Pound Sterling Price News and Forecast: GBP/USD bulls press up against key resistance

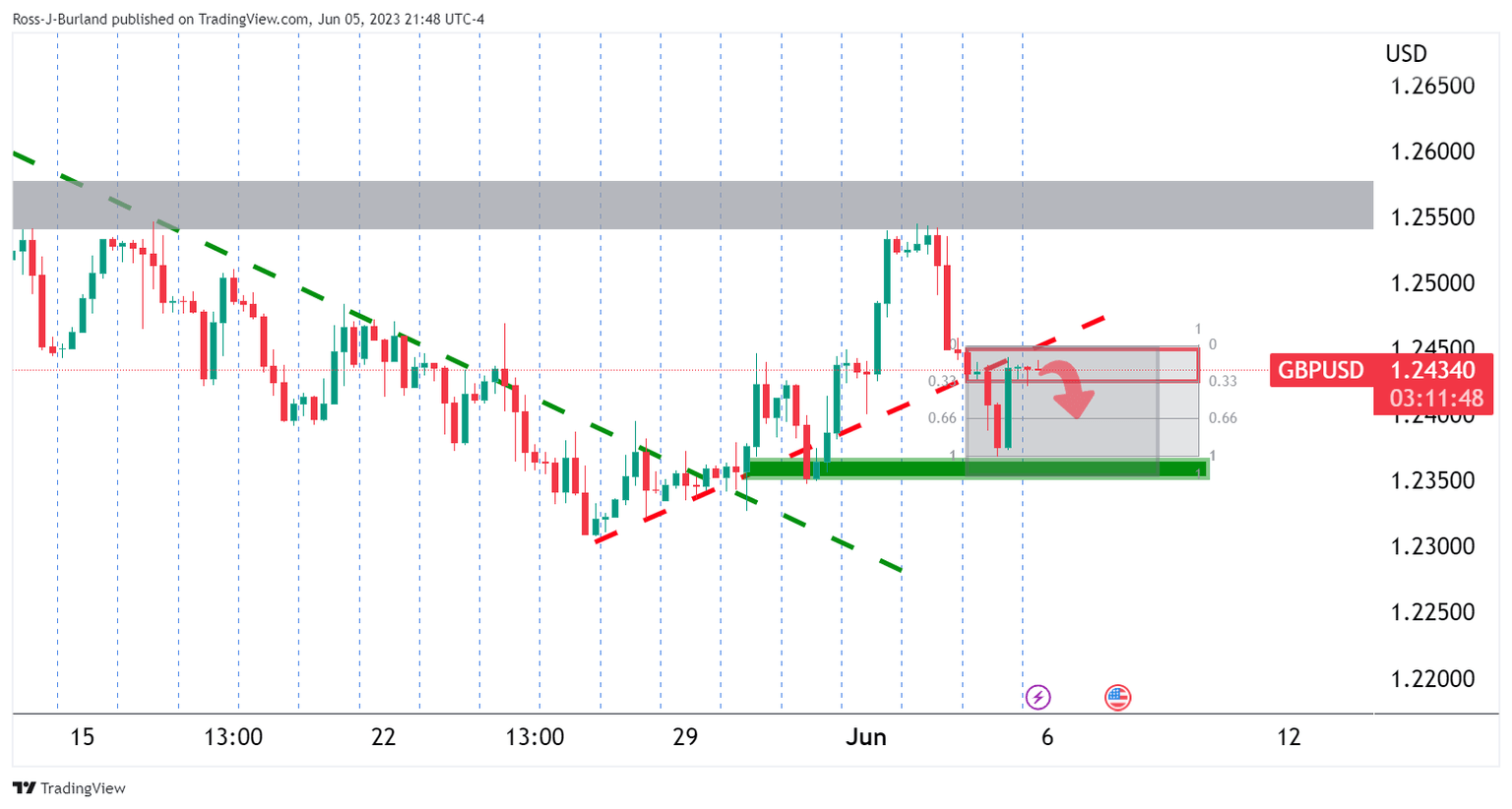

GBP/USD Price Analysis: Bears on the prowl at resistance

GBP/USD started the week off by dropping below 1.24, approaching a two-month low of 1.2306 reached on May 25th, as investors perceive a narrowing interest rate gap between the US and the UK. However, the Pound recovered those losses on the back of the weaker US dollar and data that put the Fed back into the spotlight on a dovish tip.

Technically this leaves GBP/USD in no-man's-land, treading water at the top of a 100-pip box. Read more...

GBP/USD seesaws above 1.2400 on mixed BoE vs. Fed concerns, downbeat US statistics

GBP/USD struggles for clear directions around 1.2435-40 amid early Tuesday in Asia, despite bouncing off a short-term key support line the previous day. In doing so, the Cable pair portrays the market’s indecision while also fails to cheer the downbeat US data amid mixed concerns about the Bank of England’s (BoE) next step.

On Monday, market players witnessed downbeat US statistics, as well as improved prints of the UK S&P Global/CIPS PMIs. However, the same initially underpinned the GBP/USD to rebound from a three-month-old rising support line before the recession woes and indecision at the BoE weighed on the Pound Sterling. Read more...

Author

FXStreet Team

FXStreet