GBP/USD Price Forecast: Consolidates at around 1.3000 due to soft US Dollar

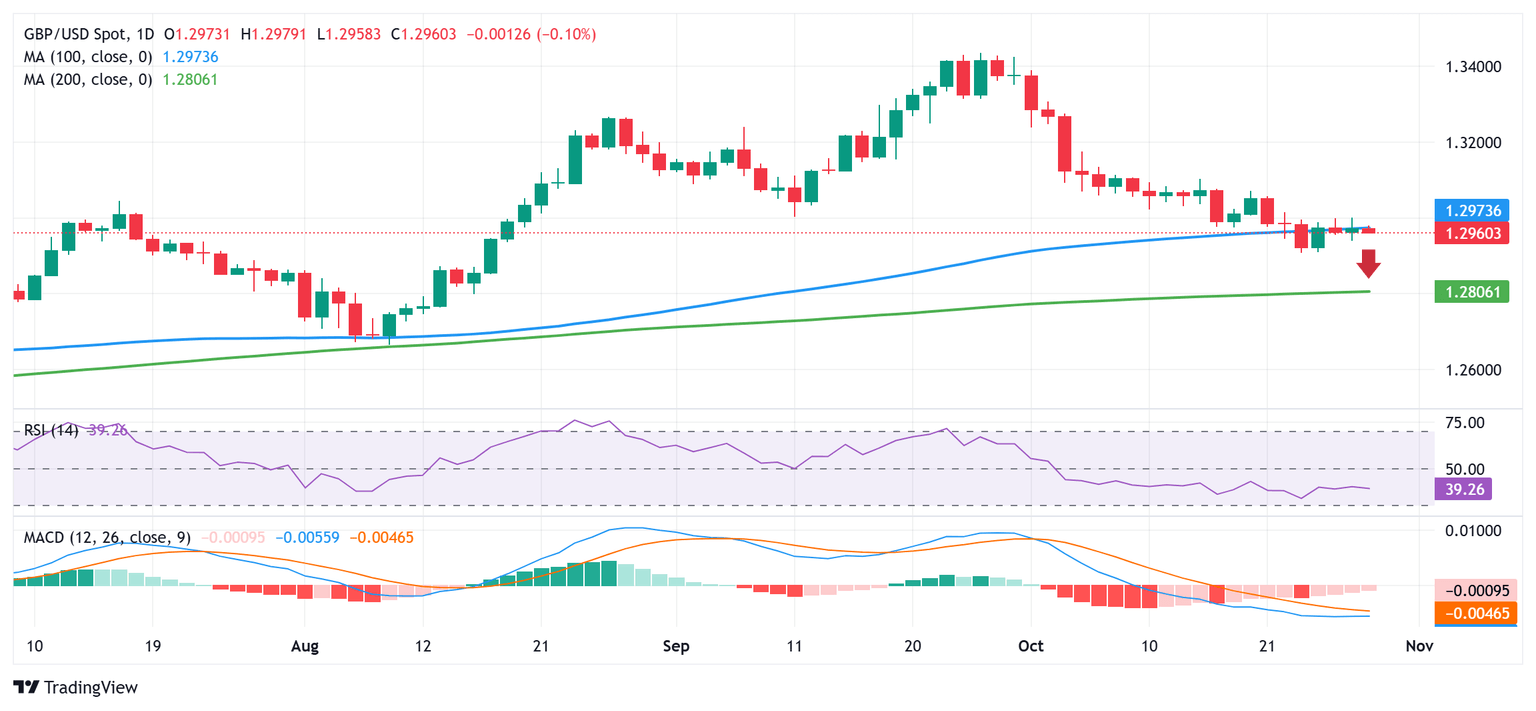

The Pound Sterling climbed past 1.3000 for the first time in five days after a US jobs report increased the chances that the Federal Reserve (Fed) would cut

rates at the last two meetings in 2024. The GBP/USD trades at 1.2998, posting gains of over 0.21%.

Read More...

