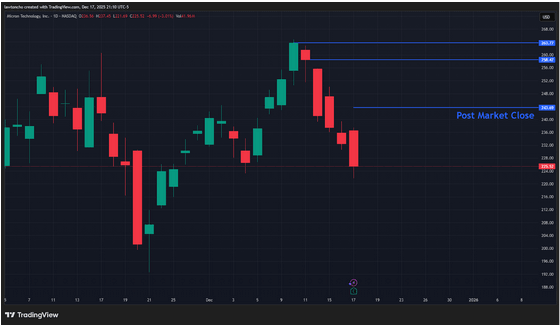

Micron pops on earnings — My resistance levels here

Micron Technology put in a strong move higher on earnings after the bell yesterday, beating both earnings and revenue expectations. The stock, which only recently printed fresh all-time highs two weeks ago, continued its momentum in the aftermarket, closing more than 8% higher on the positive news. As someone who watches the technicals closely around earnings, this kind of follow-through always gets my attention.

Before I dive into resistance levels, I want to take a moment to ground this move in the company’s background. Micron Technology has long been a major player in the semiconductor industry, specializing in memory and storage solutions used in everything from consumer electronics to enterprise-level computing. Over the years, Micron has positioned itself as one of the key contributors to global chip supply, and its performance tends to move with broader demand for high-performance memory products. As I watched today's report unfold, I kept that backdrop in mind—this isn’t a small speculative name, but one of the core names in a critical sector.

Looking at the chart heading into the rest of the week, I have two clear resistance levels overhead that I’ll be watching closely. The first sits in the $258.50 region, which coincides with a gap fill from the December 11th session. The second level I’m tracking is at the gap fill from December 10th. For myself, these are areas I’d consider shorting for a pullback if price action begins to stall or reject. I rely on technicals like these levels especially when a stock has just made a major earnings move—momentum can fade quickly, and I prefer to anticipate where sellers may step back in.

As always, trading around earnings can be volatile. I remind myself to stick with disciplined risk management—position sizing appropriately, honoring stops, and resisting the urge to chase moves. No matter how strong the reaction seems, levels are levels, and following a plan is what keeps me grounded in the market.

Author

Lawton Ho

Verified Investing

A marketing expert sharing his journey to mastering the charts.