Pound Sterling is trying to recoup some of the previous days’ losses [Video]

![Pound Sterling is trying to recoup some of the previous days’ losses [Video]](https://editorial.fxstreet.com/images/Markets/Currencies/Majors/GBPUSD/iStock-170160529_XtraLarge.jpg)

GBP/USD Forecast: Pound Sterling remains fragile as key resistance holds

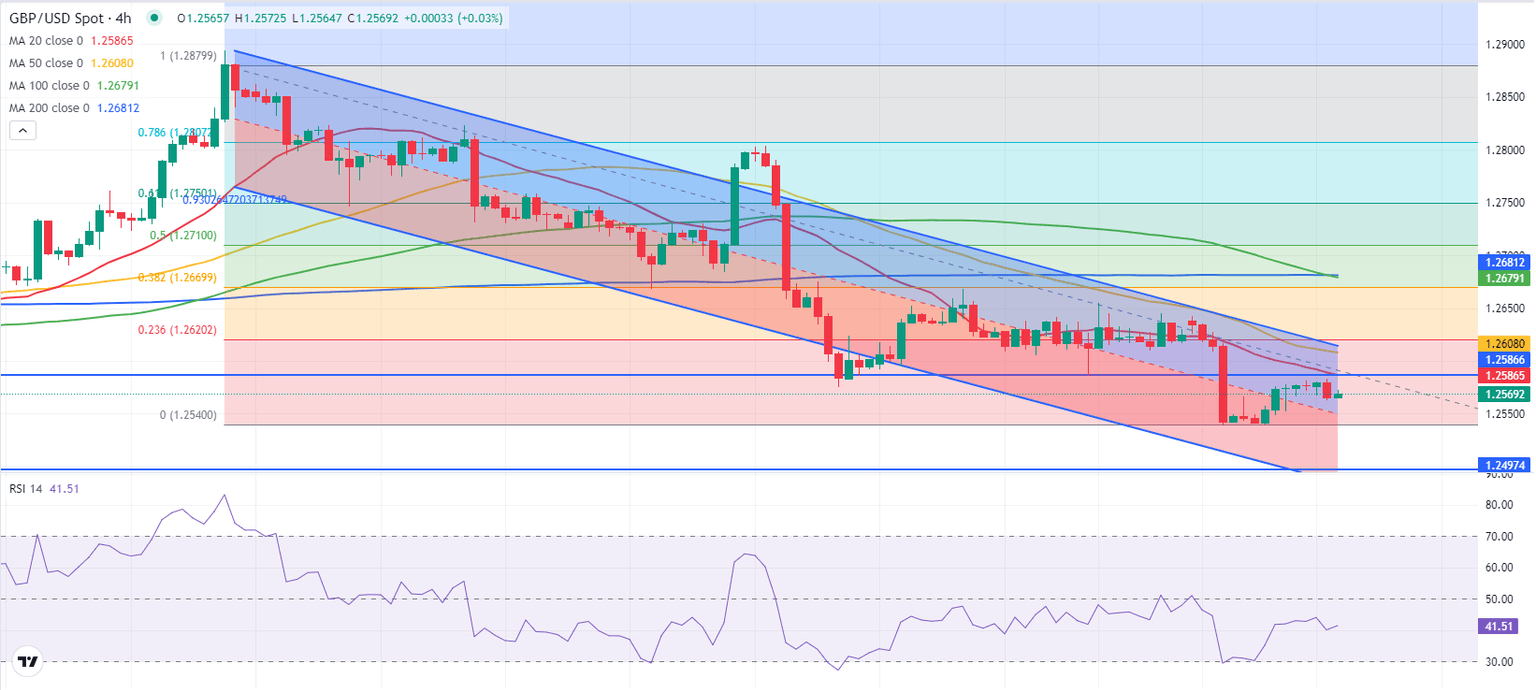

GBP/USD went into a consolidation phase above 1.2550 after closing modestly higher on Tuesday. The technical outlook is yet to point to a buildup of recovery momentum, while investors await data releases from the US.

The US Dollar (USD) came under modest selling pressure in the American trading hours on Tuesday and allowed GBP/USD to edge higher. Since there were no fundamental developments that may have caused the USD to lose interest, the pullback in the USD Index could be the product of a technical correction. Read more...

GBP/USD battles with the 200-day SMA [Video]

GBP/USD dropped beneath the long-term ascending trend line and the 200-day simple moving average (SMA). Nevertheless, it has not escaped the consolidation area of 1.2520-1.2820, which has confined the price action since November 24. Currently, the pair is trying to recoup some of the previous days’ losses, but the momentum is still weak. Read more...

GBP/USD Elliott Wave technical analysis [Video]

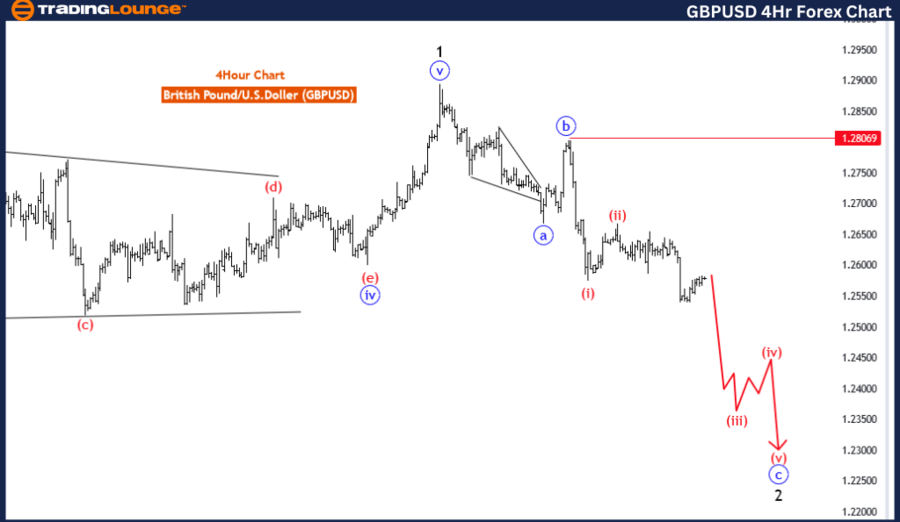

The GBPUSD Elliott Wave Analysis for the day chart provides traders with insights into potential price movements of the British Pound against the US Dollar, utilizing Elliott Wave principles for technical analysis.

Identified as a "Counter Trend" scenario, the analysis suggests that the current market direction opposes the prevailing trend, indicating a potential reversal or corrective movement against the broader price trend. Traders may expect a temporary deviation from the primary trend before a potential resumption or continuation. Read more...

Author

FXStreet Team

FXStreet