S&P 500 Index opens modestly lower after dismal US jobs report

- Wall Street's main indexes trade in the negative territory on Friday.

- Nonfarm Payrolls in the US rose less than expected in August.

- S&P 500 Real Estate Index is the biggest decliner after the opening bell.

Major equity indexes in the US opened slight lower on Friday after the August jobs report painted a gloomy picture regarding the US labor markets. As of writing, the S&P 500 Index was down 0.15% on the day at 4,530, the Dow Jones Industrial Average was falling 0.2% at 35,378 and the Nasdaq Composite was losing 0.1% at 15,310.

The monthly data published by the US Bureau of Labor Statistics showed on Friday that Nonfarm Payrolls (NFP) rose by 235,000 in August, compared to analysts' estimate of 750,000. On a positive note, the Unemployment Rate edged lower to 5.2% from 5.4% in July as expected and July's NFP got revised higher to 1.05 million from 943,000. Finally, the Labor Force Participation Rate remained unchanged at 61.7%.

Among the 11 major S&P 500 sectors, the Real Estate Index is down 0.52% as the largest decliner in early trading. On the other hand, the Energy Index is posting small gains supported by a modest increase seen in crude oil prices.

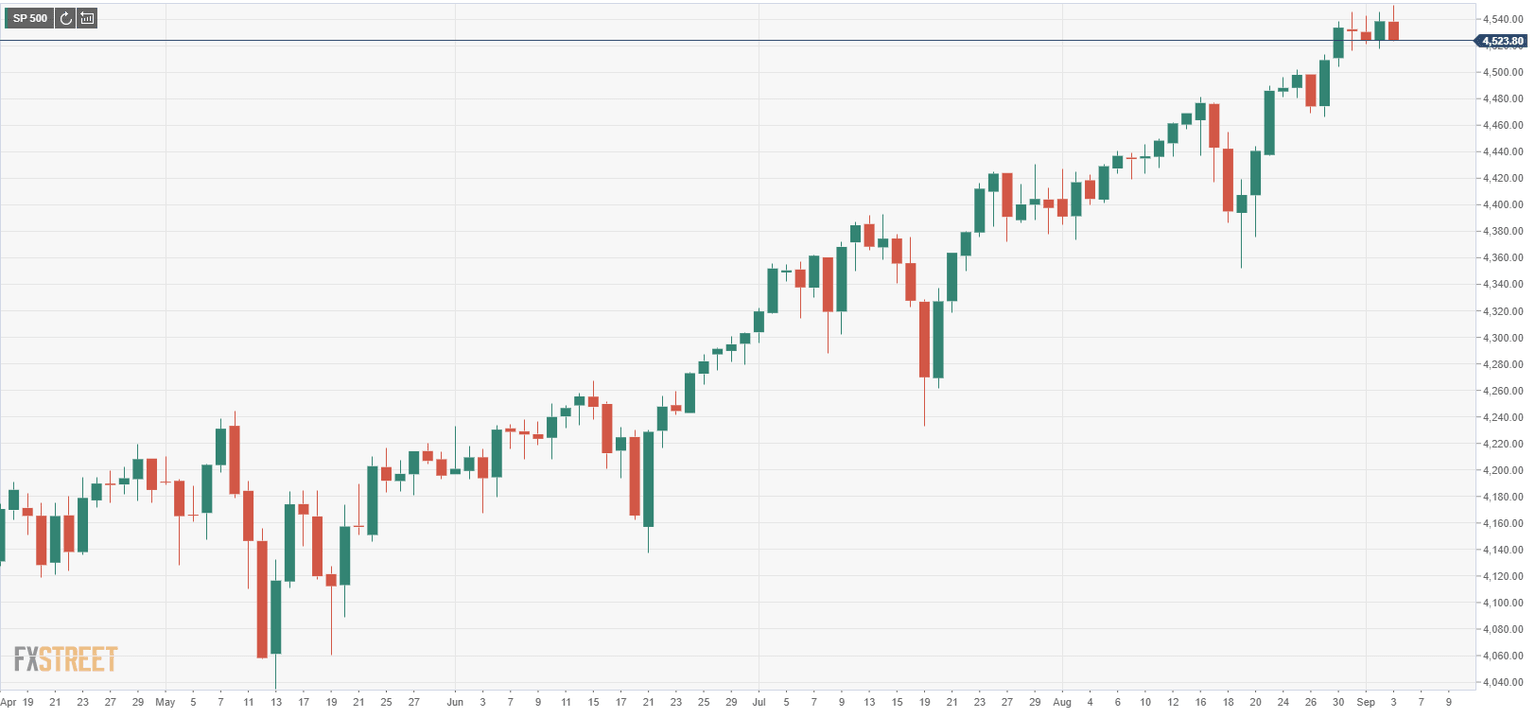

S&P 500 chart (daily)

Author

Eren Sengezer

FXStreet

As an economist at heart, Eren Sengezer specializes in the assessment of the short-term and long-term impacts of macroeconomic data, central bank policies and political developments on financial assets.