Here is what you need to know on Friday, April 9:

Up, up and away, as bulls push more record highs in equity markets. In the short term nothing, it appears, is clouding the picture. Or is it?

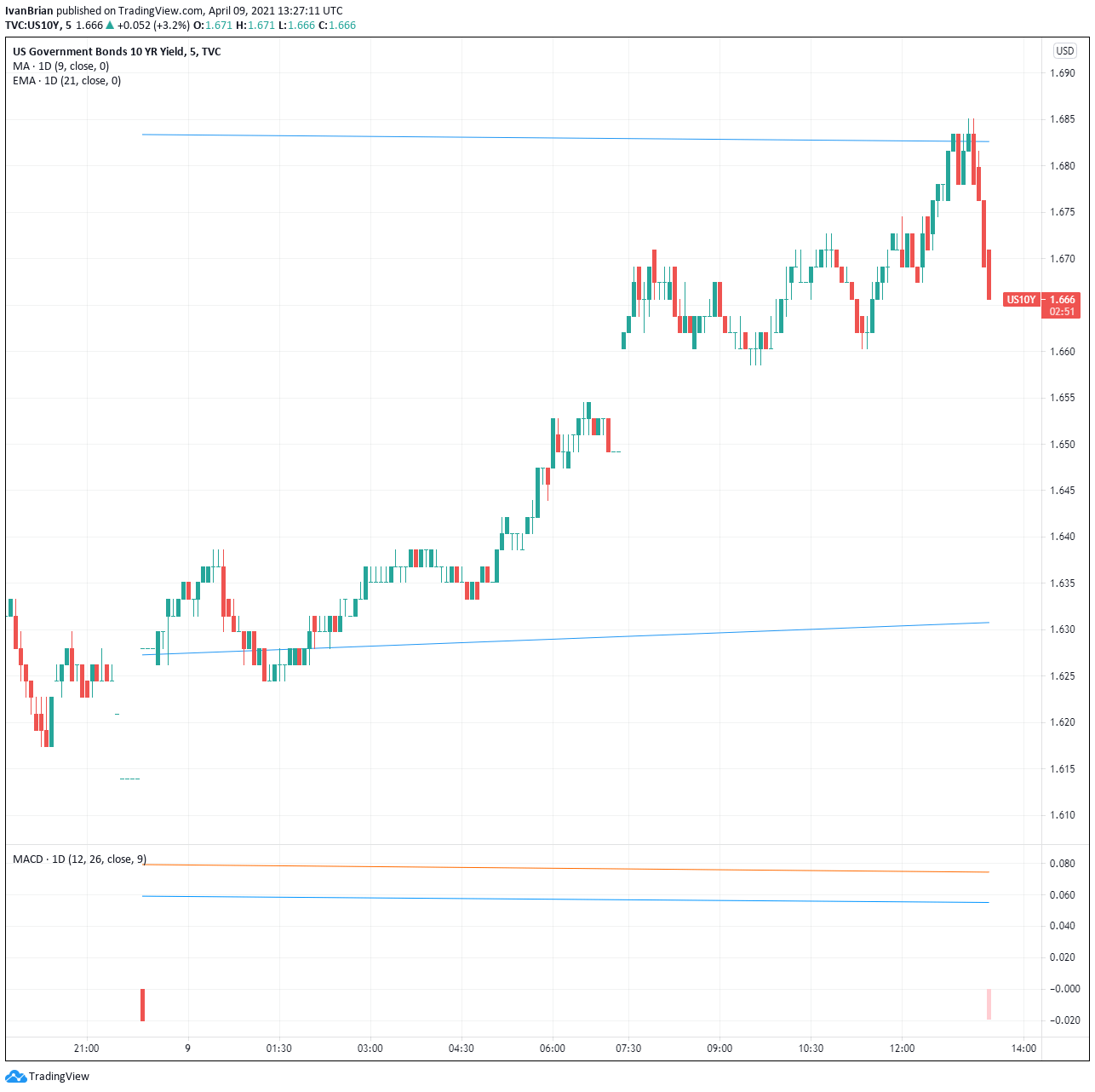

The 10-year yield reawakened with a fairly sharp rise back toward 1.7%. This may make the Nasdaq a bit hesitant on Friday with Nasdaq futures already slipping into the red. Inflation data will take its queue from the release of US PPI, if we ever get it, as the Labor Department says the data is delayed due to website problems.

