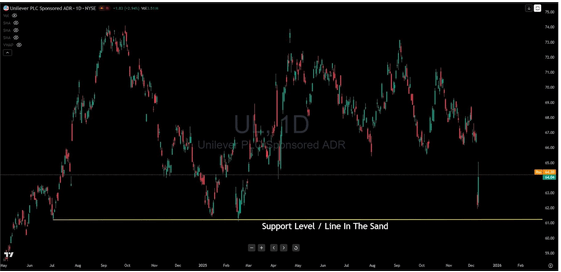

Unilever (UL) tests its line in the sand: Will the consumer giant hold or fold?

Unilever PLC (UL), the multinational consumer goods powerhouse behind brands like Dove, Hellmann's, and Ben & Jerry's, just delivered one of those chart moments that separates the patient traders from the impulsive ones. After a brutal descent from the $71 range, shares plunged to test a support level that's been battle-tested throughout 2024 and into 2025—the $61 zone. And right now the stock is fighting back, trading around $64.78, but the real question is whether this bounce has legs or if it's just another false start.

Let's unpack what makes this setup so noteworthy.

UL’s reliable $61 floor

That horizontal yellow line sitting at $61 is the key area I’m watching. It's been the floor beneath Unilever's price action for nearly two years now. Back in March 2024, buyers stepped in aggressively at this level. Fast forward to December 2024—same story. And now, in December 2025, we've seen yet another near test of this zone with price bouncing sharply higher. When a level holds this many times, it becomes psychological bedrock for both institutions and retail traders. The chart annotation calls it a "Line In The Sand," and that's precisely what it represents: the make-or-break threshold where Unilever either defends its territory or surrenders to deeper selling pressure.

The recent selloff was sharp and uncomfortable, the kind that shakes out weak hands and tests conviction. But notice how quickly price reversed just above that $61 support? That's not the behavior of a stock ready to collapse. It suggests buying interest remains intact at these levels.

The bounce: Real strength or head fake?

Unilever has clawed back roughly $3-4 from the low, and the character of this recovery matters. The bounce was decisive, not the slow, grinding recovery you see when buyers lack conviction. For those watching momentum, this could signal the early stages of a legitimate reversal setup—assuming $61 continues to hold as the foundation.

The bullish case is straightforward: if UL can maintain support above $64 and build on this momentum, the next logical targets sit in the $68-70 range, where previous consolidation zones could act as resistance. Traders looking to position on the long side might consider entries on any pullback toward $63-64, using a stop below $61 to define risk. That support level is your invalidation point. If it breaks, the technical thesis crumbles.

The bear case: One break changes everything

But let's not get ahead of ourselves. Support levels, no matter how historically significant, aren't impenetrable walls. They're probabilities, not certainties. If Unilever fails to sustain this bounce and slides back to retest $61 with declining momentum or on heavy volume, that would raise serious red flags. A confirmed break below $61 would likely trigger a cascade of stops and potentially open the door to the $58-59 zone or lower, where the next demand layer might reside.

Bears watching this setup will be looking for failed rallies—price that struggles to reclaim $66-67 before rolling over. Any inability to build on this bounce would suggest distribution is still in control, and patient short-setters might find opportunities on weakness back toward the support level.

What to watch next

The technical narrative here is clear: Unilever is at a pivotal moment. The $61 support has held firm through multiple challenges, and the recent bounce suggests buyers aren't ready to abandon ship. But until price can reclaim and hold above the $67-68 area, this remains a "prove it" situation.

For swing traders, this is a risk-defined setup. Longs with stops below $61 offer a clear trade structure, while bears need to see this bounce fail before committing capital to the short side. Either way, that yellow line at $61 will tell you everything you need to know about Unilever's next move. Will the consumer giant hold its ground, or is this support level about to become resistance? The market's about to deliver its verdict.

Author

Benjamin Pool

Verified Investing

A seasoned financial expert with a passion for empowering individuals to mastering smart money management.