analyst, news editor, and trading instructor with over 14 years of experience across FX, commodities, US equity indices, and global macro markets.