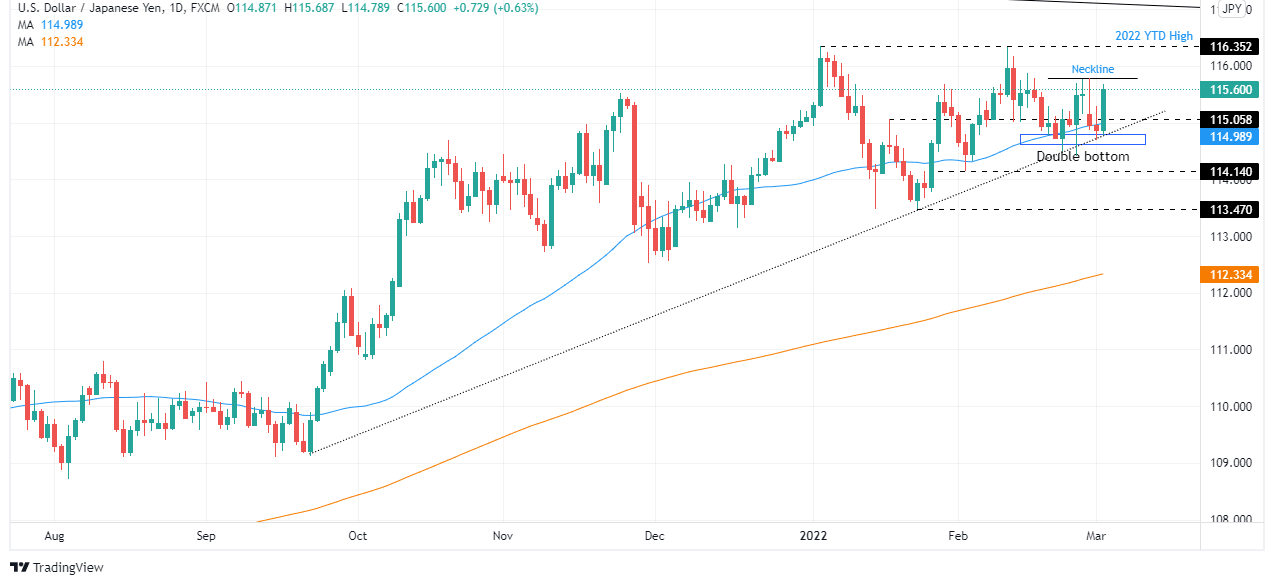

USD/JPY Price Analysis: Double bottom looms as bulls prepare a move towards the YTD high at 116.35

- The US Treasury yields rally underpins the USD/JPY as it gains close to 0.70%.

- Overall, US dollar strength across the board weighs on the USD/JPY pair.

- USD/JPY Technical Outlook: Upward biased, as shown by the DMAs under the exchange rate, alongside a double-bottom chart pattern.

Market mood improvement, spurred by reports of another round of talks between Russia-Ukraine, and higher US Treasury yields benefited the greenback. The USD/JPY rallies for the first time in the week, up some 0.70% in the day, trading at 115.63 at the time of writing.

Portraying the market’s sentiment, European equities finished Wednesday’s session in the green, while US stocks are advancing. US Treasury yield trims some of Tuesday’s sharp losses, led by the 10-year benchmark note rising 13 basis points, up at 1.844%. Higher yields are underpinning the greenback, with the US Dollar Index gaining 0.15%, sitting at 97.580.

USD/JPY Price Forecast: Technical outlook

After recording a low at 114.78, the USD/JPY has climbed steadily since the beginning of Wednesday’s Asian session. In the last three hours, it dipped from the R2 daily pivot at 115.63 to Tuesday’s high at 115.28 before resuming the uptrend, as USD/JPY bulls prepare an attack of the YTD high at 116.35.

The USD/JPY is upward biased, as depicted by two factors. Firstly, the daily moving averages (DMAs) reside below the spot price, and second, a potential double-bottom pattern in the daily chart. That said, the USD/JPY first resistance level would be the neckline around 115.78. Breach of the latter would expose 116.00, followed by the YTD high at 116.35.

Author

Christian Borjon Valencia

FXStreet

Markets analyst, news editor, and trading instructor with over 14 years of experience across FX, commodities, US equity indices, and global macro markets.