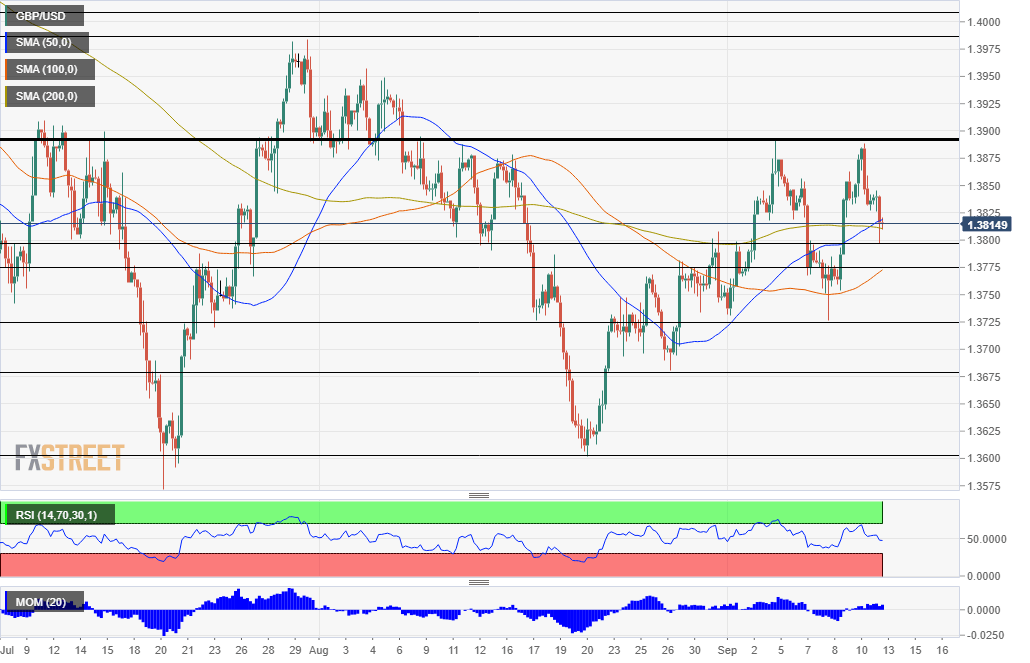

Pound Sterling Price News and Forecast: GBP/USD seesaws below 1.3850 ahead of US CPI figures

GBP/USD seesaws below 1.3850 ahead of US CPI figures

GBP/USD range-bounds during the New York session, directionless awaits for catalyst. The US dollar index is flat, waits for US Inflation numbers. GBP/USD is trading virtually unchanged on the day currently trading at 1.3831. Market sentiment remains upbeat, influencing commodity- currencies and weighing on the dollar, as investors focus on US inflation numbers. Read more...

GBP/USD Forecast: Sterling rejected at resistance, long list of worries could send it lower

GBP/USD has retreated from the highs as inflation concerns send the dollar higher. Worries about UK tax hikes, rising covid cases and other factors are weighing on cable. If at first, you don't succeed, try, try again – but what happens if that second attempt fails? GBP/USD has been rejected at the critical 1.3895 level in what could prove as a decisive blow to its recovery. There may be more in store. Read more...

EUR/USD and GBP/USD overview

The GBP/USD is showing a strong bearish reversal and is expected to decline further down. The GBP/USD is looking to test the support trend line again, which could create a larger triangle chart pattern. The breakout direction should be bearish. Read more...

Author

FXStreet Team

FXStreet