Tesla stock ($TSLA) buying the dips at the blue box area

In this technical article we’re going to take a quick look at the Elliott Wave charts of Tesla Stock ( $TSLA ) . As our members know, the stock is trading within the cycle from the April 27th low. We have been calling for the rally in the stock after 3 waves pull back. Our team recommended members to avoid selling Tesla, while keep favoring the long side. In the further text we are going to explain the Elliott Wave Forecast and the trading setup.

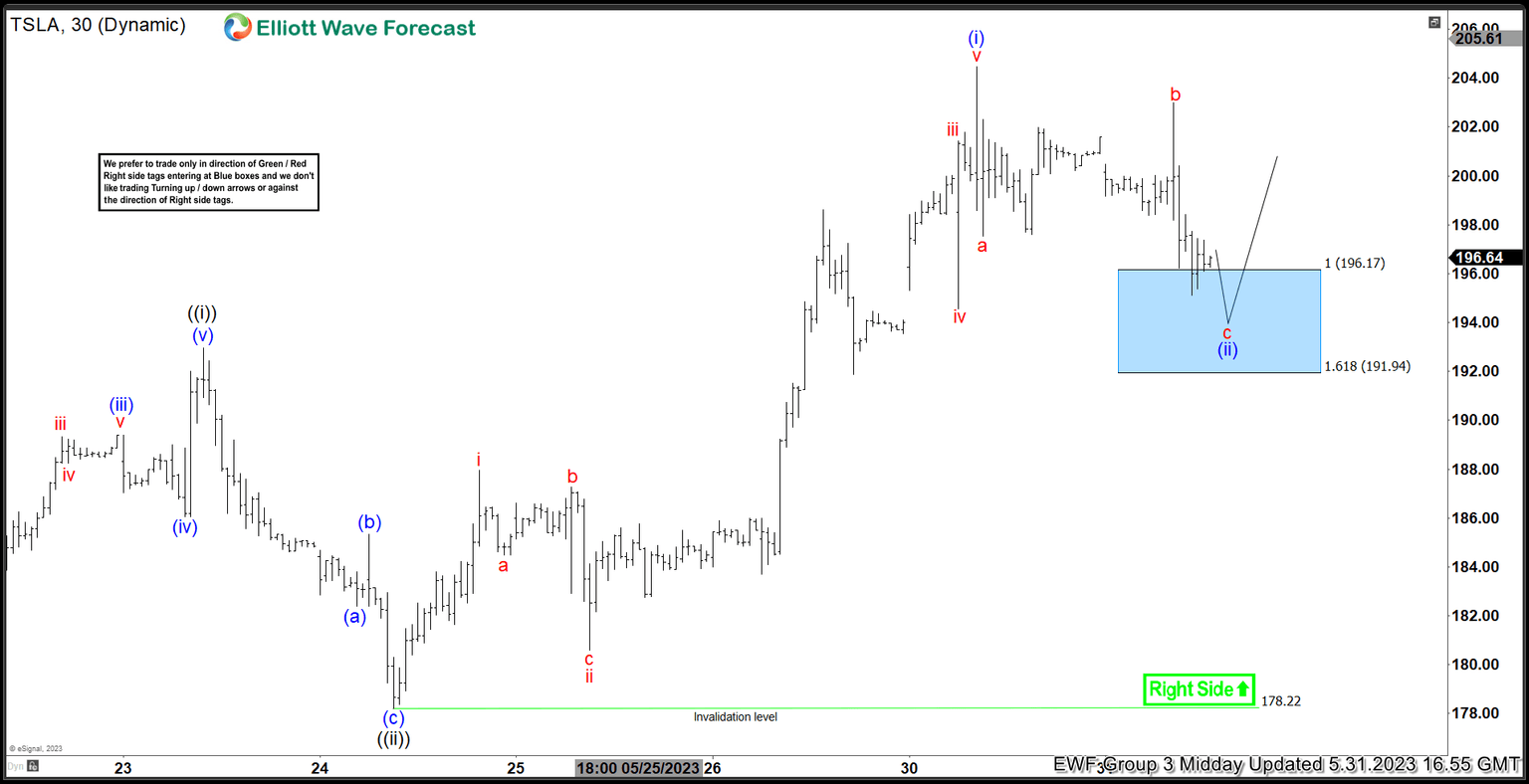

Tesla stock ($TSLA) Elliott Wave 1-hour chart 05.31.2023

Current view suggests the stock is doing correction of the cycle from the 178.22 low. We got 5 waves up from the mentioned low wave and now about to complete (ii) blue short term pull back. We can already count 3 waves down from the peak. The price has reached extreme zone at 196.17-191.94 ( blue box- buying zone) . We don’t recommend selling it and prefer the long side. Tesla stock should ideally make a rally toward new highs.

Tesla stock ($TSLA) Elliott Wave 1-hour chart 06.01.2023

$TSLA found buyers right at the Blue Box area and we are getting good reaction from there. Rally made enough separation from the lows. As a result, members who took long positions are enjoying profits in a risk free trades. Wave ((ii)) looks completed at 195.17 low . As far as the price holds above that low, the stock can be trading higher in ((iii)) toward new highs. We would like to see break above previous peak ((i)) black which will confirm next leg up is in progress. That would also make 5 waves up in (i) blue. Then we expect to get 3 waves pull back before further rally continues again.

Tesla stock ($TSLA) Elliott Wave 1-hour chart 06.02.2023

Eventually the stock made break up as expected. It completed 5 waves up in (i) blue, made pull back in (ii) blue and continued higher again.

Author

Elliott Wave Forecast Team

ElliottWave-Forecast.com