USD/CHF Price Forecast: Climbs as hot PPI boosts the Dollar

- USD/CHF up 0.26% to 0.8077 after US PPI approaches 3.5%.

- Pair rebounds from 20/50-day SMA confluence at 0.8042/50, hitting 0.8092 daily high.

- RSI signals bullish momentum; break above 0.8100 could target 0.8171, then 0.8200.

- Key support at 0.8042; a break lower opens the door to 0.8000.

The USD/CHF rises during the North American session as recent economic data from the States prompted investors to reduce bets that the Fed would cut rates by 50 bps, as stated by the US Treasury Secretary Scott Bessent on Wednesday. At the time of writing, the pair traded at 0.8077, up 0.26%.

On Thursday, Bessent backpedaled and said that it is the Fed's job to set interest rates. Meanwhile, traders who piled in for a big size cut scrambled to get out of those positions as US PPI approached the 3.5% figure.

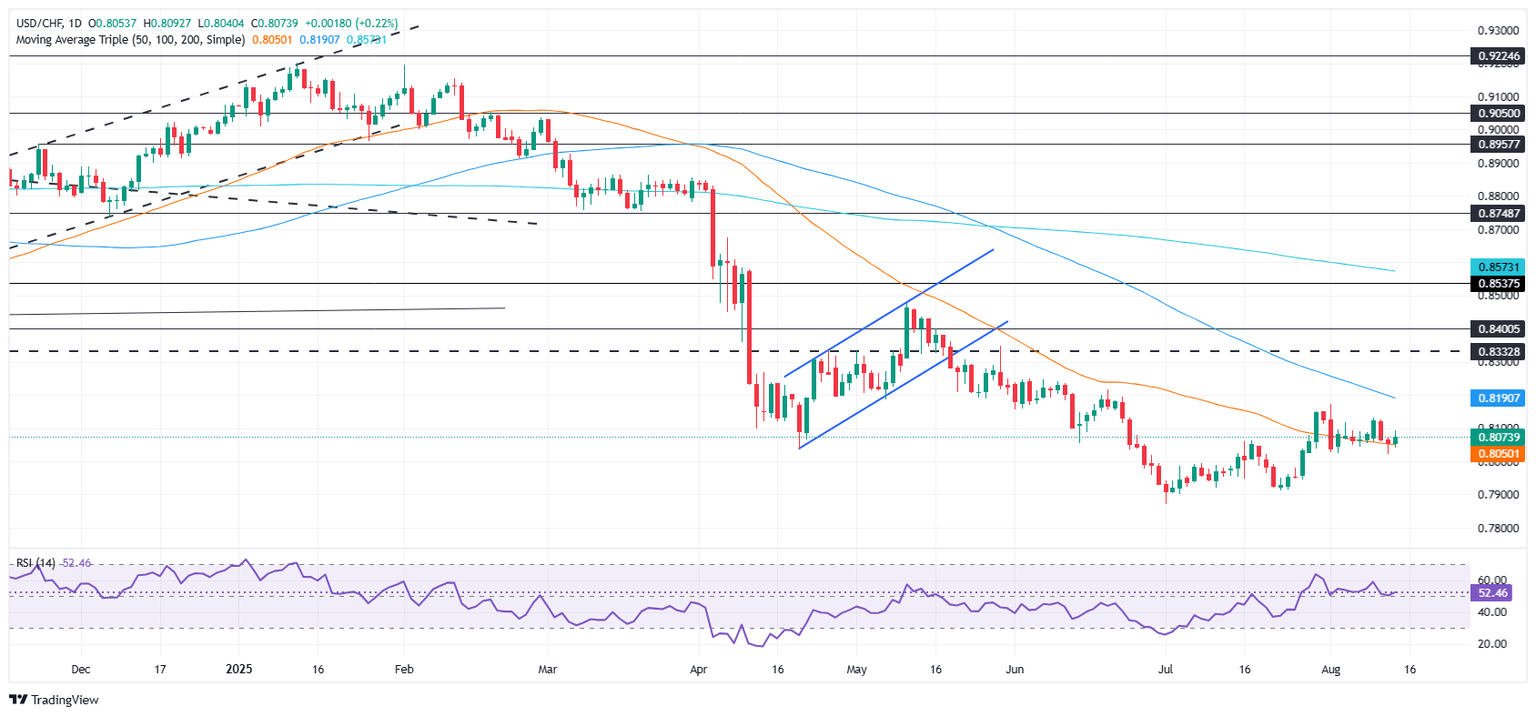

USD/CHF Price Forecast: Technical outlook

The USD/CHF rebounded at around the confluence of the 20/50-day SMA at around 0.8042/50, pushing the pair to print a high of 0.8092 before retreating to the current exchange rates.

Momentum remains bullish as depicted by the Relative Strength Index (RSI), but from a price action perspective, buyers must claim the August 1 high of 0.8171 before the uptrend resumes.

If USD/CHF rises past 0.8100, the next resistance would be 0.8171, followed by 0.8200. Conversely, if the pair tumbles below 0.8042, expect a drop towards the 0.8000 figure.

USD/CHF Price Chart – Daily

Swiss Franc PRICE This week

The table below shows the percentage change of Swiss Franc (CHF) against listed major currencies this week. Swiss Franc was the strongest against the New Zealand Dollar.

| USD | EUR | GBP | JPY | CAD | AUD | NZD | CHF | |

|---|---|---|---|---|---|---|---|---|

| USD | -0.02% | -0.60% | 0.13% | 0.48% | 0.40% | 0.68% | -0.15% | |

| EUR | 0.02% | -0.58% | 0.17% | 0.50% | 0.42% | 0.65% | -0.12% | |

| GBP | 0.60% | 0.58% | 0.70% | 1.12% | 1.01% | 1.24% | 0.47% | |

| JPY | -0.13% | -0.17% | -0.70% | 0.38% | 0.31% | 0.63% | -0.13% | |

| CAD | -0.48% | -0.50% | -1.12% | -0.38% | -0.05% | 0.15% | -0.63% | |

| AUD | -0.40% | -0.42% | -1.01% | -0.31% | 0.05% | 0.23% | -0.54% | |

| NZD | -0.68% | -0.65% | -1.24% | -0.63% | -0.15% | -0.23% | -0.77% | |

| CHF | 0.15% | 0.12% | -0.47% | 0.13% | 0.63% | 0.54% | 0.77% |

The heat map shows percentage changes of major currencies against each other. The base currency is picked from the left column, while the quote currency is picked from the top row. For example, if you pick the Swiss Franc from the left column and move along the horizontal line to the US Dollar, the percentage change displayed in the box will represent CHF (base)/USD (quote).

Author

Christian Borjon Valencia

FXStreet

Markets analyst, news editor, and trading instructor with over 14 years of experience across FX, commodities, US equity indices, and global macro markets.