The bull is still in control — But one spike in supply could flip the script [Video]

![The bull is still in control — But one spike in supply could flip the script [Video]](https://editorial.fxsstatic.com/images/i/General-Stocks_3_XtraLarge.png)

Find out the subtle signs that could hint at a sudden market reversal in the S&P 500 at this all-time high level.

Watch the video from the WLGC session on 25 Jun 2025 to find out the following:

-

What does decreasing volume near all-time highs reveal about current market strength?

-

The number #1 signal that traders are watching to spot for a pullback off the all-time high level.

-

What to anticipate in the S&P 500 should a market reversal trigger?

S&P 500 approaches all-time highs

Yesterday’s market action was bullish, with the S&P 500 making its first major attempt to break out of the previous all-time high of 6150.

We’ve been expecting this move and warned it was likely the market would keep climbing toward these lofty targets before we see any meaningful correction.

Limited pullbacks—Bullish momentum remains

Since the most recent bottom, pullbacks have been shallow and almost negligible. The majority of the moves have been “grinding up,” suggesting continued upward momentum.

Both supply and demand are decreasing, but crucially, supply is still less than demand, keeping the bulls in control for now.

Warning signs to monitor

Despite the bullish trend, traders should keep an eye on:

-

A sudden spike in supply (profit-taking or new short positions at all-time highs)

-

Potential pullbacks to the 6000 level, which now serves as psychological and technical support

Looking for healthy pauses

If we see a slight uptick in supply or increased volatility, a healthy pullback or pause could be in the cards.

This would give the market a chance to consolidate and “charge up” for another attempt higher, possibly setting the stage for a classic rounding pattern or handle formation before a breakout.

Overall market health

Despite brief dips and news-driven bearish bars, buyers keep stepping in (“demand tail”—buying the dip), and the higher highs/lows structure confirms the swing remains bullish.

Caution is still warranted near the all-time high resistance, but so far, the market action remains constructive.

The bulls are firmly in control, but it’s normal—and healthy—to expect profit-taking and brief pullbacks at resistance. Keep watching for sudden changes in supply and volatility for early clues to any upcoming reversal.

Market environment

The bullish vs. bearish setup is 502 to 36 from the screenshot of my stock screener below.

Three stocks ready to soar

17 actionable setups such as RBRK, PLTR, STX were discussed during the live session on 25 Jun 2025 before the market open (BMO).

