USD/CAD slipping back beneath 1.3500 as surging oil prices boost CAD

- The USD/CAD couldn't hold onto highs above 1.3540, falling back to end Wednesday flat.

- The US Dollar is broadly higher across the markets, but the CAD is seeing additional support from bumping oil prices.

- US & CAD GDP to land on Friday.

The USD/CAD kicked Wednesday off with a jump to 1.3543 as the US Dollar (USD) caught a broad-market bid on risk aversion and bumper US data, but soaring crude oil prices are sending the Loonie (CAD) higher and the USD/CAD is set to head into Thursday's market session trading on the low end of the 1.3450 handle.

US data continues to beat expectations, with US Durable Goods Orders for August printing at 0.2% versus the forecast -0.5%. Up next for the US data docket will be Thursday's Gross Domestic Product (GDP). US GDP for the second quarter is seen holding steady at the previous print of 2.1%.

Friday will see Canadian GDP figures for July forecast to rebound from -0.2% to 0.1%, while the US side sees Personal Consumption Expenditure (PCE) Price Index numbers, which the median market forecasts are expecting to hold steady at 0.2% for the month of August.

The US Dollar eventually lost the tug-of-war with the oil-bolstered Loonie, even as hawkish Fed officials and an impending government shutdown prop up the US Dollar Index (DXY) to fresh highs.

Crude oil prices are leaping up the charts as supply constraints continue to squeeze barrel costs to 13-month highs, and the upside fossil pressure was enough to keep CAD on-balance to send the USD/CAD back to the 1.3500 handle.

Read more:

Fed’s Kashkari: I am open to the possibility that we may need more than one hike

Forex Today: Dollar is the only safe haven in town, Oil soars

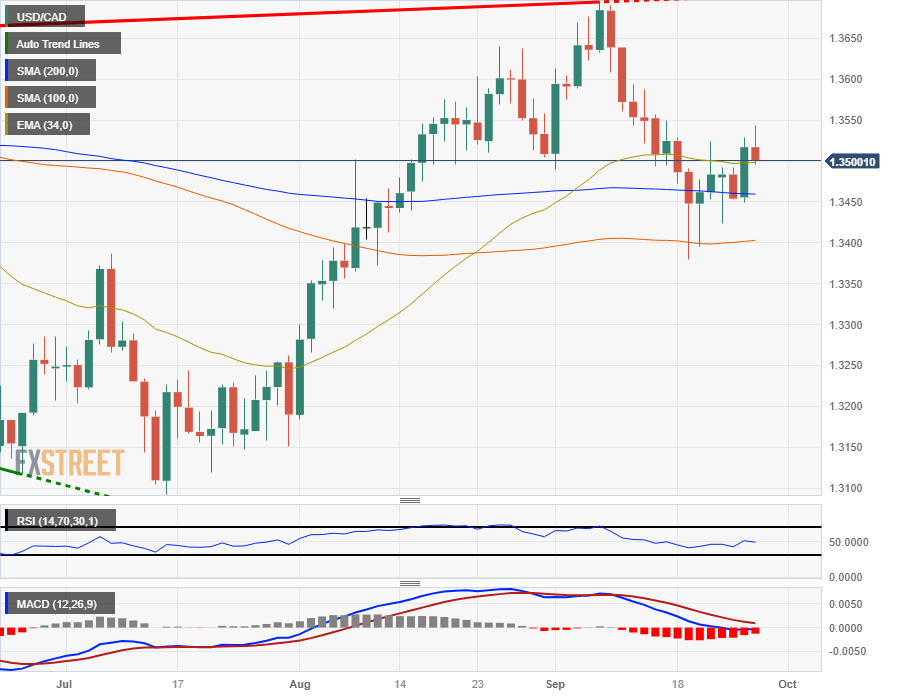

USD/CAD technical outlook

The USD/CAD is getting pinned to the 34-day Exponential Moving Average (EMA) on daily candles, and the pair is at risk of falling back to the 200-day Simple Moving Average (SMA) just north of 1.3450.

The pair is still up 3% from the last swing low into the 1.3100 handle.

On the hourly candlesticks, a continued backslide will see the pair testing the 200-hour SMA near 1.3480, with technical support coming from a rising trendline from last week's swing lows near 1.3430 and 1.3450.

USD/CAD daily chart

USD/CAD technical levels

Author

Joshua Gibson

FXStreet

Joshua joins the FXStreet team as an Economics and Finance double major from Vancouver Island University with twelve years' experience as an independent trader focusing on technical analysis.