Pound Sterling Price News and Forecast: GBP/USD recovery could remain shallow

GBP/USD Forecast: Pound Sterling recovery could remain shallow

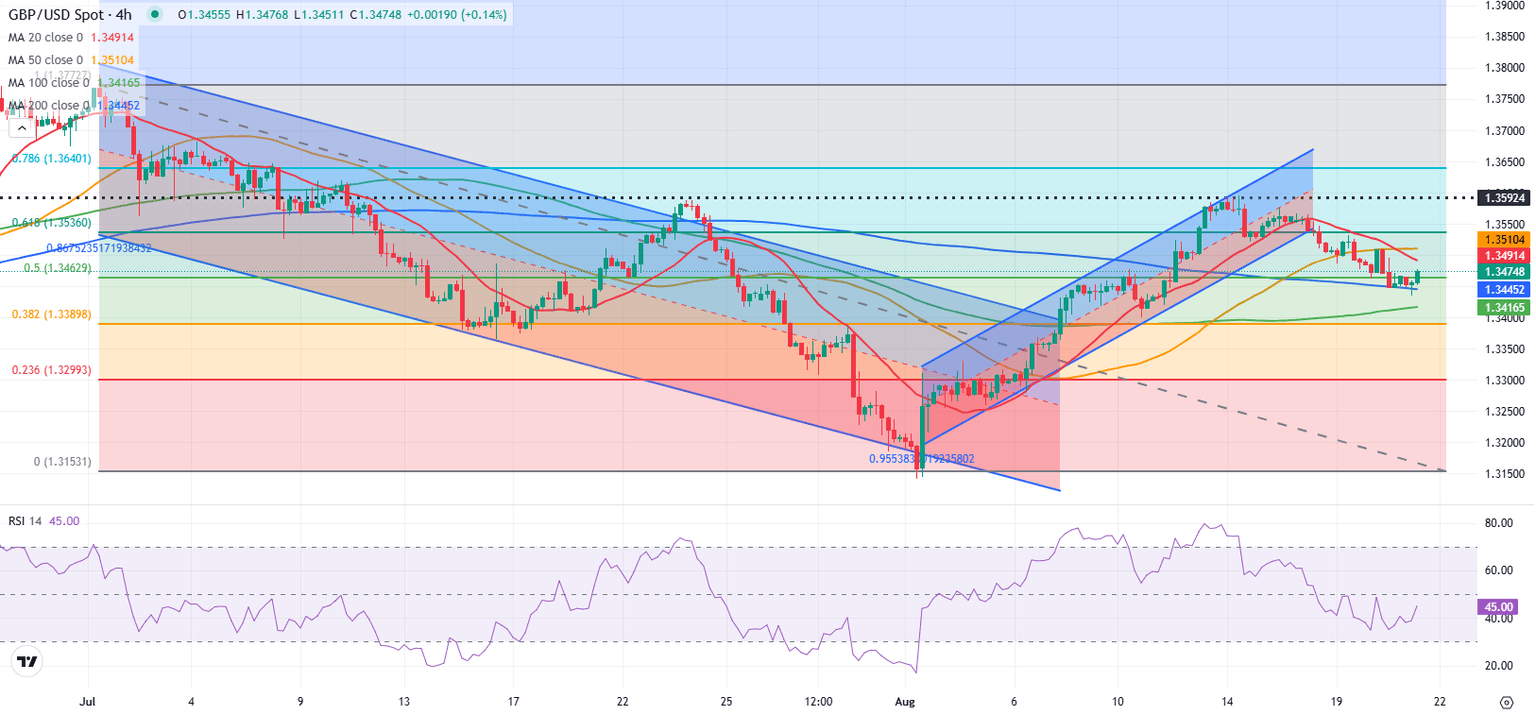

After dropping to its lowest level in over a week below 1.3450 in the Asian session on Thursday, GBP/USD regained its traction and advanced to the 1.3470 region. Despite this recent recovery, the pair's technical outlook doesn't point to an increasing buyer interest.

The risk-averse market environment caused GBP/USD to continue to stretch lower early Thursday. In the European session, Pound Sterling benefited from the preliminary August Purchasing Managers' Index (PMI) data from the UK and erased its daily losses. Read more...

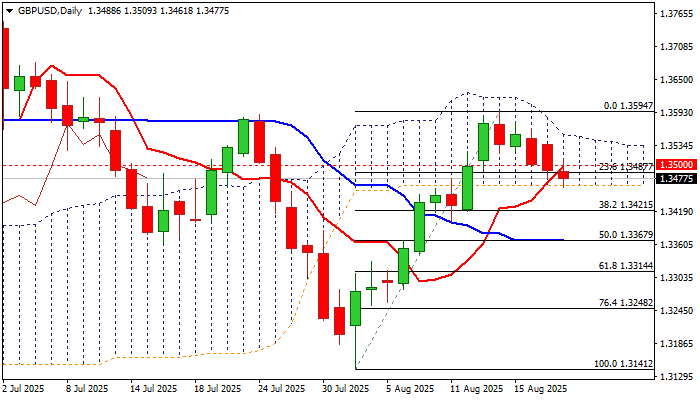

GBP/USD outlook: Continues to pressure daily cloud base following limited positive impact

Cable edged higher on Wednesday after testing next key support provided by daily cloud base (1.3464), following break below psychological 1.3500 level (reinforced by daily Tenkan-sen) previous day.

Pound was lifted by disappointing UK July inflation data which further darkened outlook as Britain’s inflation is the highest and fastest growing among G7 economies. In addition, economic growth remains weak that makes the position of UK policymakers more difficult, with bets about rate cut by the end of the year, fading after today’s data. Read more...

Author

FXStreet Team

FXStreet