Netflix resumes rally after three waves correction [Video]

![Netflix resumes rally after three waves correction [Video]](https://editorial.fxsstatic.com/images/i/netflix-2_XtraLarge.jpg)

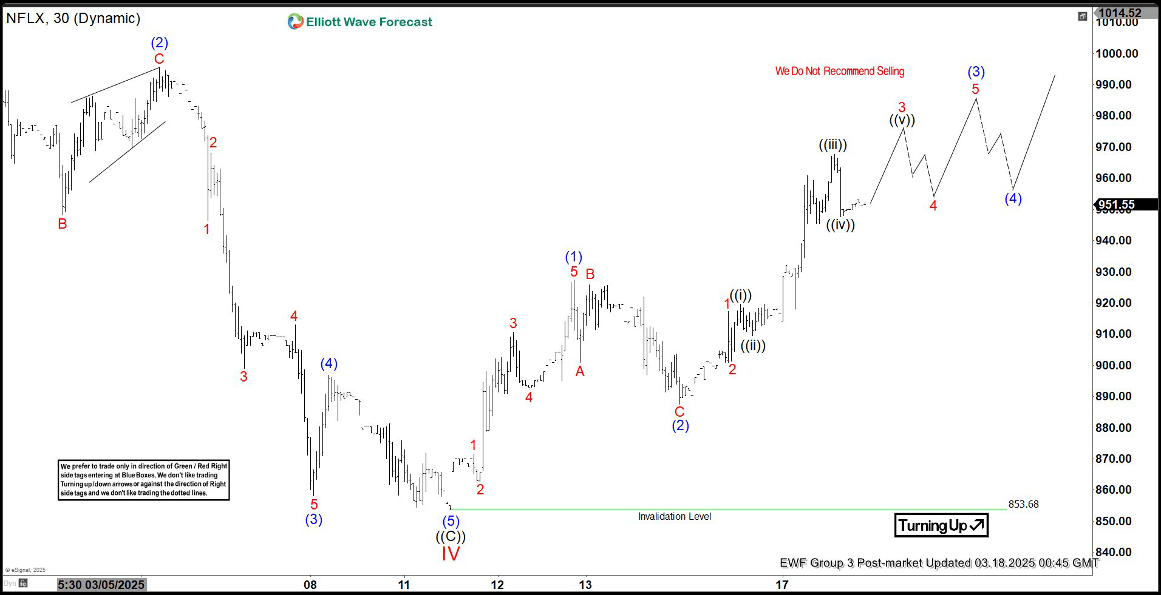

Short term outlook in Netflix (NFLX) suggests that the ETF has ended wave IV at 853.68. Decline from 2.18.2025 high is in progress as a zigzag Elliott Wave structure. Down from 2.18.2025 high, wave ((A)) ended at 955 and wave ((B)) ended at 1000.89. Wave ((C)) lower unfolded in 5 waves impulse structure. Down from wave ((B)), wave (1) ended at 958.17 and wave (2) ended at 995.6. Wave (3) lower ended at 858.11 and wave (4) rally ended at 896.9. Final leg wave (5) ended at 853.6 which completed wave ((C)) of IV.

The stock has resumed higher in wave V, but it still needs to break above 2.18.2025 high at 1065.05 to rule out a double correction. Up from wave IV, wave (1) ended at 927.18 and wave (2) pullback ended at 887.5. The stock has resumed higher in wave (3). Up from wave (2), wave 1 ended at 917.2 and pullback in wave 2 ended at 901.27. Expect the stock to extend higher 1 more leg to end wave 3, then it should pullback in wave 4 before turning higher again. Near term, as far as pivot at 853.6 low stays intact, expect pullback to find support in 3, 7, or 11 swing for further upside.

Netflix 30 minutes Elliott Wave chart

Netflix Elliott Wave [Video]

Author

Elliott Wave Forecast Team

ElliottWave-Forecast.com