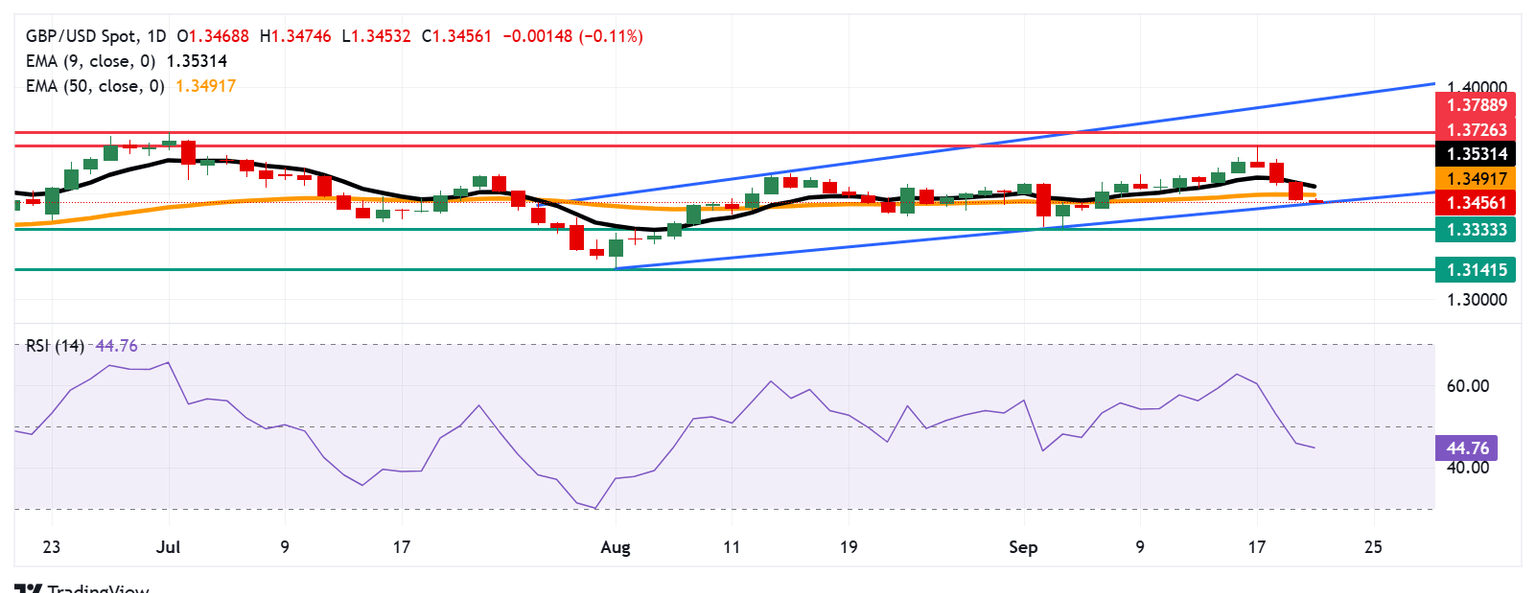

Pound Sterling Price News and Forecast: GBP/USD tests the ascending channel’s lower boundary around 1.3450

GBP/USD Price Forecast: Tests confluence zone around 1.3450 support

The GBP/USD pair continues its four-day losing streak, trading around 1.3460 during the Asian hours on Monday. The bearish shift appears as the daily chart’s technical analysis shows that the pair is on the verge of breaking below the ascending channel pattern.

However, the 14-day Relative Strength Index (RSI) remains below the 50 level, strengthening the bearish bias. Additionally, the GBP/USD pair is positioned below the nine-day Exponential Moving Average (EMA), suggesting the short-term price momentum is weaker. Read more...

GBP/USD Weekly Forecast: Pound Sterling bulls eye recovery as focus shifts to PMIs & PCE

The Pound Sterling (GBP) witnessed an eventful and volatile week against the US Dollar (USD) as markets weighed monetary policy decisions by the US Federal Reserve (Fed) and the Bank of England (BoE). Even though the week was dominated by high-impact labor and inflation data from the United Kingdom (UK), the main driver behind the GBP/USD price action remained the USD and the sentiment surrounding the Fed easing outlook.

The week began with the extension of the USD’s downtrend as markets had almost priced in three interest rate cuts by the Fed this year amid heightened stagflation risks in the United States (US) economy. That, combined with the highest inflation in the UK since January 2024, propelled the pair above the 1.3650 area before reaching fresh 11-week highs at 1.3723 in a knee-jerk reaction to the Fed policy announcements. Read more...

GBP/USD posts modest gains above 1.3450, concerns over UK’s fiscal outlook might cap its upside

The GBP/USD pair recovers some lost ground to around 1.3465, snapping the three-day losing streak during the early Asian session on Monday. However, the potential upside for the Pound Sterling (GBP) might be limited amid concerns that UK Finance Minister Rachel Reeves may not be able to keep her budget under control. The Bank of England (BoE) Chief Economist Huw Pill is set to speak later on Monday.

The latest public finance figures showed that public sector net borrowing hit £18 billion, the highest for the month in five years. Economists expected government borrowing to come in significantly lower at £12.8 billion. Analysts believe that the move threatens to worsen the debt burden and intensify fiscal risks, which might exert some selling pressure on the Cable. Read more...

Author

FXStreet Team

FXStreet