Maybe the Fed has just decided to freeze prices permanently! Powell certainly did not think rising prices will lead to "worriesome inflation" in a speech on Thursday.

10-year yield over last 18 hours

The dollar is a touch stronger back below 1.19 against the euro. Gold is 1% lower at $1,726, Oil similarily down 1% at $59.28, and Bitcoin recovers some ground to $58,500.

European markets are mixed. The Dax is +0.1%, FTSE -0.4%, and the EuroStoxx is flat.

US futures are led by the Dow +0.2% while the S&P 500 is flat, and the Nasdaq is down 0.4%.

Stay up to speed with hot stocks' news!

S&P 500 SPX top news

The US decides to release PPI after all, and it is higher than expected! PPI monthly +1% versus 0.5% expected.

Florida sues Centre for Disease Control to allow cruises from the US. Royal Caribbean says it would like to be treated like the airlines, who are allowed to fly.

President Biden is to release his first budget proposal to Congress later on Friday.

Federal Reserve Clarida says inflation should revert back by the end of the year.

Uber and Lyft are giving drivers access to vaccines and providing free or discounted rides to vaccination centres for certain communities.

LEVI beats estimates on EPS and revenue, stock up in pre-market.

FuboTV wins rights to Qatar 2022 World Cup qualifying matches for South American teams.

Amazon: Alabama unionisation ballot ongoing amid challenges to some 500 ballots according to Reuters. CNBC reports 2-to-1 so far reject unionisation.

Mcdonalds is to hire up to 25,000 across Texas in April.

MSFT: says some public LinkedIn data has been extracted and made available for sale.

Nike: says Satan Shoes released by a Brooklyn company will be recalled as part of a legal settlement. Nike had filed a trademark infringement lawsuit against the Brooklyn company.

Pfizer: Australia has doubled its order of Pfizer's COVID-19 vaccine.

Southwest Airlines is recalling over 2,700 flight attendants from leave.

Boeing asks some customers to look at potential electrical problems in some 737 Max planes.

Chipotle upgraded by Wedbush on Thursday has seen six days of price gains.

Ups and Downs

Charles Schwab: JPMorgan raises price target.

Honeywell: Deutsche Bank upgrades.

Philip Morris: JPMorgan upgrades.

GE: UBS increases price target. see more

DraftKings: Jefferies names as top pick.

Carnival: Credit Suisse upgrades.

Economic data due

At the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

This article is for information purposes only. The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice. It is important to perform your own research before making any investment and take independent advice from a registered investment advisor.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to accuracy, completeness, or the suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. The author will not be held responsible for information that is found at the end of links posted on this page.

Errors and omissions excepted.

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended content

Editors’ Picks

EUR/USD clings to daily gains above 1.0650

EUR/USD gained traction and turned positive on the day above 1.0650. The improvement seen in risk mood following the earlier flight to safety weighs on the US Dollar ahead of the weekend and helps the pair push higher.

GBP/USD recovers toward 1.2450 after UK Retail Sales data

GBP/USD reversed its direction and advanced to the 1.2450 area after touching a fresh multi-month low below 1.2400 in the Asian session. The positive shift seen in risk mood on easing fears over a deepening Iran-Israel conflict supports the pair.

Gold holds steady at around $2,380 following earlier spike

Gold stabilized near $2,380 after spiking above $2,400 with the immediate reaction to reports of Israel striking Iran. Meanwhile, the pullback seen in the US Treasury bond yields helps XAU/USD hold its ground.

Bitcoin Weekly Forecast: BTC post-halving rally could be partially priced in Premium

Bitcoin price shows no signs of directional bias while it holds above $60,000. The fourth BTC halving is partially priced in, according to Deutsche Bank’s research.

Week ahead – US GDP and BoJ decision on top of next week’s agenda

US GDP, core PCE and PMIs the next tests for the Dollar. Investors await BoJ for guidance about next rate hike. EU and UK PMIs, as well as Australian CPIs also on tap.

.png)

.png)