S&P 500 Index opens flat as investors await next catalyst

- Wall Street's main indexes opened near Tuesday's closing levels.

- Energy stocks underperform as oil loses bullish momentum.

- Technology shares edge higher after the opening bell.

As signalled by the inactivity in futures trading, major equity indexes in the US opened near Tuesday's closing levels on Wednesday. As of writing, the S&P 500 was flat at 4,487, the Dow Jones Industrial Average was down 0.2% at 35,298 and the Nasdaq Composite Index was up 0.15% at 15,045.

Earlier in the day, the US Census Bureau reported that Durable Goods Orders in July fell by 0.1%, or $0.4 billion, to $257.2 billion. Although this reading came in better than the market expectation for a decrease of 0.3%, it failed to trigger a noticeable market reaction.

Among the 11 major S&P 500 sectors, the Energy Index is down 0.4% as oil recovery seems to have lost momentum. On the other hand, the Technology and the Financials indexes both rise around 0.3% as the best performers after the opening bell.

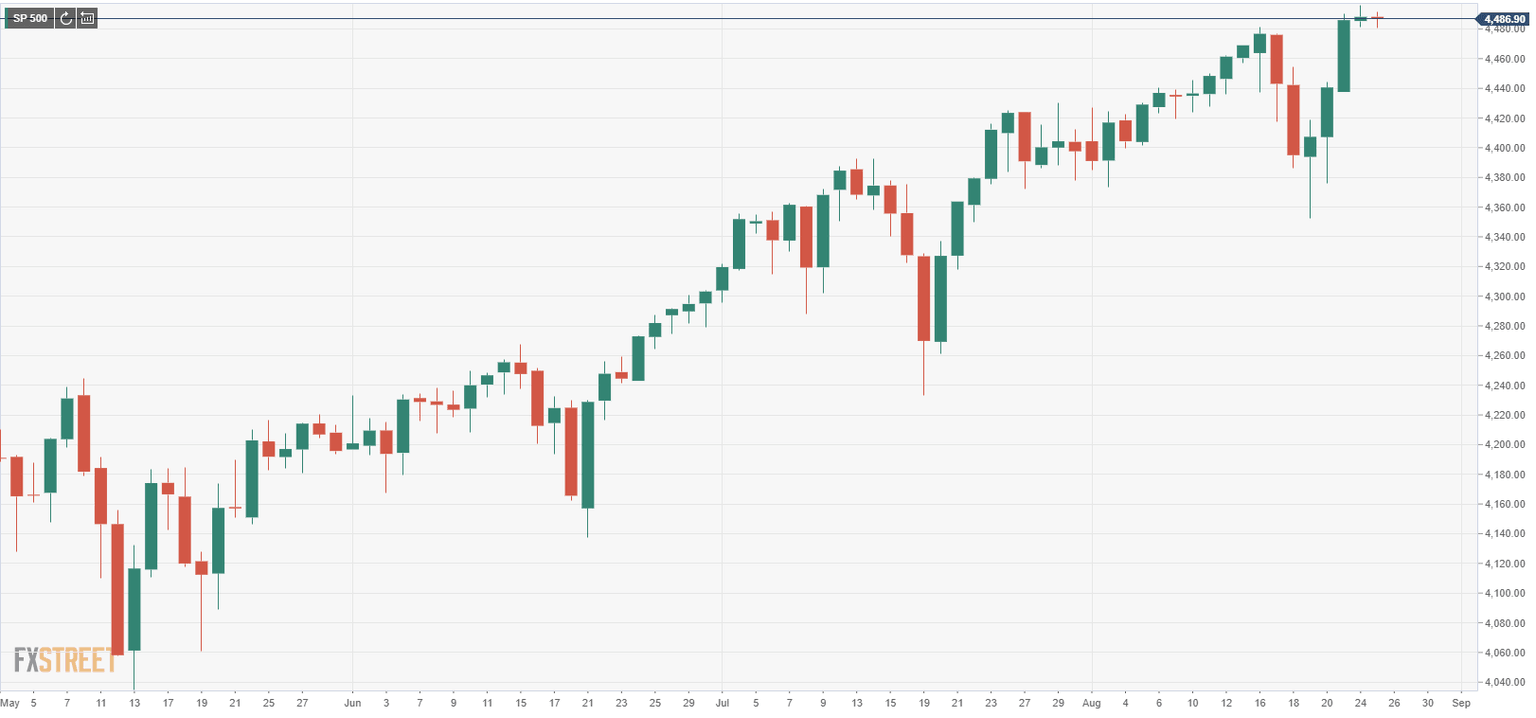

S&P 500 chart (daily)

Author

Eren Sengezer

FXStreet

As an economist at heart, Eren Sengezer specializes in the assessment of the short-term and long-term impacts of macroeconomic data, central bank policies and political developments on financial assets.