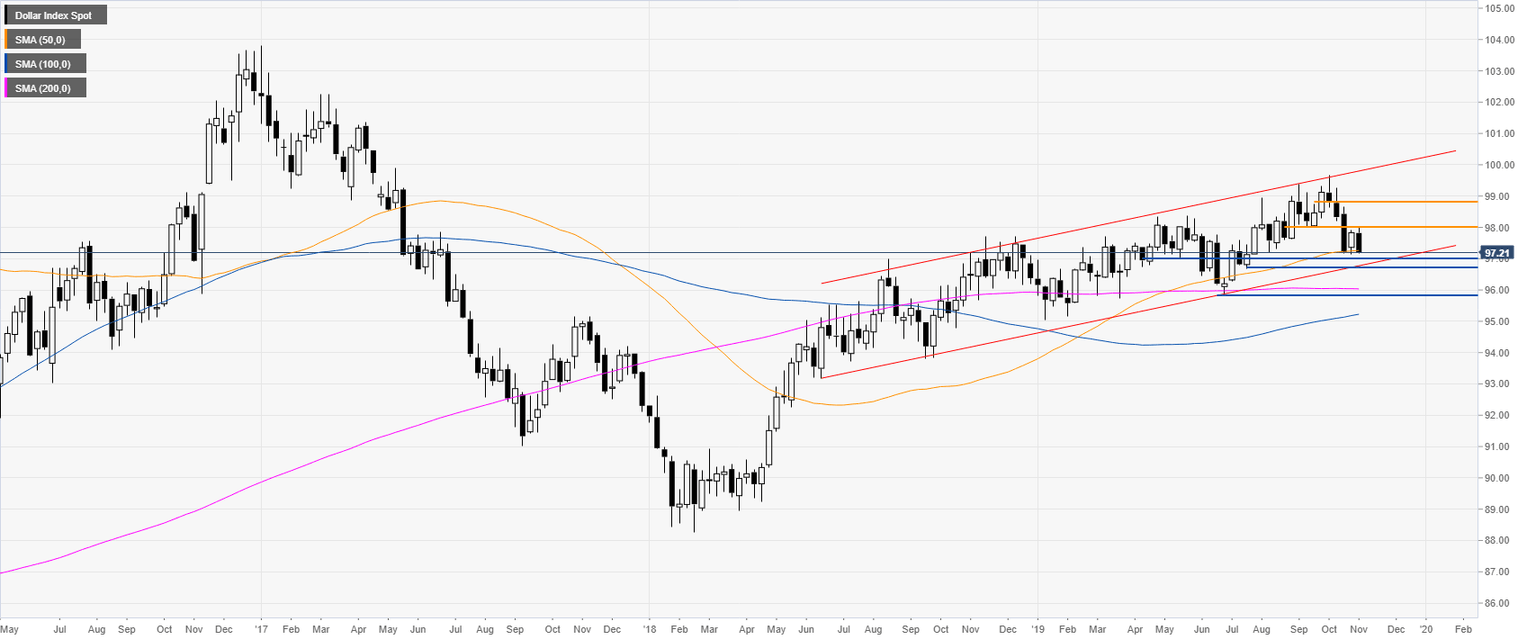

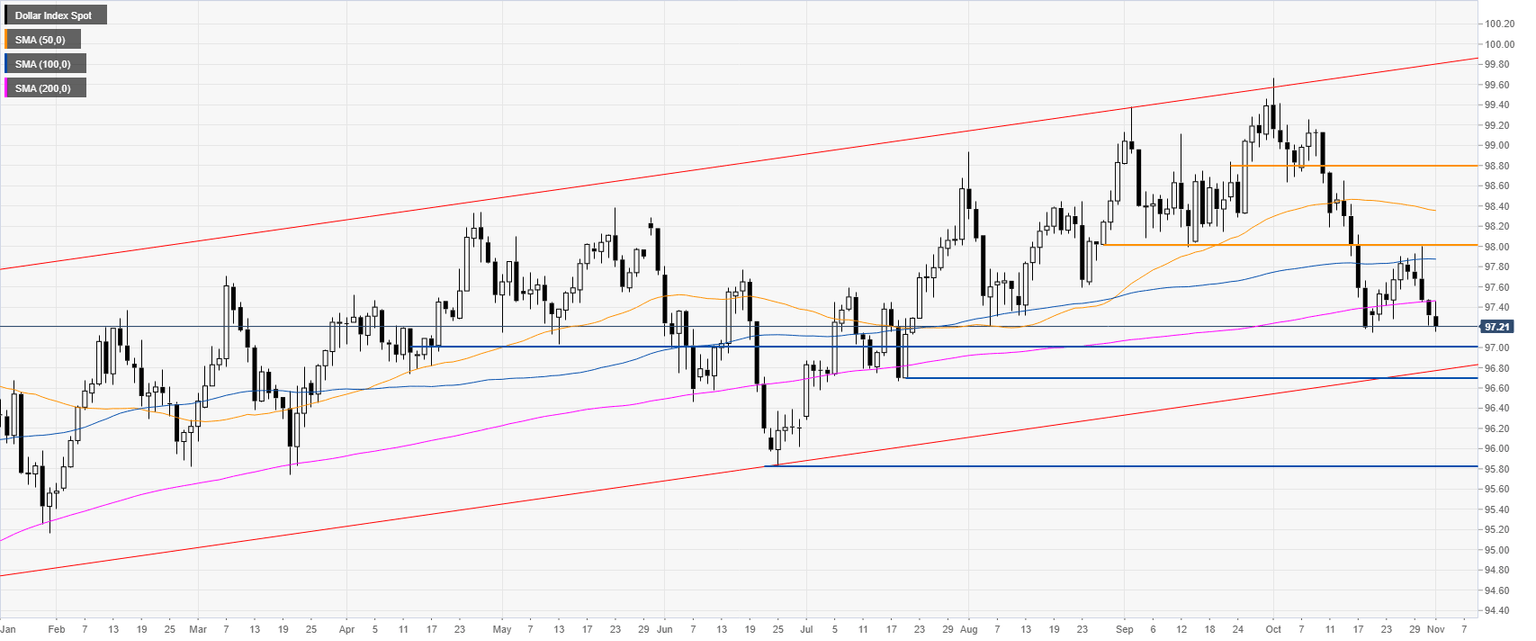

US Dollar Index technical analysis: DXY on life support, ends the week on its lows

- The US Dollar Index (DXY) remains under heavy bearish pressure as this past month of October was the worst for DXY in 21 months.

- However, the bullish bias should remain in place while above the 97.00/97.60 support zone.

DXY weekly chart

DXY daily chart

Additional key levels

Author

Flavio Tosti

Independent Analyst