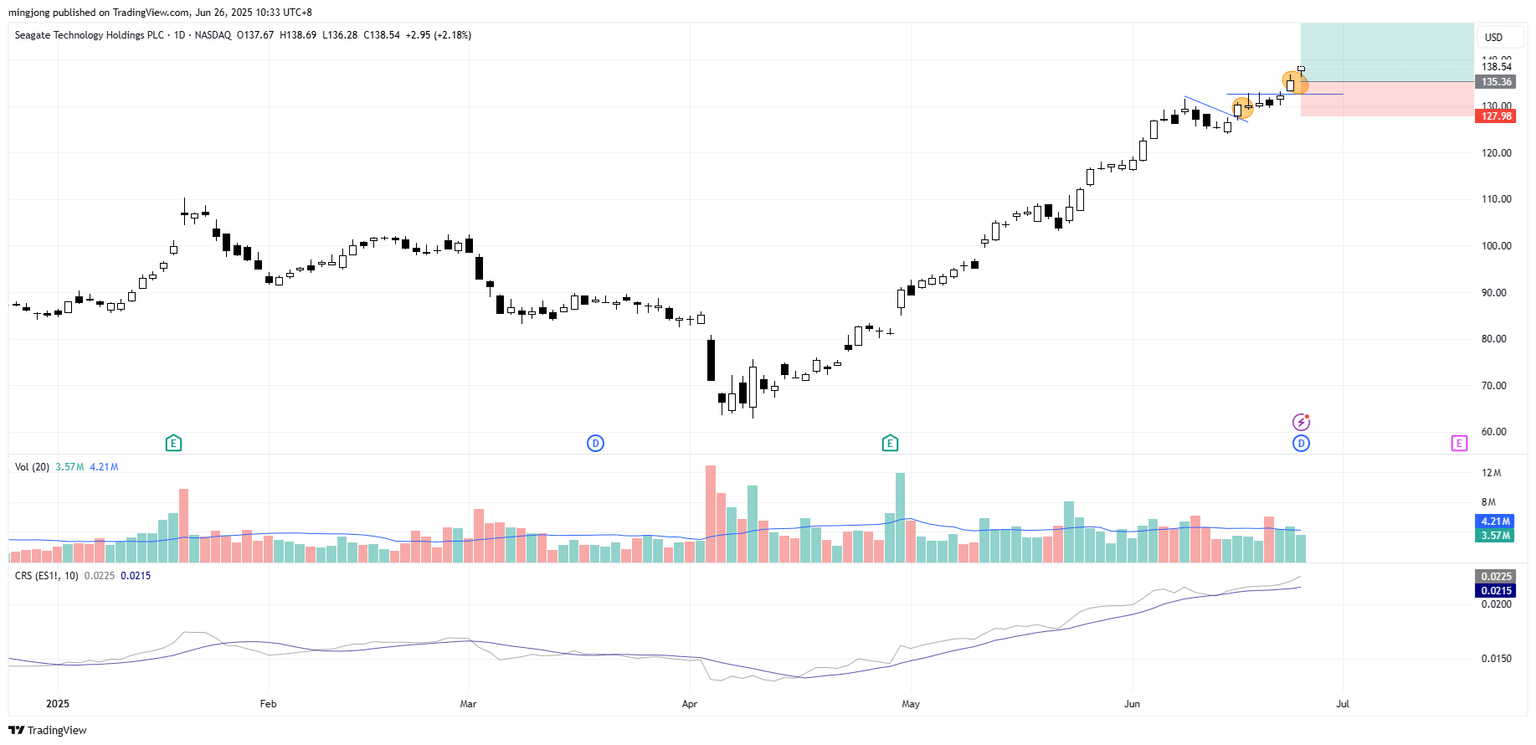

Seagate Technology Holdings (STX)

Rubrik (RBRK)

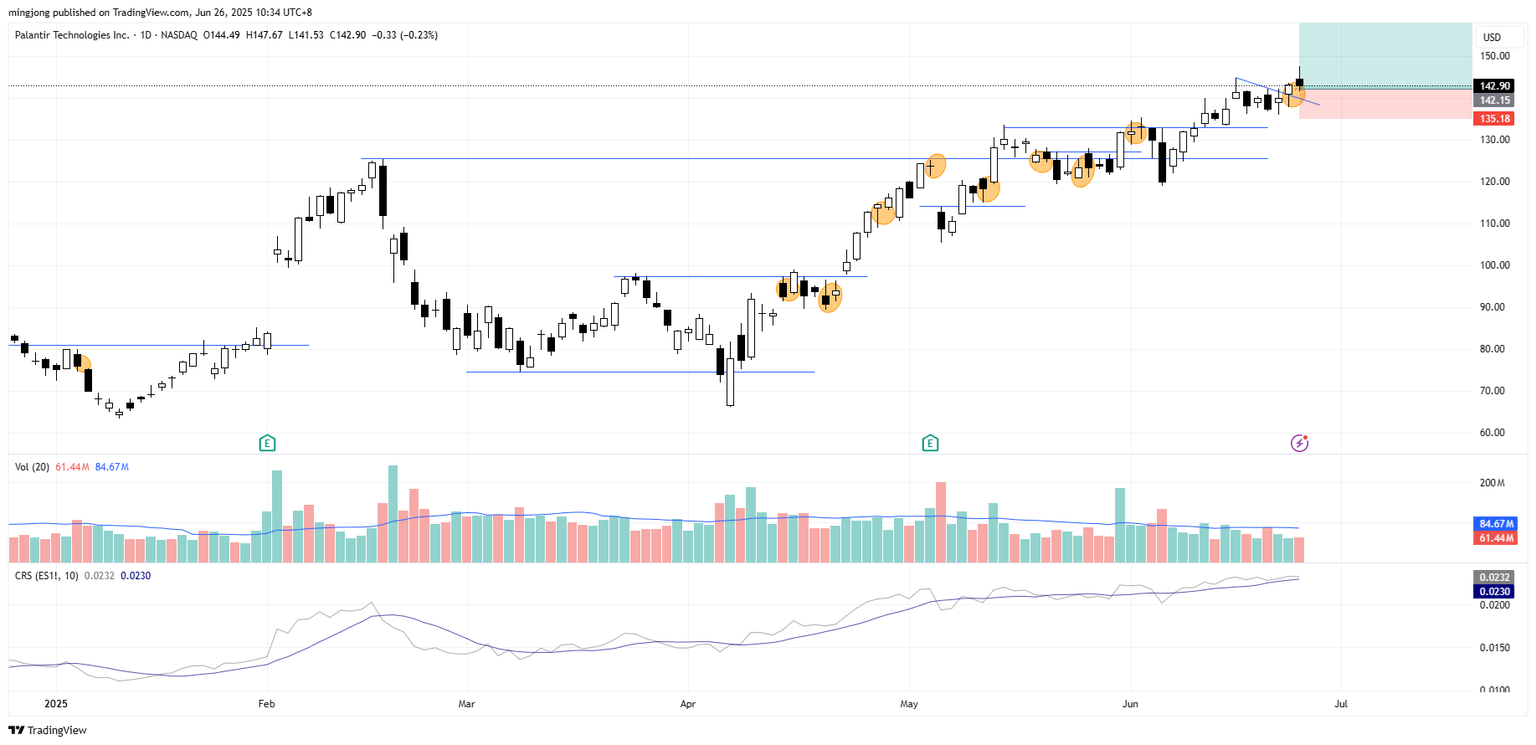

Palantir Technologies (PLTR)

Author

Ming Jong Tey

Independent Analyst

Ming Jong Tey has been trading since 2008. He started his learning journey from technical analysis (indicators, Fibonacci, etc...) to value investing. Throughout his journey, he develops an interest in price action with chart pattern trading.