Pound Sterling Price News and Forecast: GBP/USD edges up on UK-EU deal, but Fed hawkishness limits gains

GBP/USD edges up on UK-EU deal, but Fed hawkishness limits gains

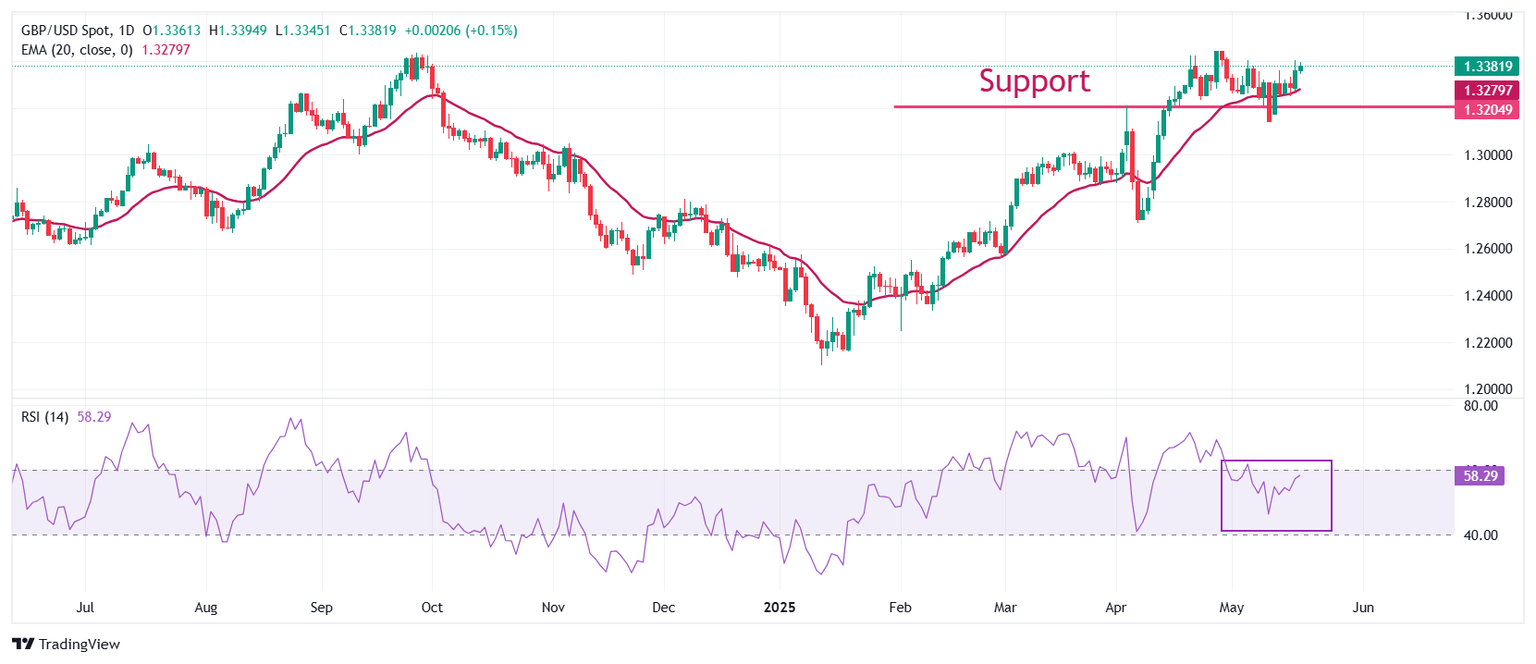

The Pound Sterling (GBP) registered modest gains versus the US Dollar (USD) on Tuesday, capped by the rise of US Treasury bond yields as news of a United Kingdom (UK)-European Union (EU) trade agreement boosts the prospects of the UK’s currency. Nevertheless, the Federal Reserve's (Fed) hawkish stance kept GBP/USD from reaching the 1.3400 figure, and it traded at 1.3371 at the time of writing. Read More...

Pound Sterling flattens against US Dollar ahead of UK CPI data

The Pound Sterling (GBP) surrenders initial gains and flattens around 1.3365 against the US Dollar (USD) during North American trading hours on Tuesday. The GBP/USD pair turns flat as the US Dollar recoups early losses, with the US Dollar Index (DXY) gaining ground near 100.00. Read More...

GBP/USD maintains position above 1.3350 as US Dollar weakens on economic concerns

GBP/USD continues its upward momentum for the second consecutive session, hovering near 1.3360 during Asian trading hours on Tuesday. The Pound Sterling (GBP) is strengthening as the US Dollar (USD) softens in response to Moody’s Ratings downgrading the US credit rating from Aaa to Aa1. Read More...

Author

FXStreet Team

FXStreet