USD/INR Price News: Indian rupee buyers battle key hurdle around 74.50-45

- USD/INR struggles to extend previous day’s pullback, offered near intraday low.

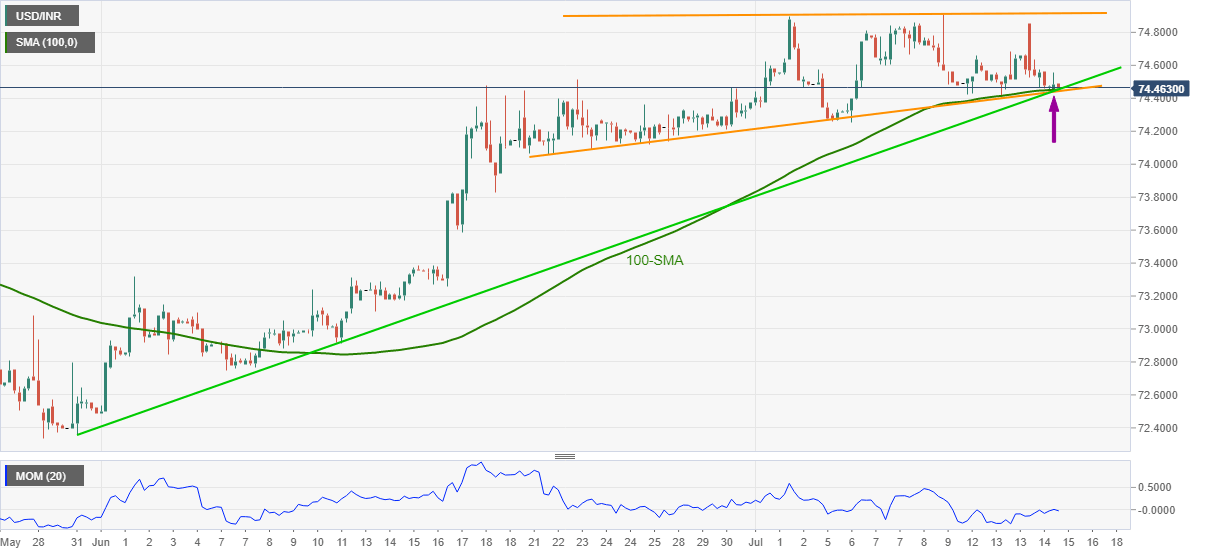

- 100-SMA, rising wedge support and ascending trend line from May 31 constitute the crucial level.

- Bulls remain cautious below 75.00 threshold, bears can aim for early June tops on support break.

USD/INR reverses early Asian bearish consolidation while taking offers near 74.45 heading into Thursday’s European session.

In doing so, the Indian rupee (INR) pair sellers attack the key convergence comprising 100-SMA, lower line of a three-week-old rising wedge bearish formation and an ascending support line from May 31.

Given the pair’s inability to cross the 75.00 hurdle, coupled with the recently picking up Momentum line, as the quote eases, USD/INR prices are likely to conquer the important support convergence near 74.50-45.

Following that, early June’s top near 73.30 becomes a theoretical target to watch but the 74.00 round figure and June 18 low near 73.80 may offer intermediate halts during the expected fall.

Meanwhile, USD/INR bulls may hesitate until the quote crosses the 75.00 resistance even as short-term bounce may recall the 74.70 level to the chart.

It should, however, be noted that a daily closing beyond the 75.00 level will enable the pair buyers to challenge the yearly top surrounding 75.65.

USD/INR: Four-hour chart

Trend: Pullback expected

Author

Anil Panchal

FXStreet

Anil Panchal has nearly 15 years of experience in tracking financial markets. With a keen interest in macroeconomics, Anil aptly tracks global news/updates and stays well-informed about the global financial moves and their implications.