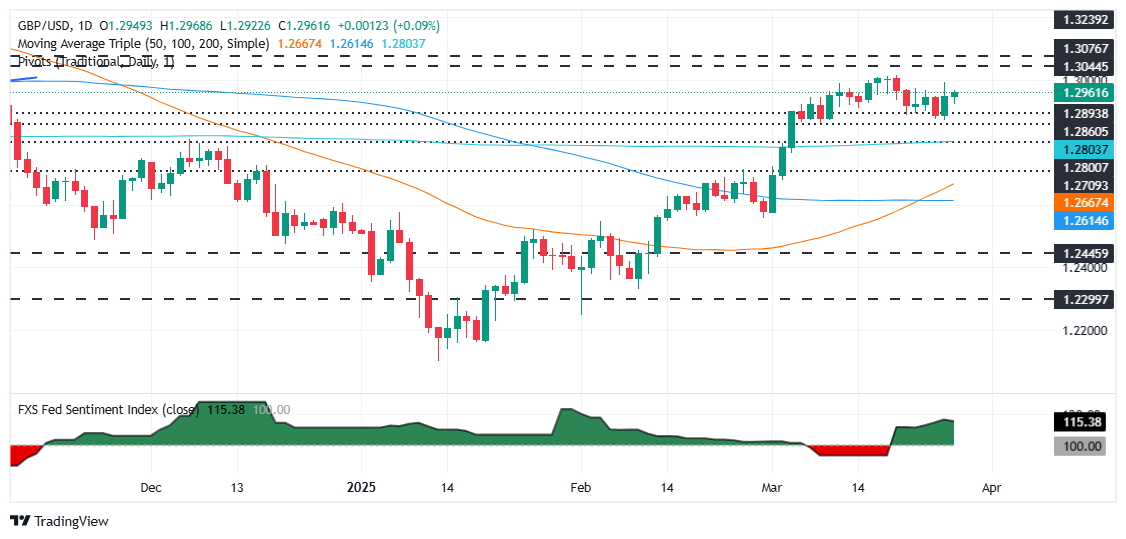

Pound Sterling Price News and Forecast: GBP/USD steadies near 1.2950

GBP/USD steadies near 1.2950 as traders digest PCE figures, tariff turmoil

The Pound Sterling remains firm, hovering around 1.2950 against the US Dollar, virtually unchanged, as traders digest the latest inflation report from the United States (US), amid uncertainty about a potential trade war escalation following Trump's imposition of tariffs on cars. At the time of writing, the GBP/USD exchange rate is 1.2948. Read More...

Pound Sterling edges higher against US Dollar after hot US core PCE Inflation data

The Pound Sterling (GBP) recovers nominal intraday losses and turns positive around 1.2960 against the US Dollar (USD) in Friday’s North American session. The GBP/USD pair ticks higher after the release of the United States (US) Personal Consumption Expenditure Price Index (PCE) data for February. Read More...

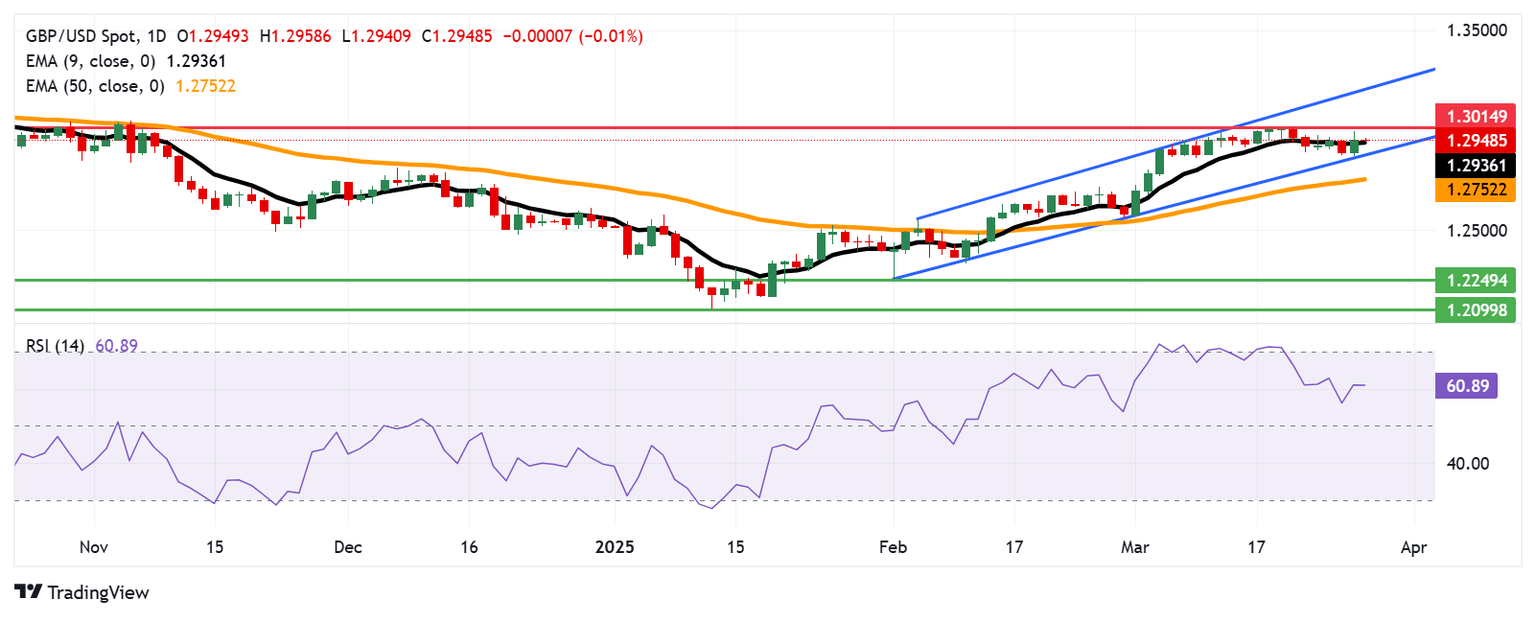

GBP/USD Price Forecast: Hovers around 1.2950 near nine-day EMA

The GBP/USD pair holds steady after gains in the previous session, hovering around 1.2950 during Friday's Asian trading hours. The technical analysis of the daily chart suggests a sustained bullish outlook, with the pair consolidating within an ascending channel pattern. Read More...

Author

FXStreet Team

FXStreet