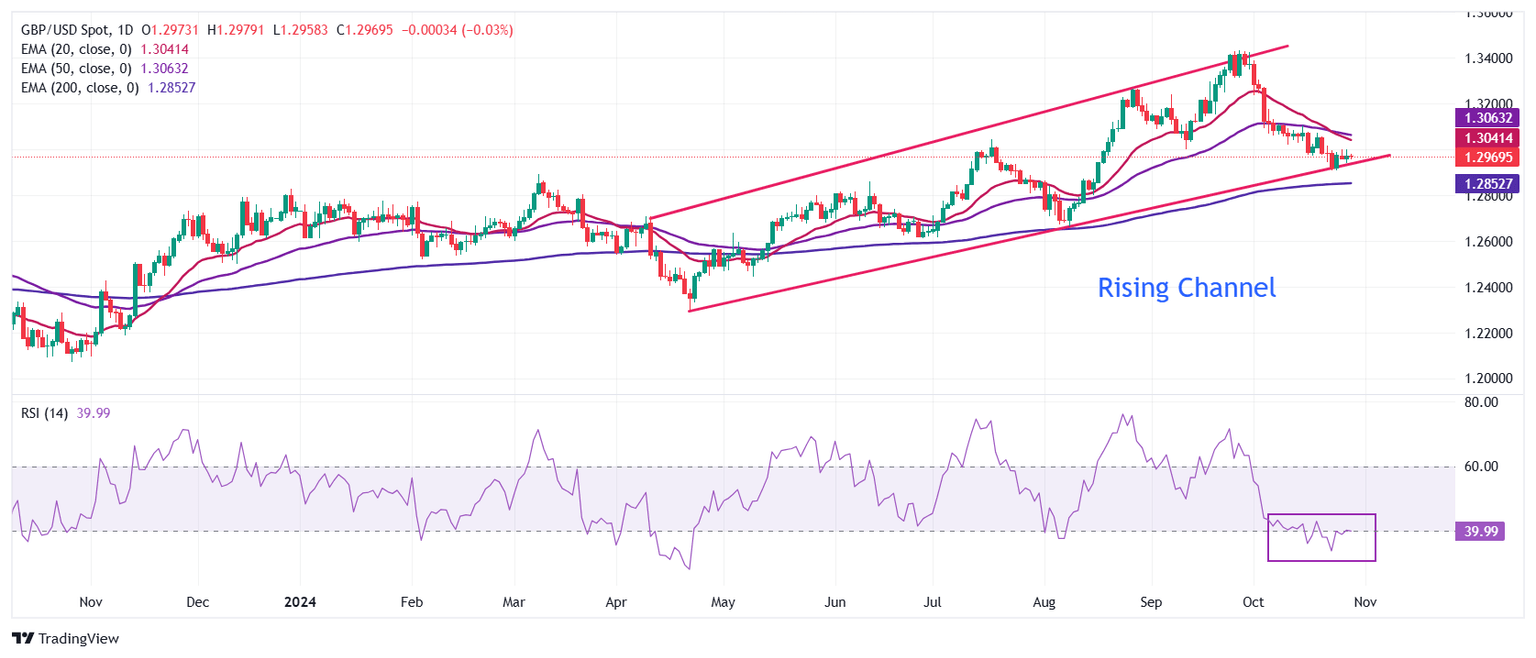

Pound Sterling gains after soft US Job vacancy data, UK budget in focus

The Pound Sterling (GBP) rises sharply to near the psychological resistance of 1.3000 against the

US Dollar (USD) in Tuesday’s North American session. The GBP/USD pair strengthens after the release of the United States (US)

JOLTS Job Openings data for September, which showed that growth in job vacancies was slower than expected.

Read More...

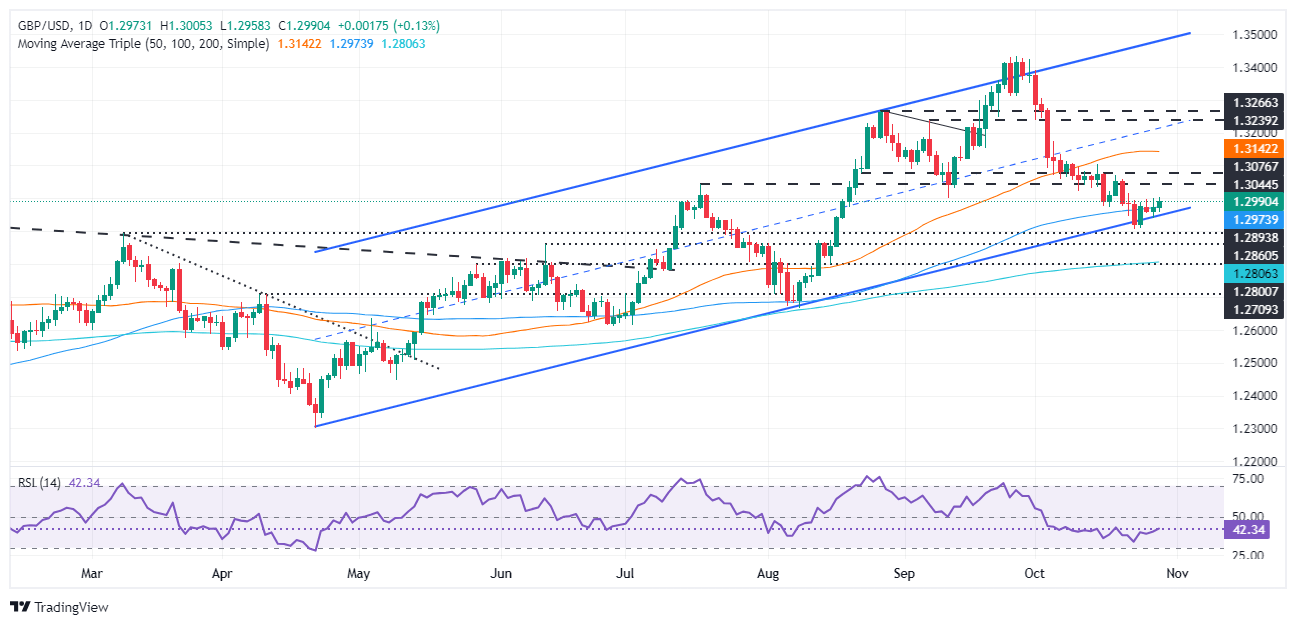

GBP/USD Price Forecast: Bears have the upper hand while below 1.3000 mark

The GBP/USD pair attracts fresh sellers following the previous day's good two-way price move and slides closer to mid-1.2900s during the Asian session on Tuesday. Spot prices, however, hold above the lowest level since August 16 touched last week and remain at the mercy of the

US Dollar (USD) price dynamics.

Read More...