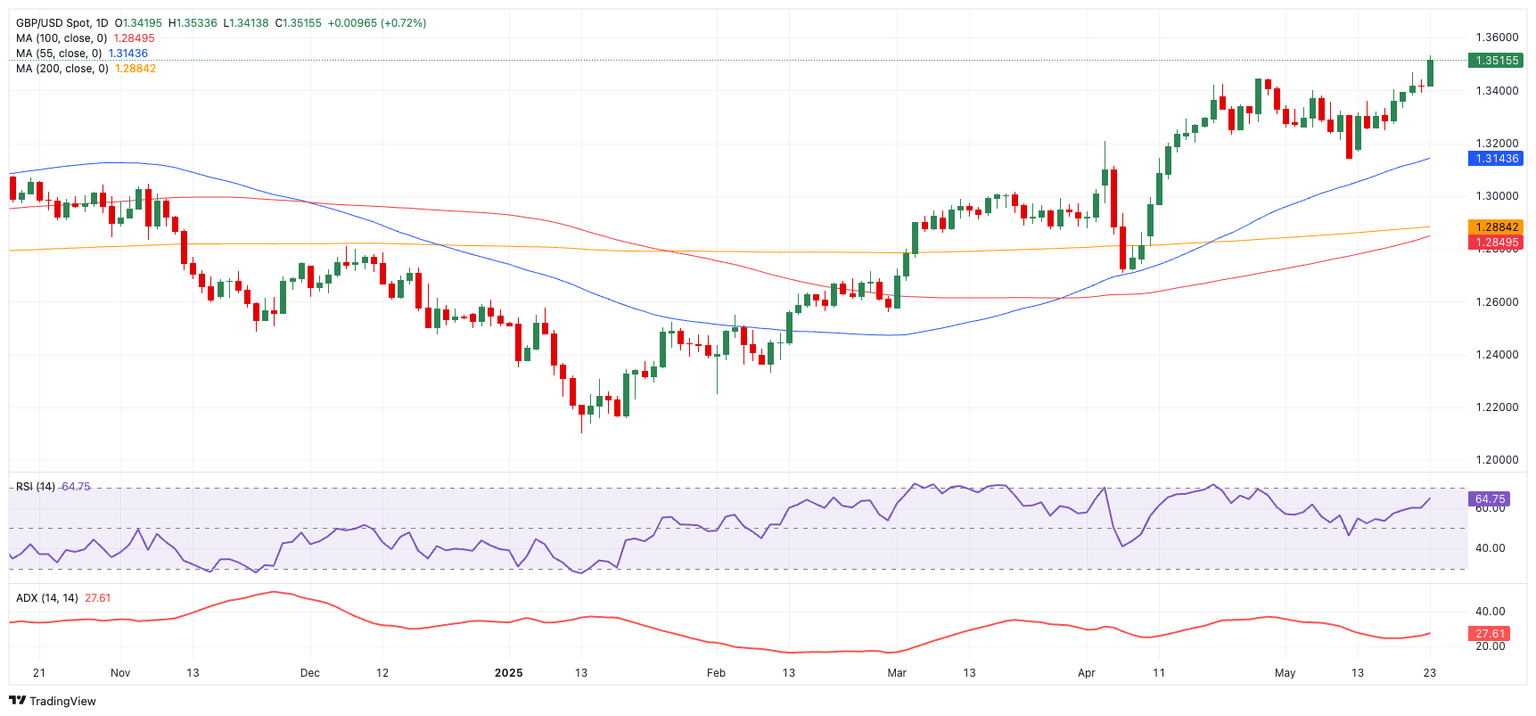

Pound Sterling Price News and Forecast: GBP/USD is on a positive note and climbs to a fresh multi-year top

GBP/USD advances beyond mid-1.3500s, fresh high since February 2022

The GBP/USD pair is seen building on last week's strong move up and gaining some follow-through positive traction during the Asian session on Monday. The momentum lifts spot prices beyond the 1.3550 level, to the highest level since February 2022, and is sponsored by a combination of factors.

The British Pound (GBP) continues with its relative outperformance on the back of the upbeat UK Retail Sales figures released on Friday, which suggest that consumer spending remains a bright spot despite a gloomy economic outlook. This, along with higher-than-expected inflation in April, fueled speculations that the Bank of England (BoE) would pause at its next meeting on June 18 and take its time before lowering borrowing costs further. Read more...

GBP/USD Weekly Forecast: Next on the upside emerges the 2022 peaks

The British Pound held a firm tone throughout the week, pushing GBP/USD beyond the 1.3500 mark on Friday, territory last seen in late February 2022. Sterling’s advance was driven largely by sustained pressure on the US Dollar (USD), which accelerated in the latter part of the week following President Donald Trump’s threat to impose 50% tariffs on European Union (EU) imports.

Adding to the bullish backdrop, UK 10-year gilt yields climbed to multi-week highs above 4.80% earlier in the week, though they later gave back some of those gains. Auspicious results from UK fundamentals highlighted the positive momentum the domestic economy appears to have walked into, at the same time prompting the “Old Lady” to maintain a prudent stance when it comes to deciding on future policy rates moves. Read more...

Author

FXStreet Team

FXStreet