NIO Stock News: Nio Inc gains as Tesla upgrades raise EV sector ahead of earnings

- NYSE: NIO gained 0.58% during Monday’s trading session.

- Tesla received a pair of analyst mentions ahead of its earnings call on Wednesday.

- BYD surpasses Volksgwagen as the second largest OEM behind Tesla.

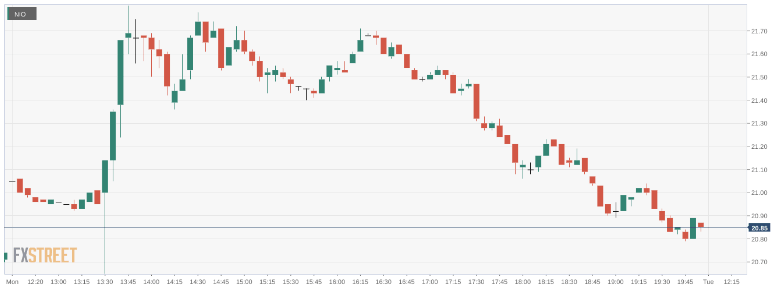

NYSE: NIO started the week off in the green as EV stocks managed to fend off a late day pullback during a volatile day of trading. On Monday, shares of Nio gained 0.58% and closed the trading session at $20.84. Stocks were out to a hot start Monday morning, but all three major indices pulled back and closed in the red ahead of a busy week of earning calls. Overall, the Dow Jones slipped by 215 basis points, the S&P 500 fell by 0.84%, and the NASDAQ dropped lower by 0.81% during the session.

Stay up to speed with hot stocks' news!

Electric vehicle stocks were gaining on Monday ahead of the highly-anticipated earnings call from Tesla (NASDAQ: TSLA) on Wednesday. It certainly helped that a pair of analysts provided some bullish insight on the stock ahead of earnings. Barclays raised its surprisingly low price target on Tesla from $370 to $380 per share. Deutsche Bank was a bit more positive on the stock as an analyst added Tesla to its short-term Catalyst Call Buy List after forecasting that Tesla will top Wall Street expectations for the quarter.

NIO stock forecast

Chinese EV giant BYD officially surpassed German automaker Volkswagen in the second quarter as the strongest OEMs in the EV sector. Of course, BYD still trails Tesla in terms of global dominance, but BYD is rapidly gaining on the industry leader. The news comes amidst a time of uncertainty for BYD’s stock as investors wait for a sell order that mirrors the position of top stakeholder Warren Buffett to pass through the clearing system.

Like this article? Help us with some feedback by answering this survey:

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Stocks Reporter

FXStreet