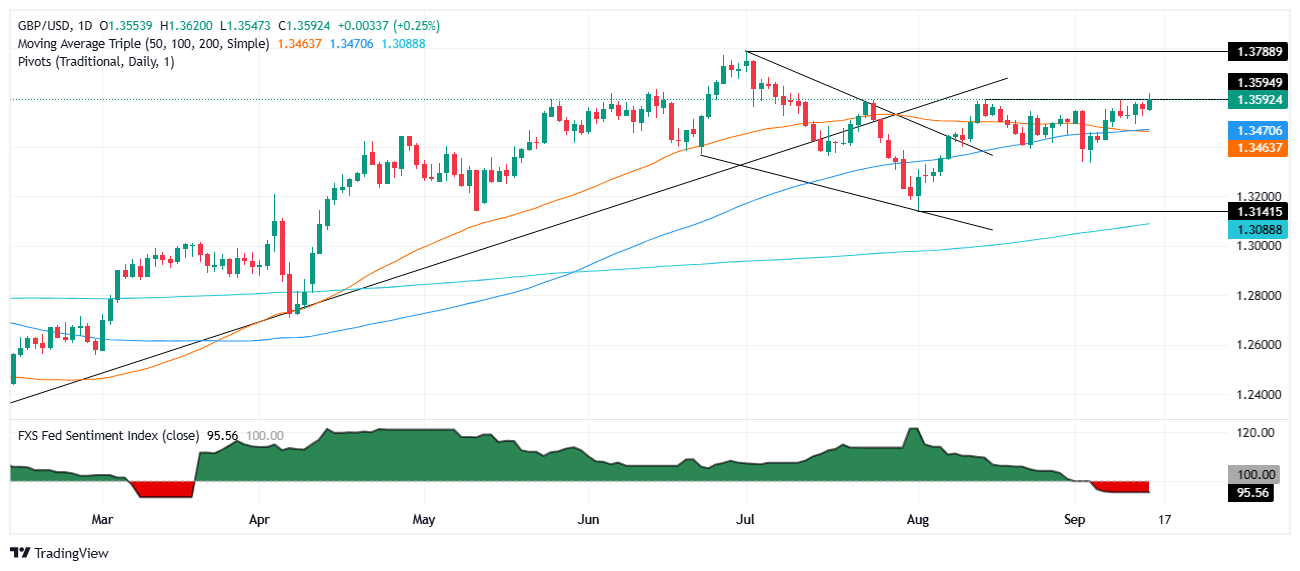

Pound Sterling Price News and Forecast: GBP/USD caught another tentative bullish leg higher on Monday

GBP/USD tests fresh multi-week highs ahead of Fed & BoE double-header

GBP/USD caught another tentative bullish leg higher on Monday, testing above 1.3600 for the first time since July. The US Dollar (USD) backslid across the board to start the fresh trading week, with investors gearing up for a critical interest rate call from the Federal Reserve (Fed).

Traders will be looking to see if the Fed meets or exceeds market expectations for rate cuts through the remainder of the year when the Summary of Economic Projections (SEP), also known as the 'dot plot' of policymakers’ rate expectations, is also released during Wednesday’s rate call. Markets are betting that the Fed will deliver three rate cuts before the end of the year, with rate markets pricing in nearly 75% odds that the Fed will cut rates by 75 basis points before January, according to the CME’s FedWatch Tool. Read more...

GBP/USD climbs as Fed-BoE policy divergence favors Sterling

The Pound Sterling (GBP) advances during the North American session on Monday as traders are set to digest monetary policy meetings by major central banks across the Atlantic. Expectations for the first rate cut by the Federal Reserve (Fed) in nine months, and the Bank of England (BoE) keeping rates unchanged, would likely underpin the British currency. GBP/USD trades at 1.3586, up 0.22% after bouncing off daily lows of 1.3548 at the time of writing.

The Federal Reserve is expected to reduce rates by 25 basis points in a meeting that starts on Tuesday and ends with the central bank’s decision, update to its economic projections and the Fed Chair Jerome Powell press conference. Unless there is a surprise, money market players had priced in a 94% chance of a quarter percentage cut, while there is a slim chance of 6% for a big size cut. Regarding the UK, a busy economic docket will feature employment data on Tuesday, Consumer Price Index (CPI) on Wednesday and the BoE’s decision on Thursday. Inflation in the UK had failed to ease, it is closing to the 4% threshold and warrants further tightening by the UK central bank. Read more...

Author

FXStreet Team

FXStreet