Silver Price Analysis: Declining in a falling channel

- Silver is weakening within a descending channel.

- The channel is more likely than not to continue unfolding lower.

- A break below the June 13 low would confirm further downside.

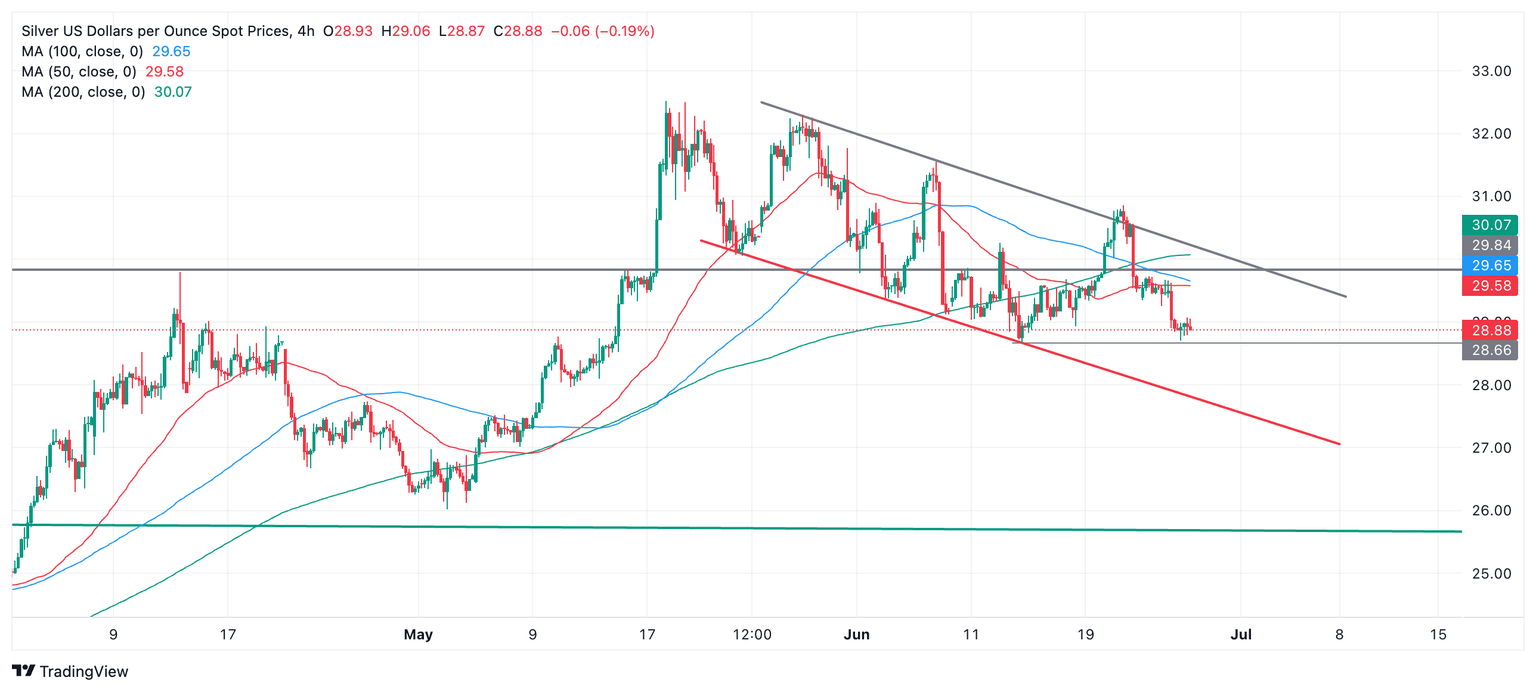

Silver (XAG/USD) looks like it has started to form a descending channel on the 4-hour chart and the evidence is building to argue that it is probably in a short-term downtrend now too. Given the old saying that “the trend is your friend” the odds probably favor a continuation lower – with some important caveats.

Silver 4-hour Chart

Silver rallied strongly on June 20 and 21 but then failed to break out of the top of its falling channel. It then fell back down, finding support at $28.66, the June 13 lows, from where it has just bounced.

If Silver breaks below $28.66 it will confirm it is in a short-term downtrend and probably continue to decline substantially lower. The next downside target likely lies at the level of the lower channel line, at around $27.50.

The caveat is that Silver did temporarily break out of its channel on June 21, and although it failed to follow-through higher the fact it breached the channel’s upper borderline suggests the integrity of the falling channel has been compromised. This will make it easier for price to break out higher on a second attempt.

If the June 13 lows hold, therefore, and Silver starts to recover it could run back up to the level of the upper channel line at around $29.90, which is also a major resistance level at the top of Silver’s four-year consolidation zone. A decisive break above that level would indicate a major turning point for the precious metal and suggest a new uptrend was probably evolving.

A decisive break would be one accompanied by a long green up candle that broke clearly above the level and closed near its high or three green candles in a row that broke above the level.

Author

Joaquin Monfort

FXStreet

Joaquin Monfort is a financial writer and analyst with over 10 years experience writing about financial markets and alt data. He holds a degree in Anthropology from London University and a Diploma in Technical analysis.