USD/INR Price News: RBI challenges Indian rupee bears expecting 80.00

- USD/INR remains pressured inside a bullish chart pattern after reversing from all-time high.

- RBI takes measures to boost USD inflow, tame current account deficit.

- Reuters’ poll signals 33% of respondents favor 80.00 level, no respite for India’s rupee.

- Economic slowdown chatters eyed for fresh impulse, second-tier US data could entertain traders.

USD/INR remains defensive above 79.00, after reversing from the record high the previous day, as the Reserve Bank of India (RBI) intervenes. That said, the US dollar pullback and sluggish markets also challenge the recent USD/INR moves during Thursday’s Asian session.

“India's central bank took a slew of measures on Wednesday to boost foreign exchange inflows, including allowing overseas investors to buy short-term corporate debt and opening of more government securities under the fully accessible route,” said Reuters.

The news also mentioned that the steps came after the Reserve Bank of India's foreign exchange reserves fell by more than $40 billion over the past nine months, largely due to the RBI's intervention in the currency market to cap rupee losses.

Elsewhere, a Reuters poll stated India's rupee will trade near its historic low in three months, battered by widening trade and current account deficits. The July 1-6 poll of over 40 foreign exchange analysts also mentioned that nearly one in three analysts expected it to weaken to 80 per dollar by September.

It’s worth noting that the recent rebound in oil prices, from a 12-week low, joins the market’s recession fears to keep USD/INR buyers hopeful. That said, WTI crude oil prices eyes to regain the $100.00 level, around $96.60 by the press time. In doing so, the black gold ignores the market’s fears of economic slowdown and a build in the US inventories, as per the weekly oil stockpile data from the American Petroleum Institute (API).

Moving on, the US Weekly Jobless Claims and monthly trade numbers will decorate the calendar and direct short-term moves ahead of Friday's US Nonfarm Payrolls (NFP).

Technical analysis

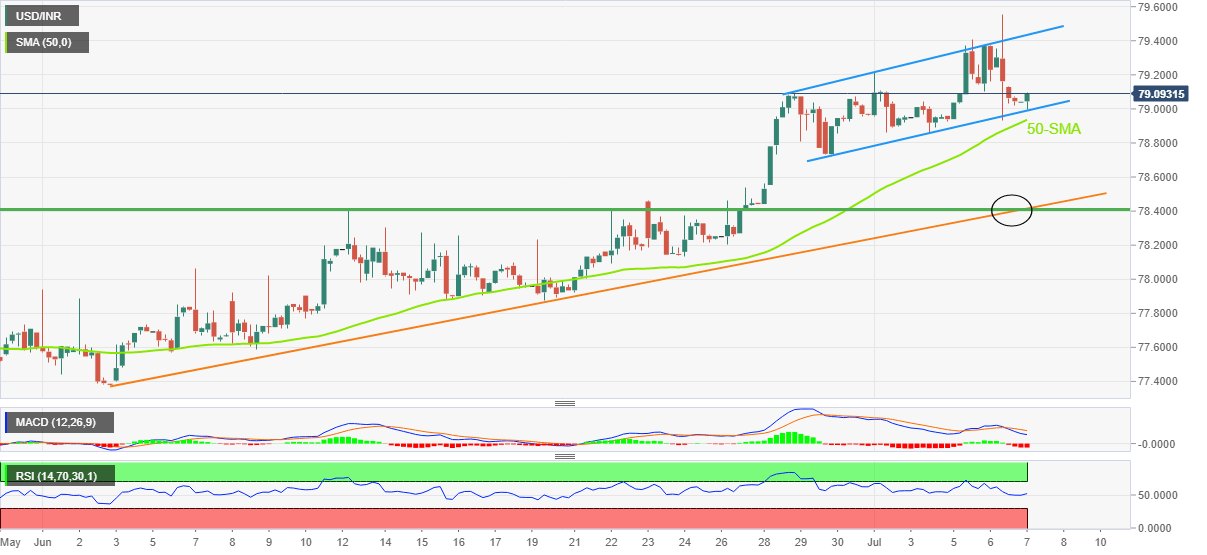

USD/INR stays inside a weekly ascending trend channel amid a steady RSI (14). However, bearish MACD signals challenge the buyers.

That said, the 50-SMA level of 78.93 adds to the immediate downside filters, other than the stated channel’s support line near 78.95.

Even if the quote drops below 78.95, a convergence of the monthly support line and early June’s swing high could test the pair sellers around 78.40.

Alternatively, 79.10 and the aforementioned channel’s upper line, near 79.45 could challenge USD/INR buyers on their way to refreshing the record high with the 80.00 threshold.

USD/INR: Four-hour chart

Trend: Bullish

Author

Anil Panchal

FXStreet

Anil Panchal has nearly 15 years of experience in tracking financial markets. With a keen interest in macroeconomics, Anil aptly tracks global news/updates and stays well-informed about the global financial moves and their implications.