Pound Sterling Price News and Forecast: GBP/USD continues with its struggle to gain any meaningful traction

GBP/USD lacks firm near-term direction, remains confined in a range around mid-1.2600s

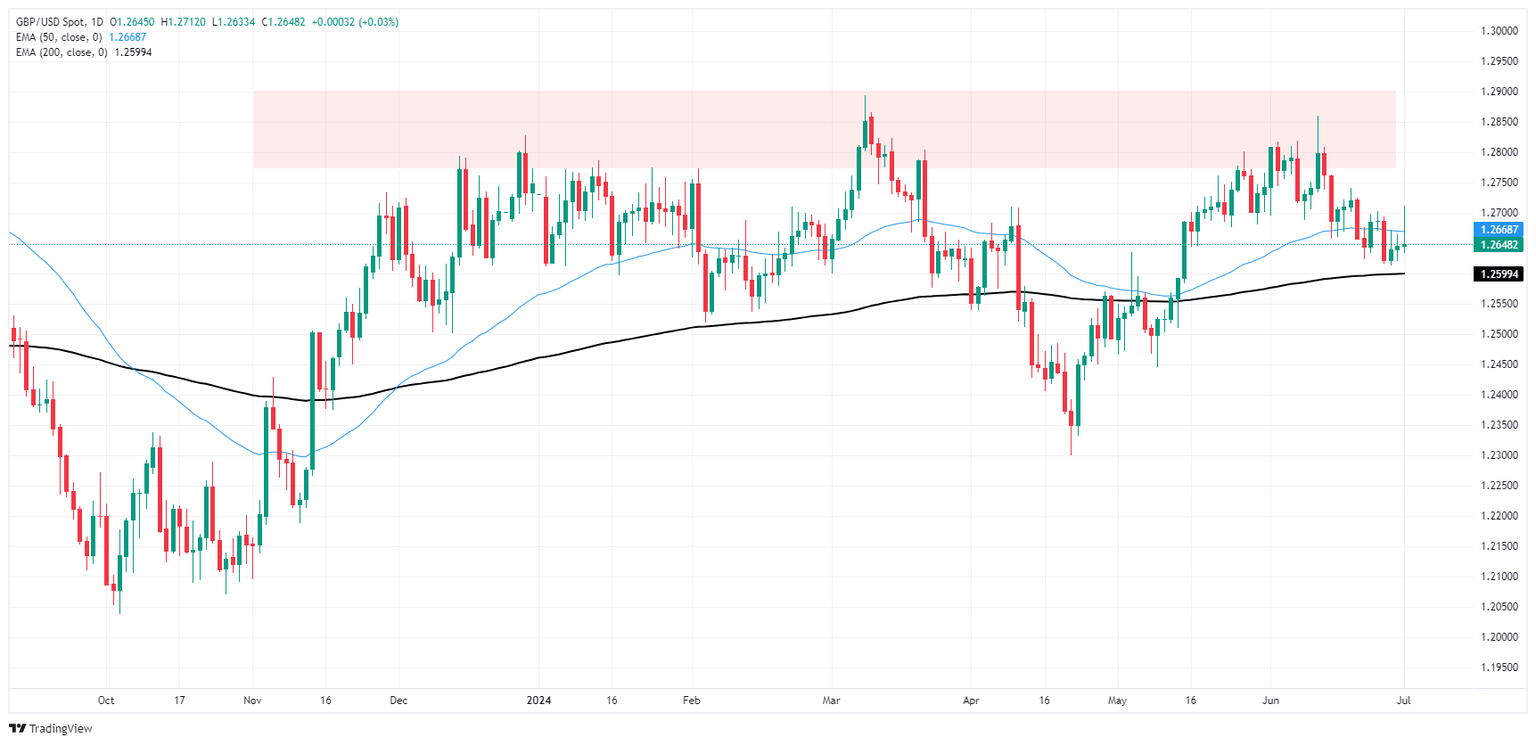

The GBP/USD pair extends its sideways consolidative price move during the Asian session on Tuesday and remains confined in a familiar range held over the past two weeks or so. Spot prices currently trade around the 1.2655-1.2645 confluence region – comprising 50-day and 100-day Simple Moving Averages (SMAs) – amid the anxiety surrounding the upcoming UK general elections on Thursday.

In the meantime, the Bank of England's (BoE) dovish pause in June, which lifted bets for a rate cut at the August monetary policy meeting, continues to undermine the British Pound (GBP). The US Dollar (USD), on the other hand, builds on the overnight solid bounce from a multi-day low and further seems to act as a headwind for the GBP/USD pair. The yield on the benchmark 10-year government bond shot to its highest level in a month on Monday amid concerns that the imposition of aggressive tariffs by the Trump administration could fuel inflation and trigger higher interest rates. Read more...

GBP/USD whipsaws on Monday as investor sentiment corkscrews

GBP/USD rallied briefly above the 1.2700 handle on Monday before US markets knocked back investor confidence, sparking a risk-off bid into the US Dollar and dragging Cable back down to the day’s opening bids near 1.2650.

US data broadly missed the mark. US ISM Manufacturing Purchasing Manager Index (PMI) figures declined in June, falling to 48.5 from 48.7 and entirely missing the forecast increase to 49.1. US ISM Manufacturing Prices Paid also declined sharply in June, falling to 52.1 from the previous 57.0, falling even further beyond the forecast decline to 55.9. Read more...

Author

FXStreet Team

FXStreet