NZD/USD Price Analysis: Pair surges, strengthening bullish signals

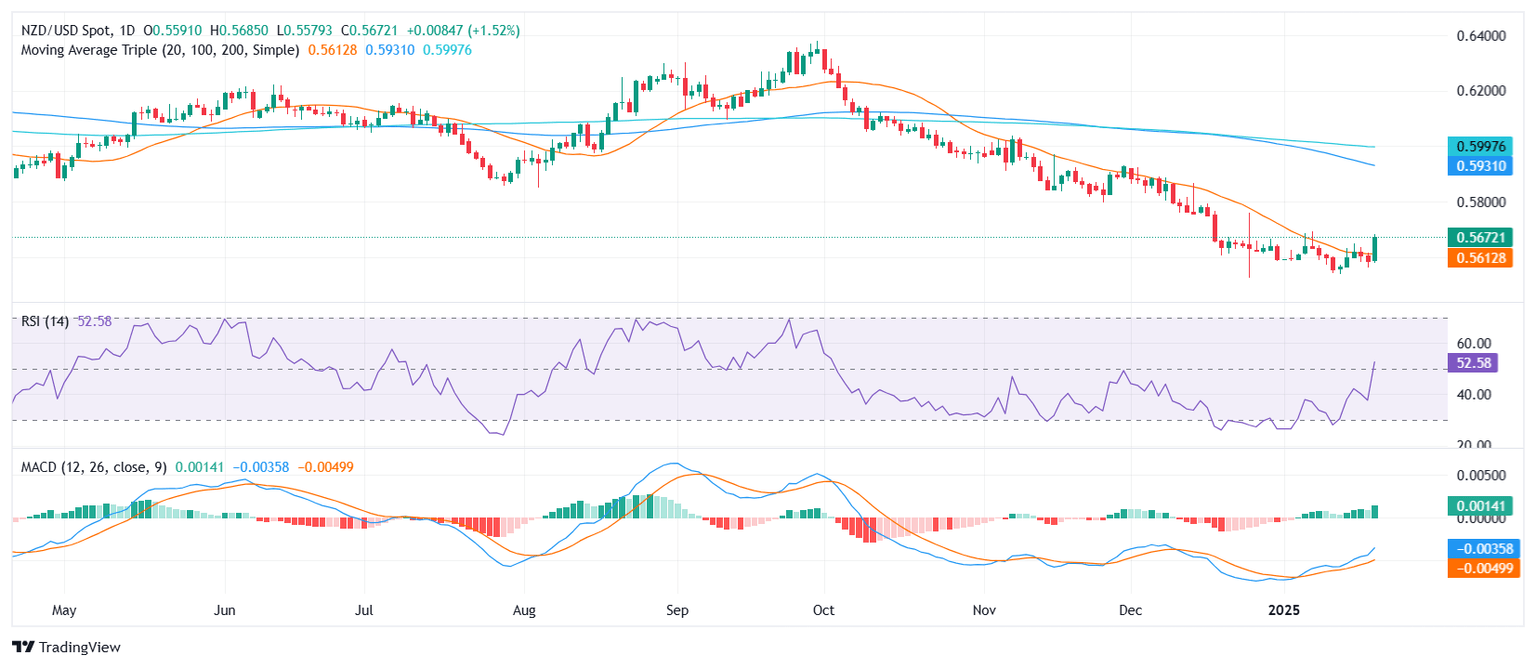

- NZD/USD jumps 1.65% on Monday, reaching 0.5675 on fresh buying interest.

- RSI climbs to positive terrain, reflecting steady bullish momentum and room for further gains.

- MACD histogram shows rising green bars, indicating an accelerating upward trajectory.

NZD/USD rallied on Monday, notching a 1.65% advance to settle around the 0.5675 mark. This robust performance comes amid a notable shift in sentiment, with traders appearing more inclined to favor the Kiwi dollar after its recent stretch of subdued price action. The mood has turned convincingly bullish, supported by technical studies pointing to ongoing upside potential.

According to the Relative Strength Index (RSI), which has pushed up to 52 and crossed the 50 middle point, the pair still has room to extend its climb despite trending on the higher side of the scale. In the meantime, the Moving Average Convergence Divergence (MACD) histogram continues to print progressively taller green bars, confirming that buying pressure remains intact. Together, these indicators hint at a market biased toward additional gains in the near term.

On the immediate horizon, any pullback may initially target the 0.5650 region, with stronger support near 0.5620 if the pair faces stronger selling. To the upside, a break beyond 0.5700 could open the door toward 0.5730, further reinforcing the pair’s shift in favor of the bulls.

NZD/USD daily chart

Author

Patricio Martín

FXStreet

Patricio is an economist from Argentina passionate about global finance and understanding the daily movements of the markets.