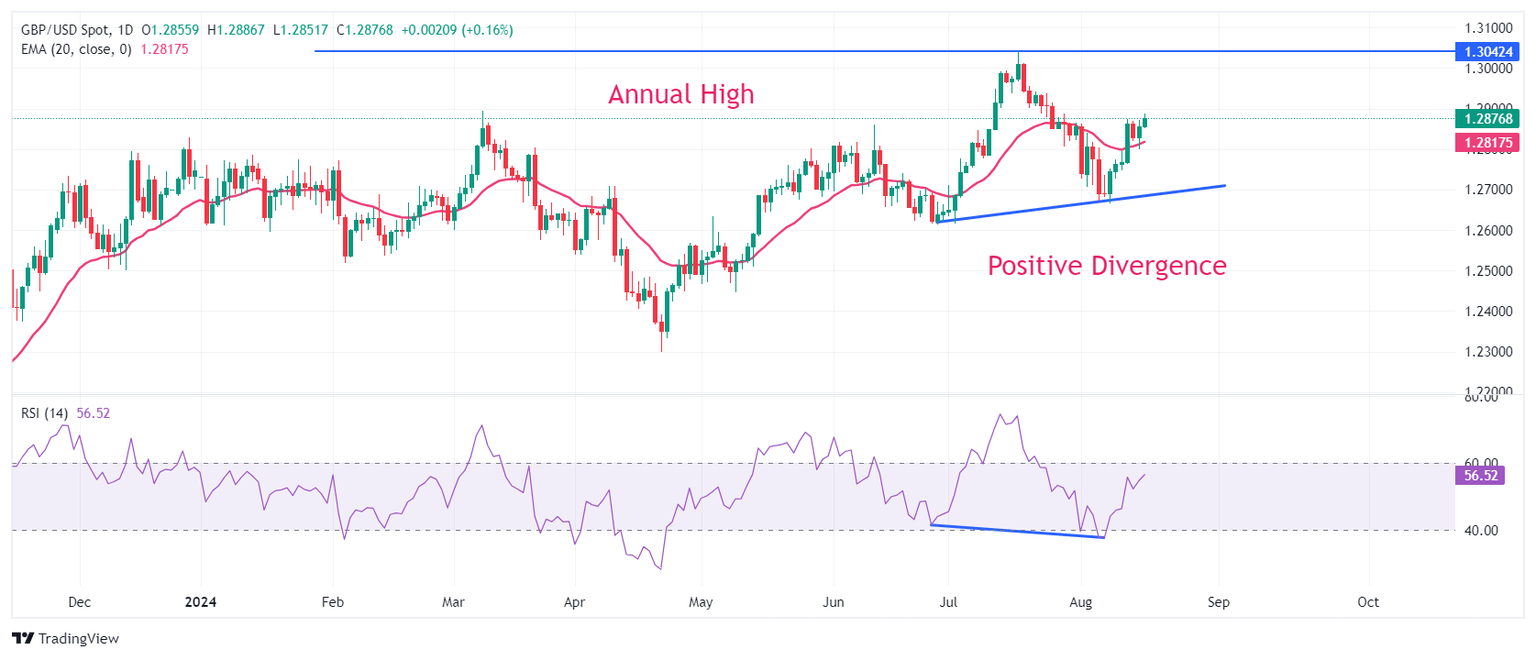

Pound Sterling jumps to near 1.2900 on a slew of upbeat UK data

The Pound Sterling (GBP) outperforms its major peers in Friday’s New York session. The British currency gains significantly as the United Kingdom (UK) Office for National Statistics (ONS) has reported that

Retail Sales rebounded in July, as expected, after contracting sharply in June.

Read More...

GBP/USD rises above 1.2850 ahead of UK Retail Sales figures

GBP/USD continues to strengthen for the second consecutive session, trading around 1.2870 during the Asian hours on Friday. The improved risk sentiment, driven by a stronger-than-expected recovery in US Retail Sales, has eased concerns about a potential US recession and boosted risk-sensitive currencies like

the Pound Sterling (GBP).

Read More...

GBP/USD bulls aim for 1.2900 amid risk appetite recovery

GBP/USD found the gas pedal on Thursday after a steeper-than-expected recovery in US Retail Sales pushed Cable back into the high end. Market sentiment rebounded on the day after fears of a possible US recession were cooled by US data beating expectations, and

the Pound Sterling caught additional bullish momentum from UK Gross Domestic Product (GDP) growth meet expectations and UK Manufacturing Production handily exceeding forecasts in July.

Read More...