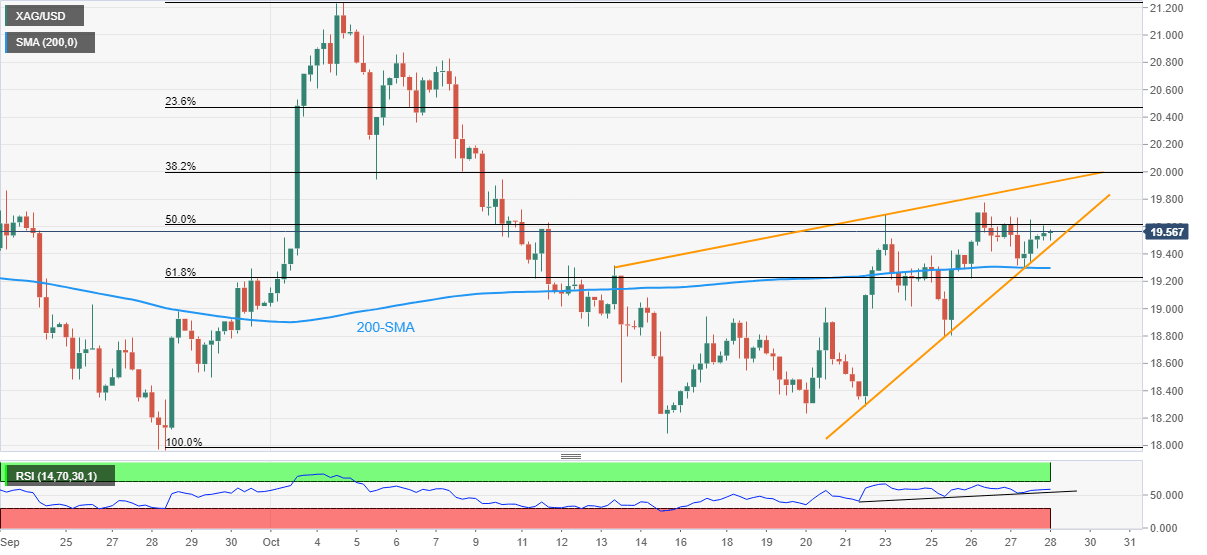

Silver Price Analysis: XAG/USD fades bounce off 200-SMA around mid-$19.00s

- Silver price snaps three-day winning streak but sellers remain cautious of late.

- Firmer RSI, a struggle to break 200-SMA keep buyers hopeful.

- Fortnight-old rising wedge bearish formation teases sellers amid a sluggish session.

Silver price (XAG/USD) prints the first loss-making day in three even as sellers make rounds to $19.50 during Friday’s Asian session.

In doing so, the bright metal fades the previous day’s bounce off the 200-SMA while staying inside a two-week-long rising wedge bearish chart pattern.

Given the gradual recovery of the RSI (14), the metal’s recovery in the last week appears interesting to lure buyers.

However, a clear upside break of the stated wedge’s resistance line, near $19.95, as well as a clearance of the $20.00 threshold, becomes necessary for the XAG/USD’s run-up.

Following that, $20.30 and $20.85 can challenge the silver buyers before directing them to the monthly peak surrounding $21.25.

Alternatively, the downside break of the $19.45 level comprising the immediate support line, forming part of the rising wedge, could lure the XAG/USD bears to challenge the 200-SMA level near $19.30.

In a case where silver bears remain dominant past $19.30, the $18.90 level may test the downside before highlighting the theoretical target of the rising wedge breakdown, close to $17.70.

Overall, the silver price may witness further downside but the bears need a solid trigger to push back the bullish hopes.

Silver: Four-hour chart

Trend: Further weakness expected

Author

Anil Panchal

FXStreet

Anil Panchal has nearly 15 years of experience in tracking financial markets. With a keen interest in macroeconomics, Anil aptly tracks global news/updates and stays well-informed about the global financial moves and their implications.