Pound Sterling Price News and Forecast: GBP/USD weakens further as markets brace for Fed decision

GBP/USD weakens further as markets brace for Fed decision

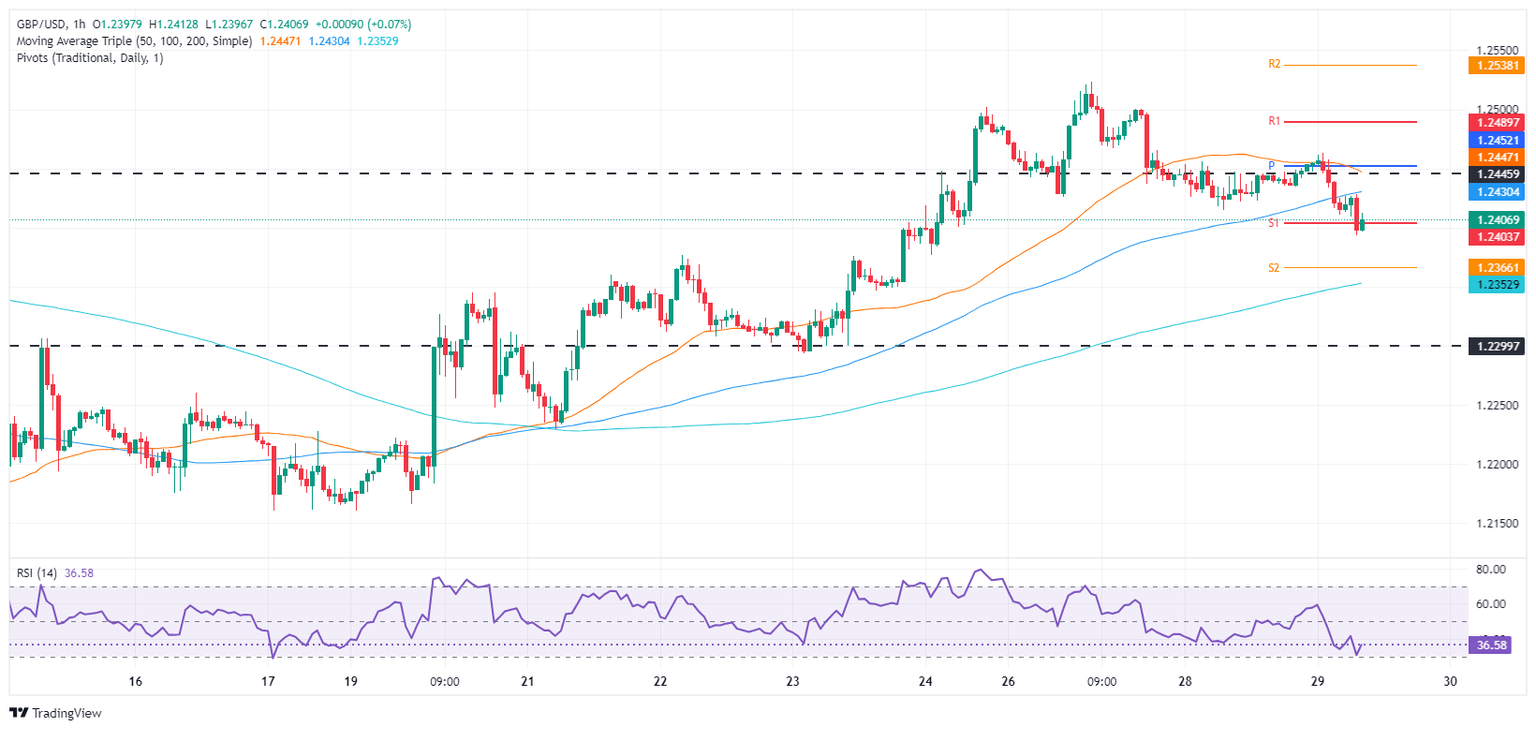

The Pound Sterling extended its losses on Wednesday as the Greenback remains firm ahead of the US Federal Reserve’s monetary policy decision. An absent economic docket in the UK, except for Bank of England (BoE) Governor Andrew Bailey's TSC hearing, could move the markets ahead of the Fed. The GBP/USD trades at 1.2406, down 0.27%. Read More...

Pound Sterling gains as UK Reeves prioritizes growth and liberalization

The Pound Sterling (GBP) gains against its major peers, except safe-haven currencies such as US Dollar and Japanese Yen (JPY) on Wednesday as United Kingdom (UK) Chancellor of the Exchequer Rachel Reeves reiterated Prime Minister Keir Starmer's positive outlook on the economy, saying that the economy is on the brisk of a “turnaround” in a speech in Oxfordshire. Reeves vowed to remove "stifling and unpredictable" regulations to boost productivity. Read More...

GBP/USD holds ground near 1.2450 ahead of Fed policy decision

GBP/USD remains steady after registering losses in the previous session, trading around 1.2440 during the Asian hours on Wednesday. The pair’s downside could be attributed to the increased risk aversion due to tariff threats made by US President Donald Trump. Read More...

Author

FXStreet Team

FXStreet