NZD/USD Price Analysis: Bears test key support as downside risks grow

- NZD/USD was seen trading near the 0.5700 area ahead of the Asian session, marking its second consecutive daily decline.

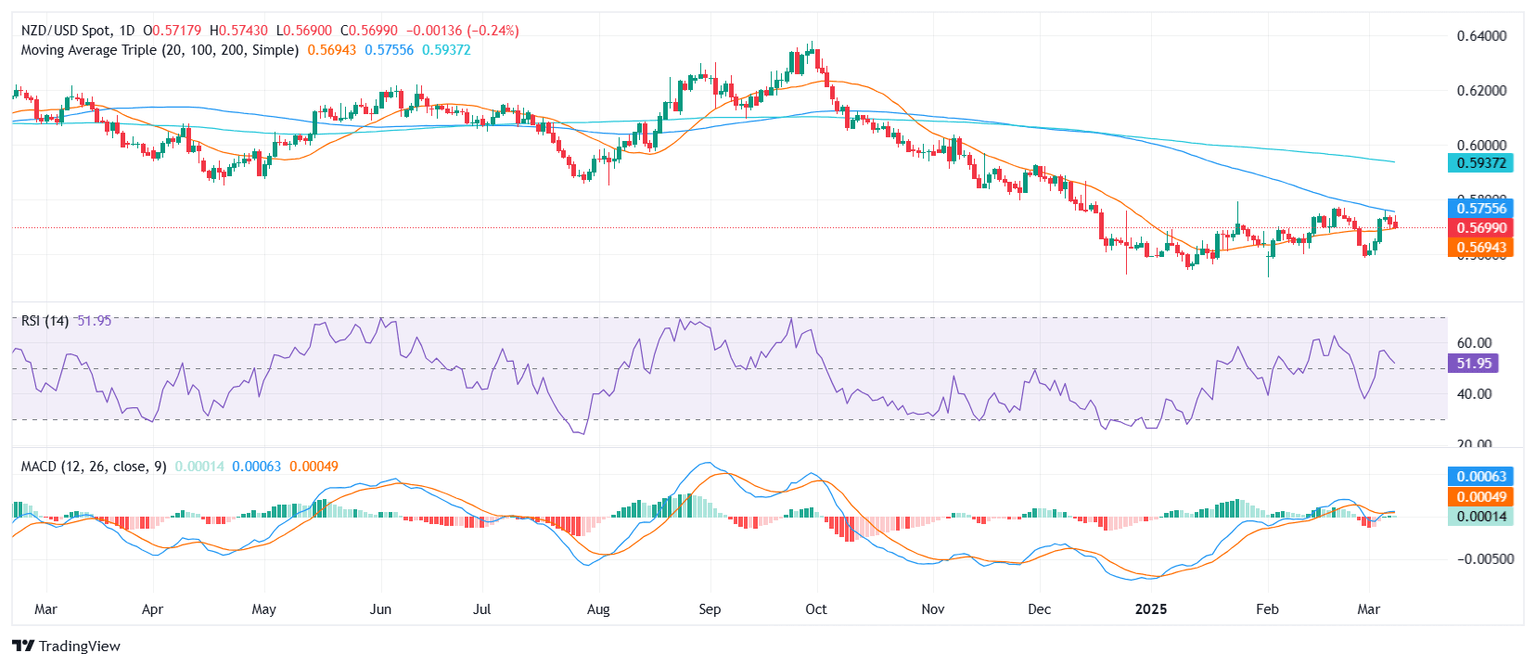

- Buyers face a key test at the 20-day SMA near 0.5960, as a break below this level could accelerate selling pressure.

- Technical indicators signal increasing downside risks, with the 100-day SMA approaching a bearish crossover with the 20-day SMA.

The NZD/USD pair extended its decline on Monday ahead of the Asian session, slipping toward the 0.5700 zone as sellers maintained control. The pair has now fallen for two straight sessions, with buyers struggling to defend the 20-day Simple Moving Average (SMA), a level that has acted as key support in recent weeks. The inability to hold above this area could trigger a deeper pullback, exposing the pair to additional losses.

Technical indicators reflect a growing bearish bias. The Relative Strength Index (RSI) remains in positive territory but is declining sharply, indicating fading bullish momentum. Meanwhile, the Moving Average Convergence Divergence (MACD) is neutral, signaling a weakening trend with limited upside potential. More importantly, the 100-day SMA is edging closer to the 20-day SMA, hinting at a potential bearish crossover that could further weigh on the pair.

Looking at key technical levels, immediate support is seen at the 20-day SMA around 0.5960. A break below this level would expose the 0.5650 region, followed by stronger support near 0.5600. On the upside, resistance stands at the 0.5750 level, with a stronger barrier at 0.5800.

NZD/USD daily chart

Author

Patricio Martín

FXStreet

Patricio is an economist from Argentina passionate about global finance and understanding the daily movements of the markets.