SNDL Stock News: Sundial Growers enters a bid for the acquisition of Zenabis

- NASDAQ:SNDL posted a 0.48% loss over the past five trading sessions.

- Sundial is entering a bid for the acquisition of Zenabis Global.

- Sundial could be looking to open its warchest to grow through acquisitions.

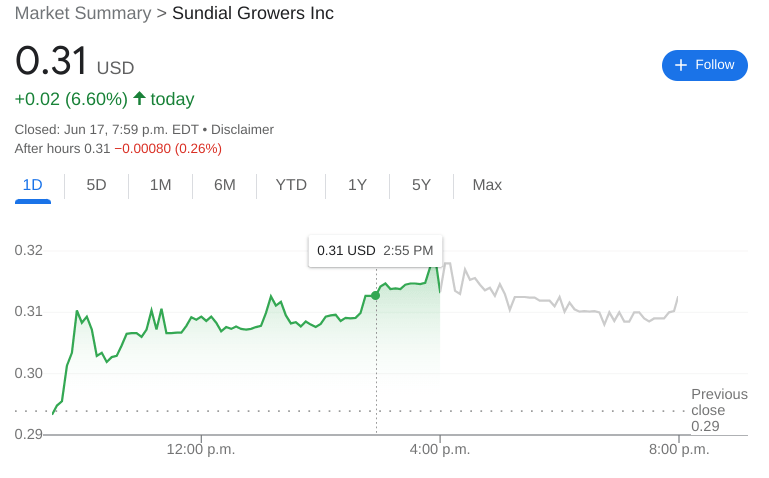

NASDAQ:SNDL managed to reclaim the $0.30 price level at the end of last week but the stock still posted a loss for the previous five trading sessions. Sundial has struggled this year, posting a 49% loss in 2022 and remains in jeopardy of being delisted from the NASDAQ exchange after falling below the $1.00 price level. Rumors of a reverse split have not helped the stock, which finds itself out of favor with even the meme stock crowd. With a short interest of just 9.14%, it doesn’t seem like even a short squeeze will be able to push Sundial back over $1.00.

Stay up to speed with hot stocks' news!

Over the weekend, Sundial emerged as a potential candidate to acquire the Zenabis Group, which is a subsidiary of Quebec-based company Hexo (NASDAQ:HEXO). Sundial made an application to make a stalking horse bid, which is a bid to acquire the assets and resources of a bankrupt entity. Hexo recently sold a stake of its company to Canadian cannabis giant Tilray (NASDAQ:TLRY). The Zenabis assets would include a grow facility in New Brunswick which produces over 46,000 kilograms of dried cannabis per year.

Sundial stock forecast

Sundial could finally be making use of its warchest of cash to make more acquisitions within the industry. Earlier this year, Sundial closed on its acquisition of Canadian liquor distributor, Alcanna, which should reap benefits for Sundial as early as this next quarter. With no debt on its balance sheet, Sundial is in a fortunate position to be able to make acquisitions, and it looks like Zenabis is the company’s first target following the close of the Alcanna deal.

Like this article? Help us with some feedback by answering this survey:

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Stocks Reporter

FXStreet