NZD/USD bears moving in and bulls looking for a discount

- NZD/USD bears are moving in despite the softness in the greenback.

- The week is premature and we are yet to see the bias unfold.

At 0.6295, NZD/USD has been pressured despite the growing consensus of a weaker US dollar. The bird is down some 0.28% at the time of writing and has fallen from a high of 0.6326 to a score a low of 0.6281.

The US session was mixed and the greenback was bought back across the board in the absence of anything fundamentally bearish for the greenback on the day other than a terrible miss in the manufacturing data. The Dallas Fed Manufacturing Index fell to -17.7 in June, down from -7.3 in May, putting it at its lowest level since May 2020. ''However, labour market indicators continue to show robust growth in employment and longer workweeks. Prices and wages both continued to increase, but manufacturers are less optimistic about the future,'' analysts at ANZ Bank explained.

''The Kiwi is lower this morning as risk assets take a breather and US bond yields resume their slow upward march,'' analysts at ANZ Bank added. Indeed, US stocks pulled back, lacking a catalyst while investors remain concerned over inflation and tightening Fed policy.

The Dow Jones Industrial Average, which is down 13.5% so far in 2022, is on pace for its worst first half of a year since 2008 and the higher beta currencies continue to be at risk. The Nasdaq, as well, is down 26.5% so far this year and is on track for its biggest first-half of a year slide ever. Nevertheless, the NZD remains fairly range-bound, bouncing around with the general vibe of global sentiment and there are limited data releases. Investors will instead keep an eye on the risk associated with Russia which has now technically defaulted on its external sovereign bond payments.

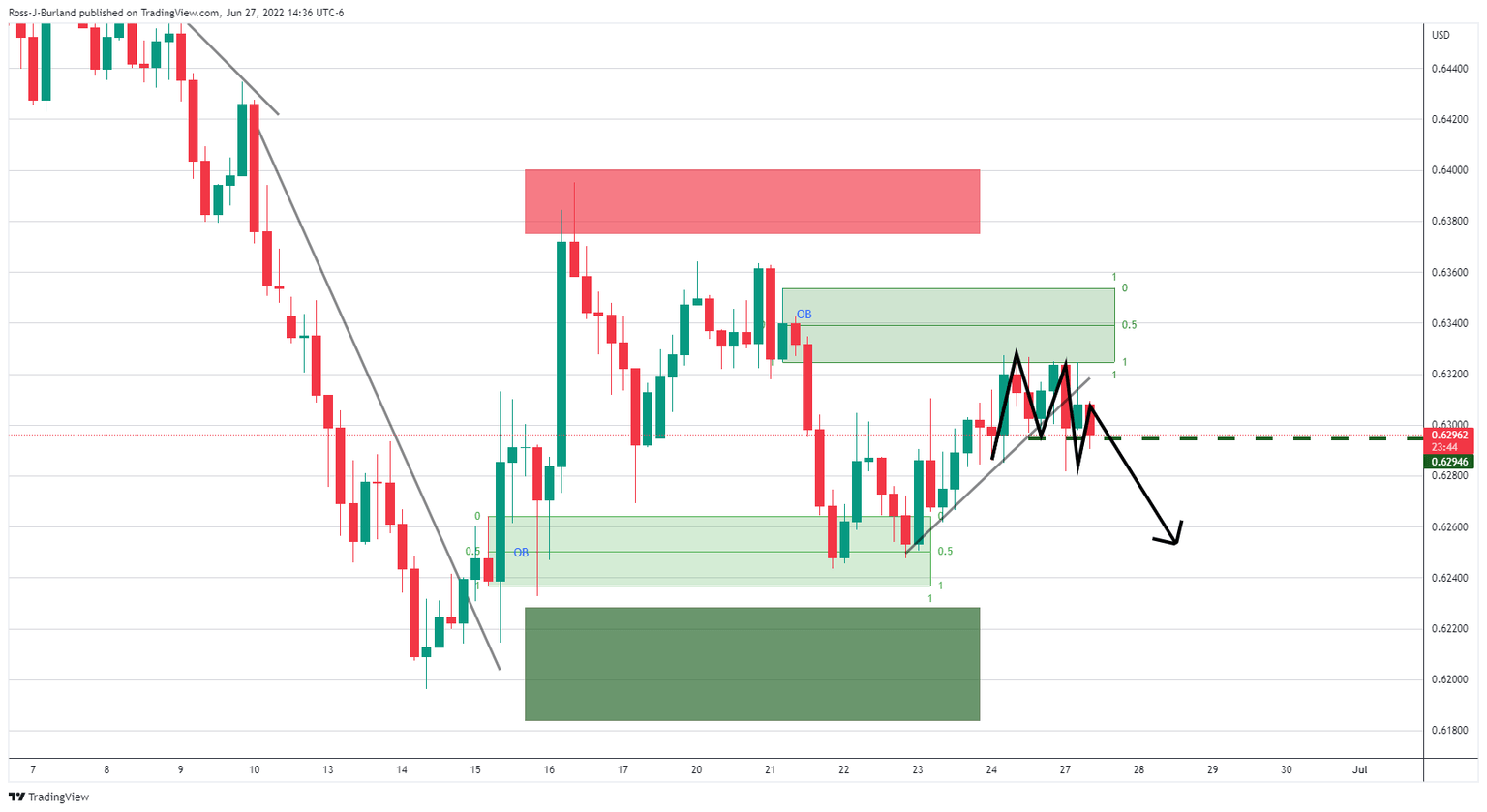

NZD/USD technical analysis

There are a couple of scenarios besides sideways consolidation and the following illustrate the bearish and bullish prospects:

Above and below are the bullish outlooks.

The following is noting of the M-formation's neckline and prospects of a sell-off below the structure.

Author

Ross J Burland

FXStreet

Ross J Burland, born in England, UK, is a sportsman at heart. He played Rugby and Judo for his county, Kent and the South East of England Rugby team.