Nasdaq futures Monday playbook: POC at 21,315 holds the key to a rally or a breakdown

Nasdaq-100 Futures (NQM25) – Weekly day-trading snapshot & Monday playbook

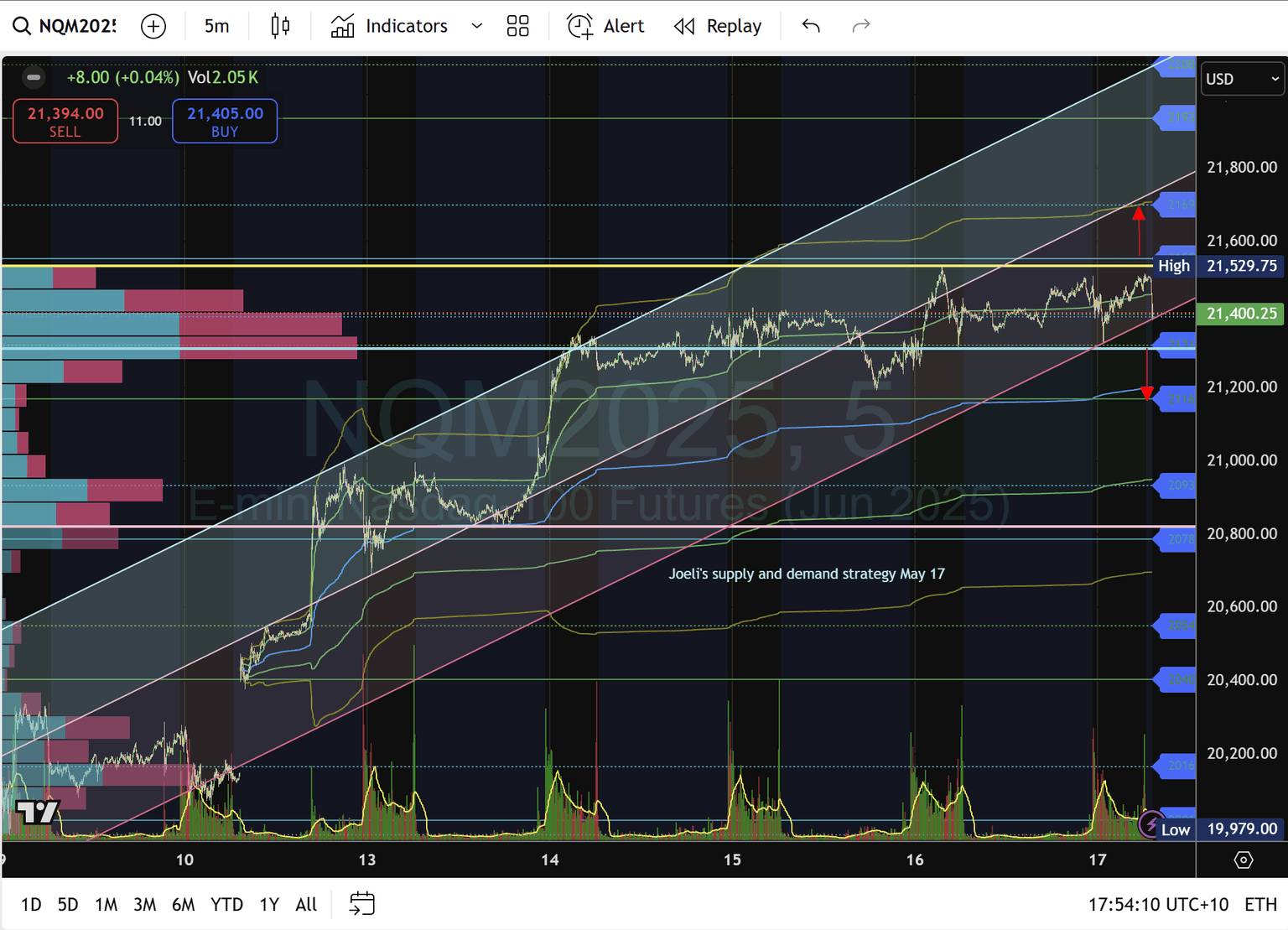

5-Minute Chart with projected supply and demand zones, H4 Levels, VWAP & Volume Profile

1. Market context

-

Strong weekly base: The large gap on May 12 at 20,402 set the springboard for this week's rally inside the rising regression channel (light cyan).

-

Mid-week congestion: Price stalled and chopped between ~21,434 and 21,947 for two sessions, forming a micro consolidation just below the channel's upper pitch.

-

Volume profile & VWAP: The POC (cyan line) around 21,371–21,315 has anchored value; VWAP mid-band (green) lies just below 21,300.

2. Key levels

Immediate resistance 21,434 - Recent mid-week swing high.

Next resistances 21,497 / 21,575 / 21,631 - 38.2%, 23.6%, 50 fibs of May 14–16 moves.

H4 resistances 21,557 / 21,806 / 22,209 / 22,458 - Major session pivots.

POC / VWAP Mid ~21,371–21,315 - Daily Value-Area Control.

Immediate support 21,315 - 61.8% retrace of Wednesday's rise.

Secondary supports 21,169 / 21,077 - VWAP mid-band & 61.8% of May 12 gap.

Lower channel base ~21,024 - 127.2% extension & lower regression channel.

H4 supports 21,331 / 21,014 / 20,751 / 20,502 - Key 4-hour pivots.

3. Bullish scenario

-

Hold & bounce POC (21,315 – 21,371):

-

Entry: Long on a clear rejection of 21,315 with a 5-min close above.

-

Targets: 21,434 → 21,497 → 21,575 → 21,631.

-

Stop: Below 21,300 (VWAP mid-band).

-

-

Break & reclaim 21,434:

-

Entry: Aggressive breakout above this swing high on volume.

-

Targets: 21,575 → 21,631 → H4 zone at 21,806, then 22,209.

-

Stop: 21,400 (just under the breakout level).

-

4. Bearish scenario

-

Fail at 21,434–21,497 Fib Zone:

-

Entry: Short on a reversal candle into this resistance band.

-

Targets: 21,371 → 21,315 → 21,169.

-

Stop: Above 21,515.

-

-

Break below POC/VWAP (21,315):

-

Entry: Short on 5-min close beneath, confirming value shift.

-

Targets: 21,169 → 21,077 → 20,948 (78.6% fib) → channel base (~21,024).

-

Stop: Above 21,350.

-

5. Monday execution plan

-

Pre-market alerts: Set alarms at 21,315 (POC), 21,434 (swing high) & 21,169 (VWAP band).

-

Volume confirmation: Favour trades that align with spikes at these pivots.

-

Risk management: 1% account risk per setup; trail stops on 2:1+ moves.

-

Channel respect: If price revisits the lower regression rail (~21,024) and holds, switch bias long for a channel-bound bounce.

Author

Denis Joeli Fatiaki

Independent Analyst

Denis Joeli Fatiaki possesses over a decade of extensive experience as a multi-asset trader and Market Strategist.