NZD/JPY Price Analysis: Pair continue with mild upwards movements, reversal signs gaining relevance

- The NZD/JPY pair is on a three-day winning streak, with Wednesday's session adding to those gains, rising to 88.25.

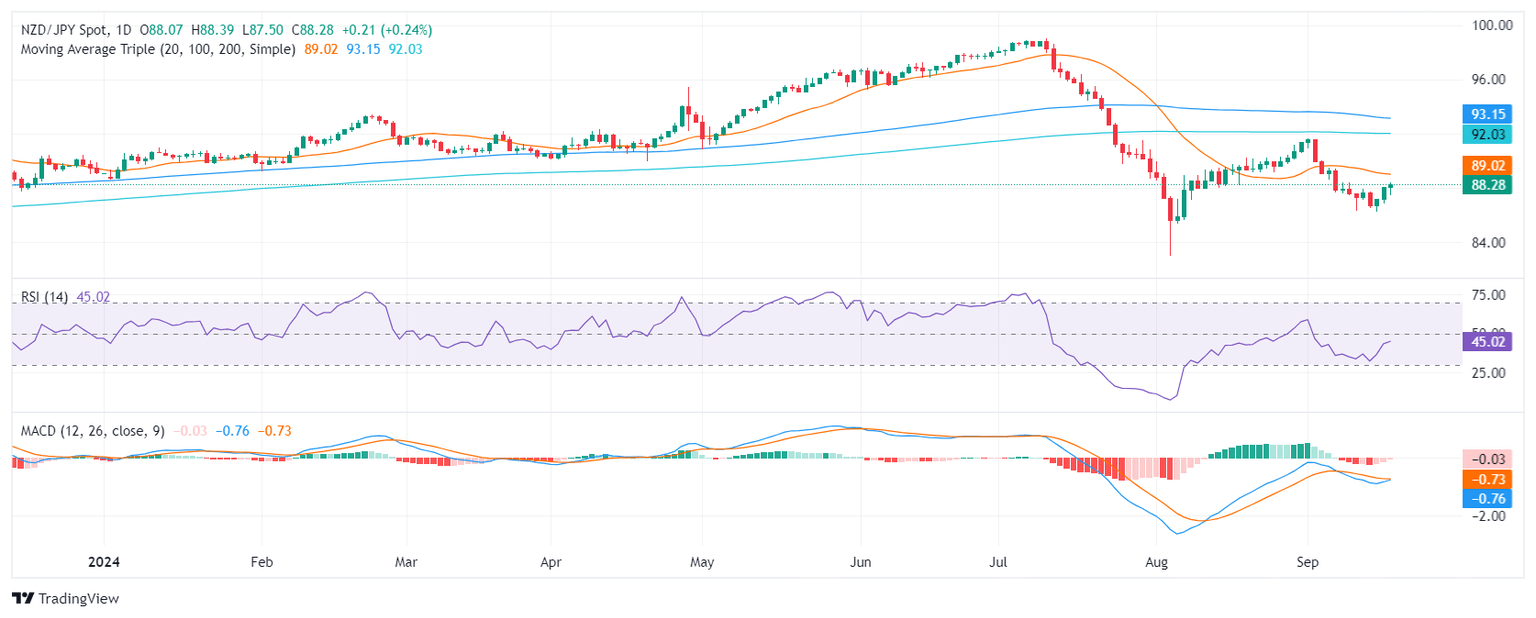

- RSI is still negative but shows a rising slope, indicating recovering buying pressure.

- Decreasing red bars in the MACD confirms that selling pressure is weakening.

In Wednesday's session, the NZD/JPY pair rose by to 88.25. Considering the fresh gains and the latest technical outlook, the possibility of a reversal of last week's losses is growing.

The Relative Strength Index (RSI) is currently at 46, which is still in negative area. However, the slope of the RSI is sharply rising, indicating that buying pressure is recovering. The Moving Average Convergence Divergence (MACD) is also red, but the histogram is decreasing, suggesting that selling pressure is declining. With the cross accumulating gains and tallying a three-day winning streak the bulls are making an argument for a reversal.

NZD/JPY daily chart

Key support levels are at 87.00, 86.50, and 86.00, while resistance points are at 88.00, 88.50, and 89.00 (20-day SMA). A break above the latter would confirm a recovery and further upside movements could be expected if the bulls complete it.

Author

Patricio Martín

FXStreet

Patricio is an economist from Argentina passionate about global finance and understanding the daily movements of the markets.