Pound Sterling Price News and Forecast: GBP/USD hits three-week highs against the US Dollar

GBP/USD Weekly Forecast: Pound Sterling looks at US inflation amid data-light week

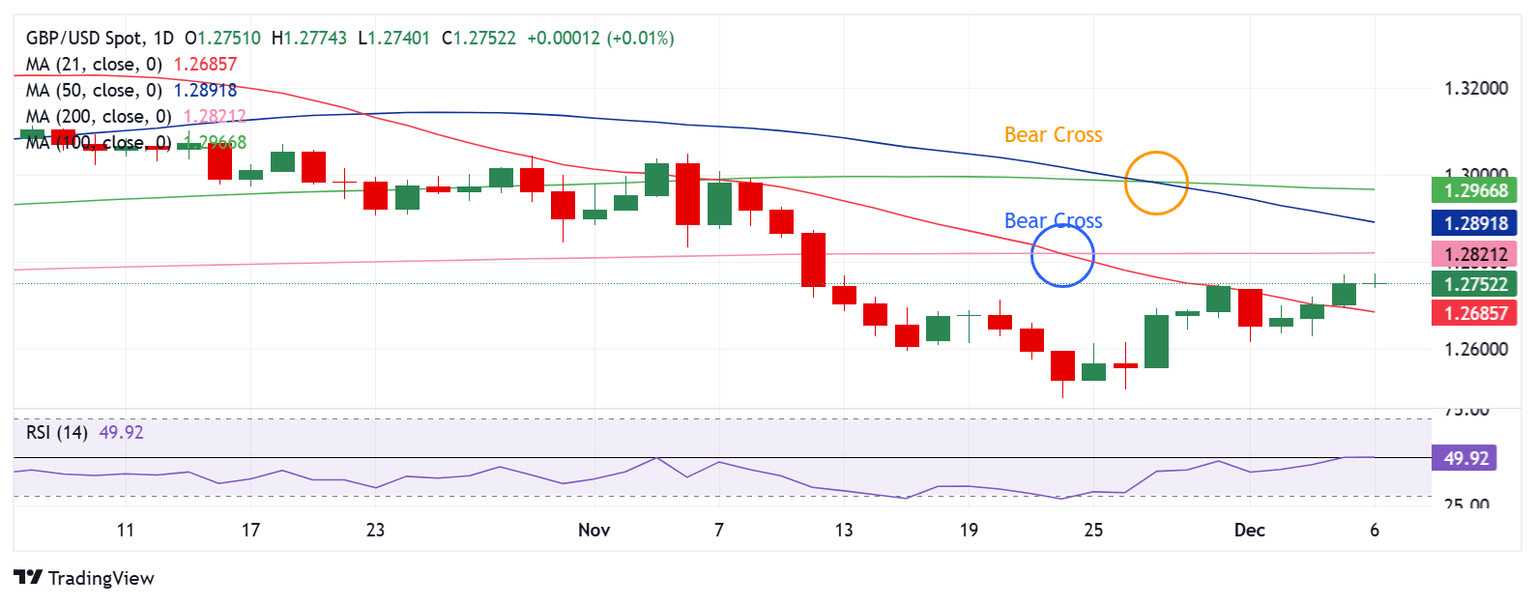

The Pound Sterling (GBP) held on to the corrective upside against the US Dollar (USD), fuelling a brief GBP/USD recovery above the 1.2750 barrier.

Political turbulence in South Korea and France, US President-elect Donald Trump’s tariff threats, and the diverging monetary policy outlooks between the US Federal Reserve (Fed) and the Bank of England (BoE) emerged as the main drivers for the GBP/USD price action. Read more...

GBP/USD consolidates below mid-1.2700s; upside potential seems limited

The GBP/USD pair kicks off the new week on a subdued note and oscillates in a narrow trading band, below mid-1.2700s during the Asian session. Spot prices, meanwhile, remain within striking distance of over a three-week high – levels above the 1.2800 mark – touched on Friday, though the fundamental backdrop warrants some caution for bullish traders.

The US Nonfarm Payrolls (NFP) report released on Friday showed that the Unemployment Rate inched higher in November and reaffirmed expectations that the Federal Reserve (Fed) will lower borrowing costs in December. The initial market reaction, however, turned out to be short-lived amid bets that the US central bank would slow the pace or pause its rate-cutting cycle in January. This, in turn, assists the US Dollar (USD) to hold above its lowest level in nearly one-month low, which, in turn, is seen acting as a headwind for the GBP/USD pair. Read more...

Author

FXStreet Team

FXStreet